Sending bills and receiving payments are crucial customer touchpoints, for several reasons. Besides the impact this experience can have on customer satisfaction, bill payments can also be a primary revenue source. To mitigate customer frustrations and maintain collections, organizations must ensure a seamless experience for their customers. However, this involves a deep understanding of how, when, and why today’s payers choose to receive bills and make payments.

In an effort to keep billing organizations informed about vital payment preferences and trends, InvoiceCloud collaborated with Regina Corso Consulting to survey Americans who make online payments. The survey aimed to uncover insights into bill payment trends like the bills they pay online, their preferred payment methods, frustrations they encounter in the online payment process, and more. Here are three key takeaways every billing organization needs to know for 2024.

1. Consumers prefer to make payments on a mobile device

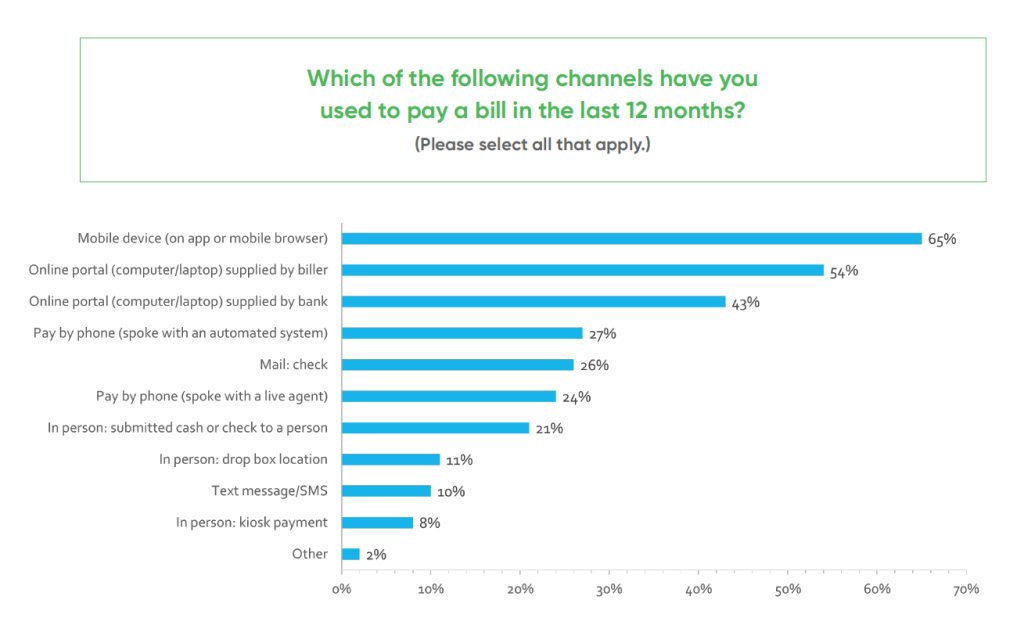

Mobile devices have remained the top choice for bill payments for the second consecutive year, with 65% of Americans using them in the past 12 months. Online portals provided by billers (54%) and banks (43%) are also commonly used.

Not surprisingly, younger generations, including Gen Z, Millennials, and Gen X, express a stronger preference for mobile payment channels compared to Baby Boomers. The resistance of Baby Boomers to adopt digital payment channels highlights the need for billers to make digital self-service options more accessible and user-friendly for this demographic, as embracing these options can lead to time and cost savings for both customers and billing staff.

On the other end of the spectrum, as Gen Z enters adulthood and takes on more financial responsibilities, organizations must adapt to their preferences for digital payments to avoid potential non-payment issues. (Want to see the differences in channel usage by geographic region? Get the full report here.)

When considering how to optimize your mobile payment channel – or when evaluating the quality of an online payment solution’s mobile platform – there are a few key factors your organization must keep top of mind, including design, thoughtful communication, mobile wallets, and more.

2. Healthcare and personal loan payments take a digital dip

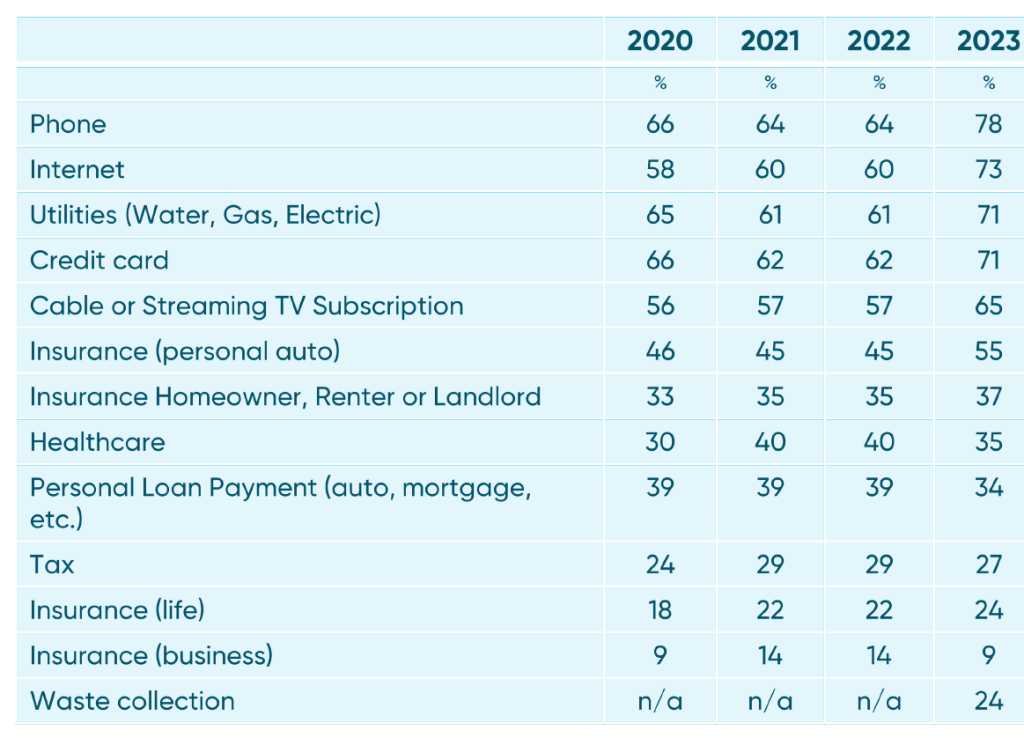

As we mentioned, Americans have increasingly paid their bills online or through mobile devices, with phone, internet, utilities, and credit cards topping the list. However, healthcare and personal loan bills have seen a decline in digital payments, both of which have taken a 5% dip since last year’s report.

Many other bills are continuing the digital payment trend. Seventy-eight percentage of respondents paid their phone bill online after staying stagnant at 64% for the last two surveys, 73% paid their internet (up 13% since last year), 71% paid their utility and credit card bills online (up 10% and 9 %, respectively), and 65% paid their cable or streaming TV service subscription online (up 8% last year).

To sustain this digital payment trend, it’s crucial not to keep self-service options under wraps. Organizations should actively inform their customer base about available digital payment options and ensure that these options are easily accessible and user-friendly. Keeping customers in the loop about the convenience of digital payment channels is key to maintaining and expanding the adoption of online payment methods.

3. Forgetting username and password is the #1 issue with digital bill payment

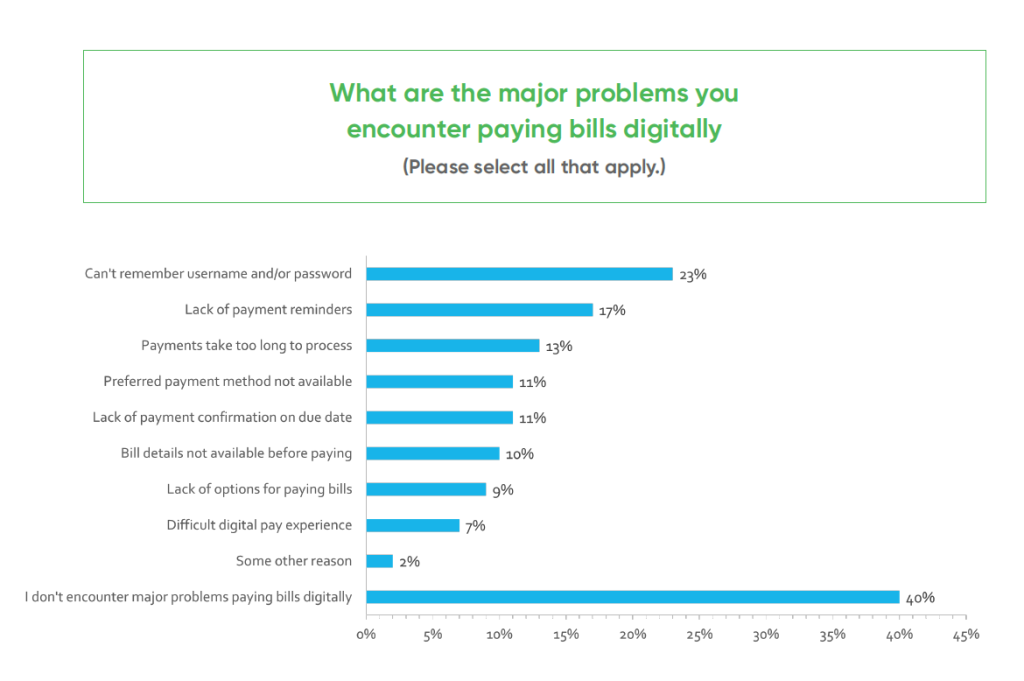

Online bill payment isn’t without its challenges. While 40% of Americans report a smooth experience, a significant 60% encounter issues. The most common problems include difficulty recalling usernames and passwords (23%), a lack of payment reminders (17%), and delays in payment processing (13%).

With so many consumers experiencing an issue with forgetting a username and password, optimizing a guest checkout route for online payments can be a game-changer. Not offering payers the option to make a one-time payment can create huge customer experience issues. This is because customers care about convenience when it comes to online payments. In fact, according to another InvoiceCloud survey, 38% of respondents said that ‘convenience’ was the number one reason they chose to make a recent payment online. And forcing your customers to register an account to pay a bill is the opposite of a convenient experience.

The Annual State of Online Payments Report

For more detailed insights into each of these key takeaways and for even more information about the current state of online payments, download the full report here.