Enhanced Policyholder Experience Drives Digital Engagement: Client Story

Brian Melle

Brian Melle

EmPRO Insurance Company, a medical professional liability insurance carrier, was struggling with inefficient collections technology that complicated payments and increased staff’s manual workload. This caused a difficult policyholder payment experience along with time-consuming payment cycles.

In order to streamline processes, improve the policyholder experience, and conserve organizational resources, EmPRO knew it needed to find a digital payment solution that could offer the modern, intuitive payment options today’s policyholders expect.

Outdated technology causes excessive friction

EmPRO was experiencing both customer-facing and backend challenges, all stemming from its previous billing and payment solution. Between lagging, manual processes that drained staff resources and a frustrating premium payment experience, there was dissatisfaction to go around.

Overall, excessive friction in the payment process was causing these pain points and more. Without a simple way to check on payment status, for instance, customer call volumes were skyrocketing with inquiries. And time wasn’t the only resource being drained; difficult-to-use digital payments led to excessive manual payments, which increased print and mail costs.

Frictionless billing and payments drives digital engagement

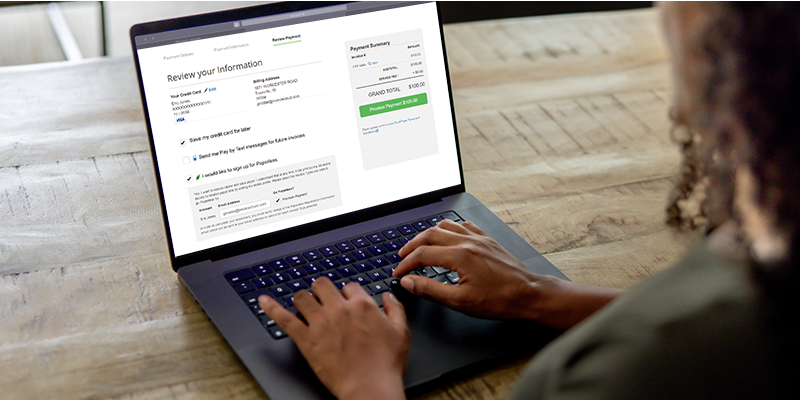

After evaluating its major challenges, EmPRO Insurance decided it needed a digital engagement and payment solution that could provide a cohesive user experience across all channels. A solution that could remove friction from the billing and payment experience and drive self-service would be critical, as the team needed to create more bandwidth for other impactful projects.

EmPRO chose InvoiceCloud’s solution as it offered a customer-centric, flexible payment experience with the benefits of a true SaaS solution that could enable future growth. Plus, EmPRO loved that InvoiceCloud seamlessly integrated with its core billing software for easier reconciliations and would even offer customizable resources for marketing its new digital payment options.

Resources conserved and policyholders thrilled with InvoiceCloud

In its first year of working with InvoiceCloud, EmPRO Insurance saw a significant increase in resource-saving payment behaviors, including a 211% increase in electronic payment adoption and a 7x increase in automatic payment (AutoPay) enrollment.

Not only were resources significantly saved in that first year, but InvoiceCloud’s frictionless billing and payment experience also turned around EmPRO’s policyholder satisfaction scores and has offered a stronger competitive edge in today’s insurance market.

For all the results EmPRO Insurance has seen with InvoiceCloud, get a free copy of the case study below.