Every day, billions of dollars move through a payment system called the Automated Clearing House (ACH), a complex but essential network you’ve likely interacted with in your day-to-day life, perhaps without realizing it. If you’ve ever signed up for a digital bill payment option or had a paycheck directly deposited into your checking account, you’ve benefited from the ACH system.

In this three-part series, we’re going to explore the ins and outs of the ACH system and why these automated payments are critical for billing organizations nationwide. But let’s begin with the basics: what is ACH and how does it work?

What is ACH?

ACH transfers are electronic, bank-to-bank money transfers processed through the Automated Clearing House Network. The Automated Clearing House is the primary system that agencies use for electronic funds transfer (EFT). With ACH, funds are electronically deposited in financial institutions, and payments are made online.

Getting paid through direct deposit or making digital outbound payments are just two examples of ACH transfers. You can also use ACH transfers to make single or recurring deposits into an individual retirement account (IRA), a taxable brokerage account, or a college savings account. Business owners can also use ACH to pay vendors or receive payments from clients and customers.

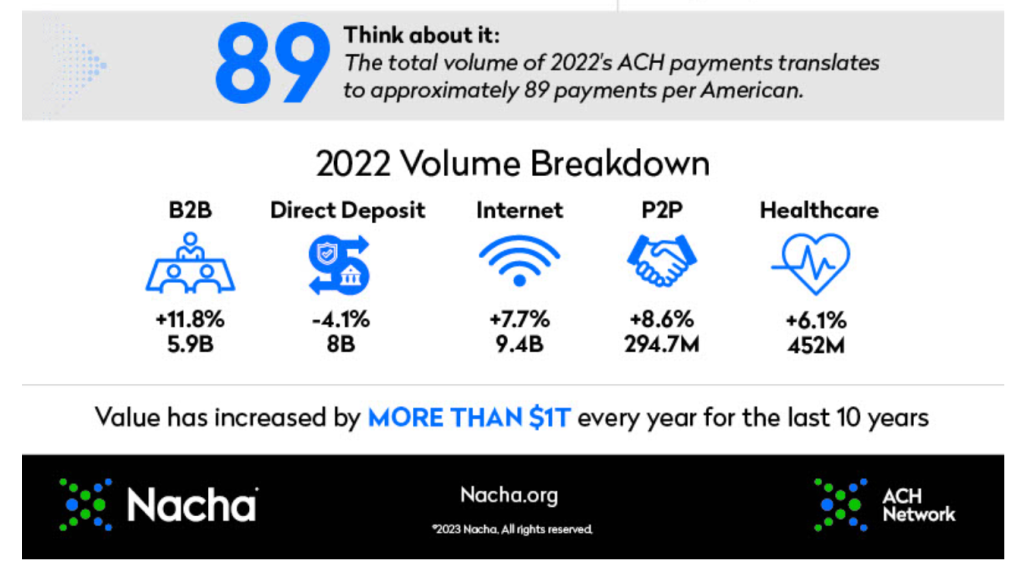

As a quick, convenient, and often free method for transferring funds, automatic payments through the system are increasing in popularity. Nacha reported that the ACH Network processed 30 billion payments in 2022, encompassing $76.7 trillion total. Those numbers were up by 3% and 5.6%, respectively, over what the network handled in 2021.

In March 2022, the per-payment limit on Same Day ACH transactions increased from $100,000 to $1 million, fueling remarkable growth for the payment method. As a result, business-to-business (B2B) payments across Same Day ACH are up 44% year over year.

How Does ACH Payment Work?

ACH payments work by moving money from one bank to another electronically, without a physical exchange of currency. Two categories of transactions use ACH payments: direct payment and direct deposit.

- Direct payment refers to the movement of money to make or receive payments. If you’re paying a credit card bill, donating to someone’s GoFundMe campaign or sending money to a friend via your bank’s mobile payment service, those transactions all fall under the ACH direct payment umbrella.

- Direct deposit involves the transfer of payments from a business or government agency to a consumer. Your employer might offer direct deposit, and the government uses it to disburse Social Security benefits and federal tax refunds.

All ACH payments are routed and processed by the U.S. Federal Reserve or the Clearing House Payments Company, a private business owned by 24 of the world’s largest commercial banks. The Clearing House’s ACH payments service, called the Electronic Payments Network, is responsible for approximately half of all U.S. commercial ACH payment volume. The U.S. Federal Reserve banks handle the other half of ACH transactions.

Does InvoiceCloud offer ACH?

ACH transfers have many uses and are more cost-effective than using credit cards and more user-friendly than writing and depositing checks. InvoiceCloud was designed to make life easier for both billing organizations and their customers – so, needless to say, offering ACH for bill payment is an essential part of making that mission a reality.

Keep an eye out for Part Two of our ACH series, where we’ll dive into why it’s critical for billers to offer ACH payment options. If you have questions in the meantime, schedule some time with one of our digital payment experts for insights and answers