We talk a lot about payment channels, but what exactly are they? As their name suggests, payment channels are basically any way that a customer might make a payment or anywhere that you (as a merchant) might accept a payment. For digital payment channels, this “where” can look like an online portal, a payment via text message (pay by text), or traditional snail mail. This is different from payment methods, which is how the funds are transferred for payment (i.e., cash, credit card, Automated Clearing House).

Being a critical part of payment collection, it’s understandable that billing organizations want to keep tabs on the payment channels their customers prefer, most frequently use, or struggle to use.

In our annual State of Online Payments research report, we asked over 2,100 people nationwide to share which payment channels they’ve used for bill payment in the last year, and which channels they most prefer.

From the data, a few payment channels stood out as “channels on the rise.” Let’s dig into which channels have seen an increase in usage since last year’s report and how to improve the experience of these standout channels.

1. Pay by Text

We spend a lot of time on our phones texting (in fact, it’s most consumers’ favorite way to communicate), so why not make payments via text, too?

Pay by text is our first payment channel on the rise – this option allows organizations to accept payments through text messages. Since last year’s report, the channel has increased in popularity by 3%. (That might sound like a small percentage but imagine if your next 63 customers chose to pay their bill via text instead of calling or coming into your office!)

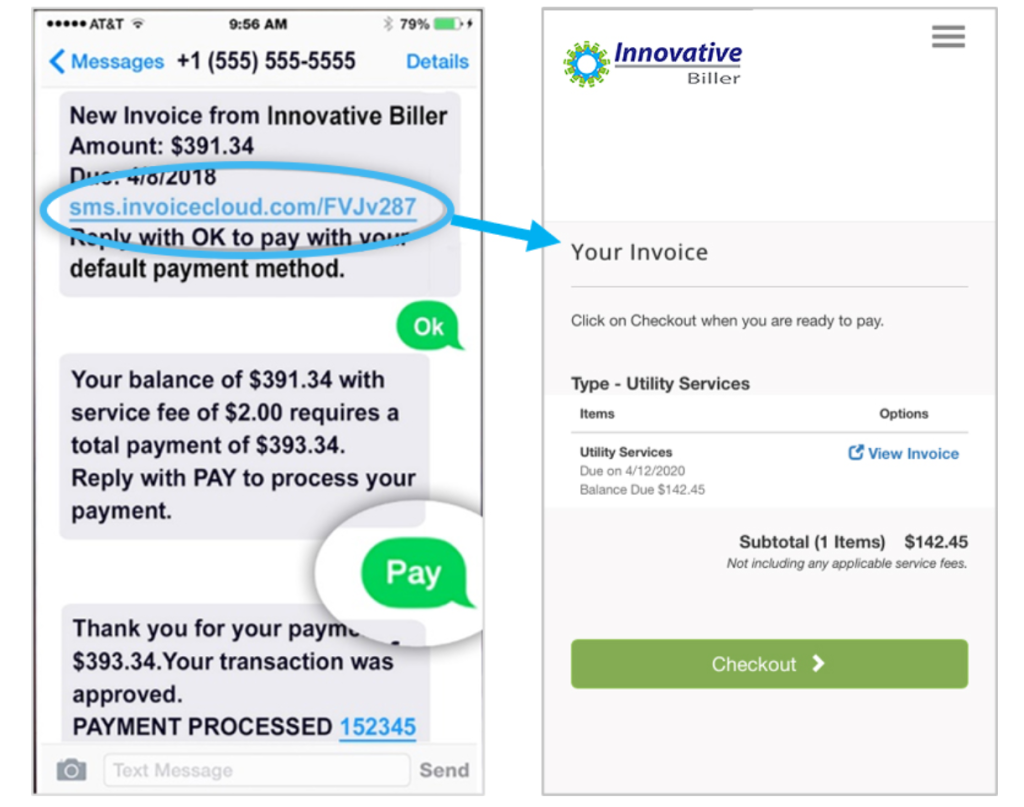

Here’s how it works. Once customers opt into receiving texts from the organization, they’re able to send bill information directly to the customer’s phone. Typically, each text includes information about which bill needs to be paid, the amount due, the due date, and options for making the payment. The customer then has two options for paying their bill: clicking an external link that leads them to a payment portal or paying directly in the text message.

For customers, this option is incredibly convenient. And, as we know from the State of Online Payments report, convenience is the number one reason customers make payments digitally.

To enjoy the streamlined internal efficiencies, conserved resources, and higher customer satisfaction scores that can come from offer pay by text, you first need a digital payment solution that provides a pay by text service. Make sure your chosen solution makes the pay by text route as easy as possible for customers by allowing them to save their payment information and removing roadblocks like login walls.

2. Automatic Payments (AutoPay)

Considering the “set it and forget it” nature of automatic payments (AutoPay), it comes as no surprise that this payment channel has climbed 5% in usage since last year’s report.

While AutoPay offers maximum peace of mind and minimal friction for the bill payer, it still has a long way to go in terms of adoption. The data shows that 88% of respondents are enrolled in AutoPay for at least some of their bills, but only 45% have chosen to enroll in AutoPay for more than half or all their bills.

There are a few ways organizations can help encourage AutoPay adoption – mainly by making the enrollment process easier to start. In the past, InvoiceCloud billers have had success driving AutoPay adoption via tactics like:

- Including QR codes on flyers or paper bills that route customers to AutoPay enrollment.

- Communicating to customers via mail or email how to sign up for AutoPay with a link to enroll.

- Highlighting where to enroll along every step of the payment process, including your website, the payment page, confirmation screens, and more.

3. Mobile Devices

For the past three years of our annual survey, “online portal (on computer/laptop)” has taken the top spot for preferred payment channel. However, for the first time, “mobile device (on app/mobile browser” has climbed to the top in both usage and preference.

This not only includes making payments on an app or mobile browser, but also includes mobile wallets, which have become increasingly popular. In fact, according to a survey from ACI Worldwide, 45% more consumers paid with mobile wallets in 2022 than in the previous year. Our most recent research mirrored this stat, with 50% of our respondents stating they use mobile wallets for at least some bills, with Apple Pay being the most popular.

To be sure you’re gaining all of its benefits, ensure the capabilities of your mobile platform are just as robust and efficient as your online payment portal. Check out our Mobile Payment Optimization Checklist to see if your mobile payment experience is ready to meet customer expectations.

The State of Online Payments Today

Ready to learn more about customer payment preferences for 2023 and beyond? Download our latest State of Online Payments report for all the insights from the annual survey.