On-demand Webinar: the State of Municipal Bill Payments

InvoiceCloud Team

InvoiceCloud Team

Few customer touchpoints are as operationally important as billing and payment collection. Not only are bill payments a main source of revenue for many organizations, but research also indicates this touchpoint can have a major impact on customer satisfaction and the efficiency of internal processes.

To help billers stay aligned with customer payment preferences, InvoiceCloud ran an online survey in October of 2022 with the goal of better understanding payment trends and general behaviors around making bill payments. Then, in December, we partnered with Governing to share highlights from the data with nearly 300 billing and collection professionals nationwide!

If you missed the webinar, don’t worry! You can watch the on-demand presentation right here or keep reading for a few important points from the webinar.

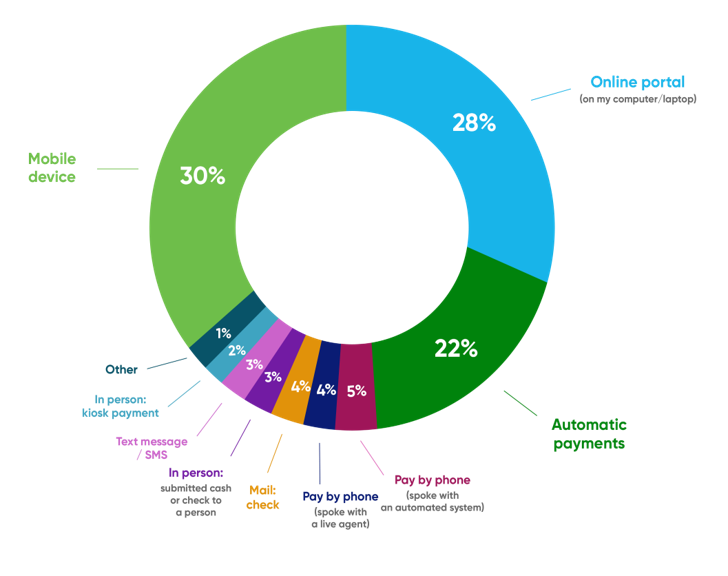

1. Mobile channels have overtaken online portals

For the last two years, when gauging which payment channels are the most used and most preferred by customers, “Online portal (on my computer/laptop)” has always taken the top spot. However, for the first time, “Mobile device (on app or mobile browser)” has overtaken “Online portal” in both usage and preference.

Both preference and usage for “Online portal” is significantly down, having shrunk by 15% since 2020.

Considering its ranking as one of the most preferred payment options among all respondents, your organization should focus on providing an easy, intuitive mobile payment experience.

Here’s an interesting example from the details of this survey data: the vast majority of respondents — 92% — took this survey on their phone, yet only 30% say mobile devices are their preferred method for making a bill payment. Clearly, payers are very comfortable using their mobile phones for many things, but the payment experience must be severely lacking if almost as many payers are going to their computer/laptop to pay a bill.

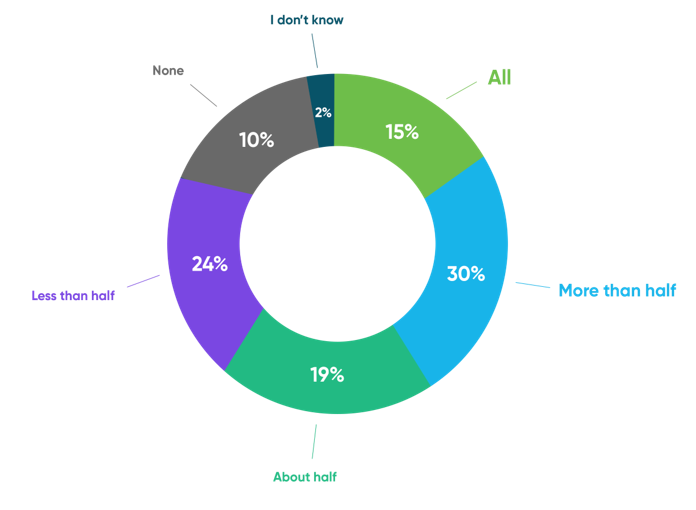

2. Automatic payments are on-the-rise, especially for those older than 60

Another burgeoning trend that aligns with an emphasis on convenient digital payments is the rise of automatic payment (AutoPay) enrollment, which has climbed by 5% since last year. Considering that the “set it and forget it” nature of this payment channel offers maximum peace of mind and minimal friction for the bill payer, it makes sense that this convenient option would be gaining popularity among today’s customers.

However, despite the upward momentum of this payment option, there is still plenty of opportunity for adoption. The data shows that 88% of respondents are enrolled in AutoPay for at least some of their bills, but only 45% have signed up for AutoPay for more than half or all their bills.

One age group, in particular, has taken a growing interest in the convenience of AutoPay: respondents over 60 prefer automatic payments for bills more than any other age group. When asked which payment channel was their preference, 22% of respondents stated AutoPay was their favorite option — and respondents 60 and older were most likely to select AutoPay as their preference.

3. Apple Pay is the #1 most popular mobile wallet

Mobile wallets remain a divisive option for bill payments. Exactly half of the survey respondents use mobile wallets to pay at least some of their bills, whereas the other 50% do not. Although this payment option is more favored by younger respondents, the disparity is not too significant between younger demographics and the <60 respondents.

For respondents that use mobile wallets to pay some or most bills, we wanted to understand which wallet was their go-to for bill payment, as there are several heavy-hitters on the market. Overall, Apple Pay was the most popular mobile wallet for bill payments.

For this reason, billers should plan to offer at least a few digital wallet options. Apple Pay, as the overall most preferred mobile wallet, is an essential offering. But the data shows, different age groups would prefer additional options like PayPal, Venmo, and Google Pay, so an array of offerings is best to cater all customer preferences.

Finally, make sure that any available mobile wallet is easy to access in your bill payment process; this frictionless payment option is a fantastic way to bring in more on-time payments, every collection cycle.

More ways to improve the resident payment experience

If you want more insights on how you can leverage this consumer data to meet policyholder expectations, watch the on-demand webinar recording below! You can always save the recording on your browser to share with colleagues or revisit anytime.