3 Contactless Payment Options to Help Combat Flu Season

Tessa Newell

Tessa Newell

Fall and winter usher in some lovely end-of-year milestones – the holiday season, time with family, and some truly picturesque weather, to name a few.

One unfortunate year-end tradition? The arrival of flu season.

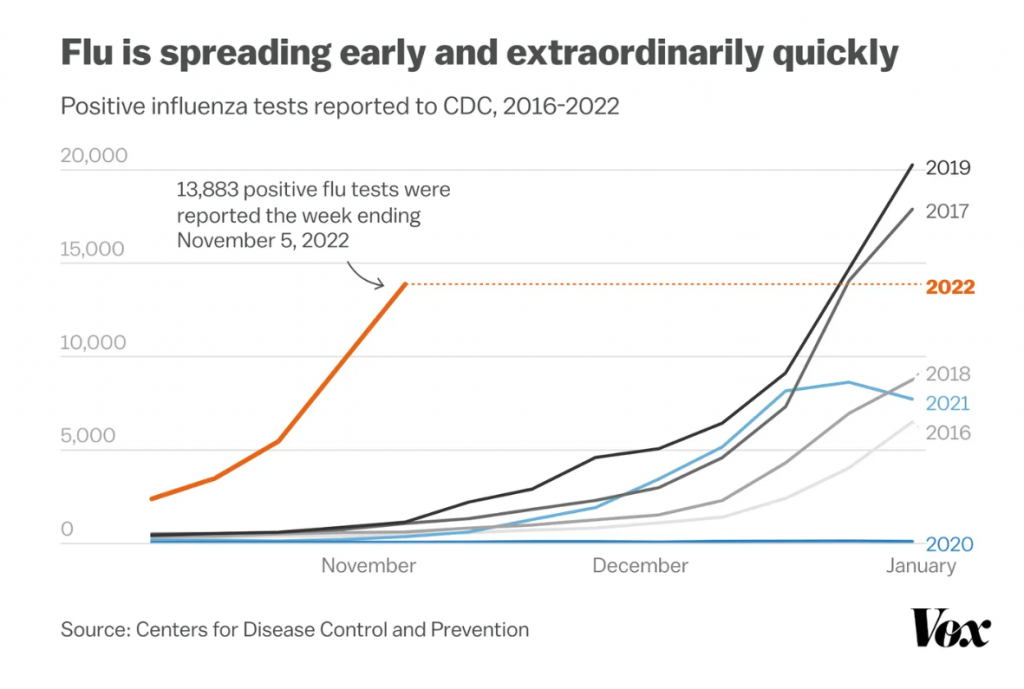

The 2022-2023 flu season is already underway and has impacted more than half the country in just a few short weeks. According to CNN, about half of the US (22 states, along with Washington DC, New York City, and Puerto Rico) is reporting high or very high respiratory illness activity, as flu season swept through the country weeks earlier than usual. We’ve seen about five flu hospitalizations for every 100,000 people, rates that aren’t typically seen until late December or January, CDC data shows.

Although the numbers are especially high for this time of year, experts say the trends are otherwise following an expected pattern, and the early arrival of flu season doesn’t necessarily mean it will last longer or be more severe. However, there’s no harm in safeguarding yourself and your community against influenza while it’s peaking.

For local governments and municipalities that often receive in-person payments, an easy tactic to curve infection rates is leveraging contactless payment methods to discourage those visits during flu season.

3 contactless payment methods to promote this flu season

Contactless payments are exactly how they sound: methods for making bill payments without interacting with billing and collections staff. Opting for self-checkout at the grocery store, for instance, might be considering contactless – but there are digital payment options even more health-conscious and convenient for customers at your disposal.

Here are a few contactless bill payment options organizations can offer for simple, frictionless payment collection without the worry:

1. Suggest mobile wallets instead of cash

Cash can be touched by hundreds of people in a matter of hours and germs can linger on surfaces for days, whereas mobile wallets are, essentially, virtual wallets that store payment card information on a mobile device. Customers only need to enter their payment information in their mobile wallet once before they’re able to use this digital option at a retailer. What’s more, that stored payment information is then accessible for online payments – i.e., on a website or a payment portal – creating a truly omni-channel user experience.

In InvoiceCloud’s upcoming research report, the 2023 State of Online Payments, we uncovered that all age groups use mobile wallets for bill payment but there is plenty of room for adoption. What’s more, we found that Apple Pay is the overall most preferred digital wallet and PayPal is most preferred by respondents <60.

2. Make it easy to set up automatic payments (AutoPay)

Automatic payments (otherwise known as AutoPay) are when payments are automatically withdrawn from an account or charged to a credit card on a scheduled date, each collection cycle. Not only is AutoPay a great way to avoid in-person contact during flu season, but this method also guarantees consistently on-time collections all year long.

The key to driving AutoPay enrollment is not keeping the option secret from your customers! Advertise this option wherever possible. Think: your organization’s website, on digital invoice or the checkout page, on flyers around your office, on paper bills and notices – you get the idea.

At InvoiceCloud, we boast industry-leading levels of AutoPay enrollment because our payment solution was designed with customer engagement in mind. We leverage every opportunity to remind your customers about their ability to enroll in AutoPay, and we make that enrollment process quick and painless to further encourage adoption.

3. Increase convenience with pay by text

When you think of sending text messages to your customer base, you may think of sending them emergency communications or reminding them of an upcoming payment. But text messages also make for an incredibly convenient, contactless bill payment option.

One way to leverage pay by text is prompting customers to click an embedded link that leads them to your online payment portal. For customers who select this option, organizations should strongly consider utilizing a guest checkout route rather than prompting them to log in.

Another is for customers to pay their bill directly within the text message, without having to click an external link. In order to utilize this option, customers will need to save their payment information on the biller’s payment platform. Once saved, customers can respond to the text message with a simple “Pay Now” or other a similar prompt to make their payment.

However pay by text is utilized, this payment route enables organizations to collect revenue faster, thrill customers, and discourage in-person visits, especially during flu season.

Staying prepared for future flu seasons and health events

Who can predict where the global health landscape will go next? Hopefully we won’t see another pandemic in our lifetime, but influenza season is an annual high-risk event that billing organizations can plan and prepare for.

Check out our ebook, The New Biller Best Practices: How COVID-19 has changed billing and payments, for additional insights into how your office can adapt to our post-COVID world.