In the insurance industry, there are several key challenges that organizations need to address to remain competitive and keep policyholder satisfaction high, such as:

- Improving policyholder retention and satisfaction

- Ensuring accurate account reconciliations

- Keeping up with innovation

Add to this the pressure to remain innovative and embrace the latest technologies, and it’s difficult for most organizations to keep up. The right online bill payment software can solve many of these common challenges and can even improve efficiencies across your entire organization.

Here are three common challenges faced by insurance companies – and how a well-designed online bill payment platform can help your organization overcome them.

Challenge #1: Policyholder Retention and Satisfaction

Consumer expectations are always changing – and that extends to the online payment process. Your policyholders expect you to enable them to pay when, how, and where they want. In today’s environment, where more than half of customers (across industries) are willing to switch providers to get a better online experience, staying competitive means keeping up with consumer demands.*

To keep satisfaction high, your online bill payment software needs to meet or exceed policyholder expectations — and the ability to do that starts with design. Take a look at your organization’s current online bill payment platform, and ask the following questions:

- Does it enable and communications across all channels, including online, voice and text? If not, your organization is missing out on key opportunities to engage your policyholders.

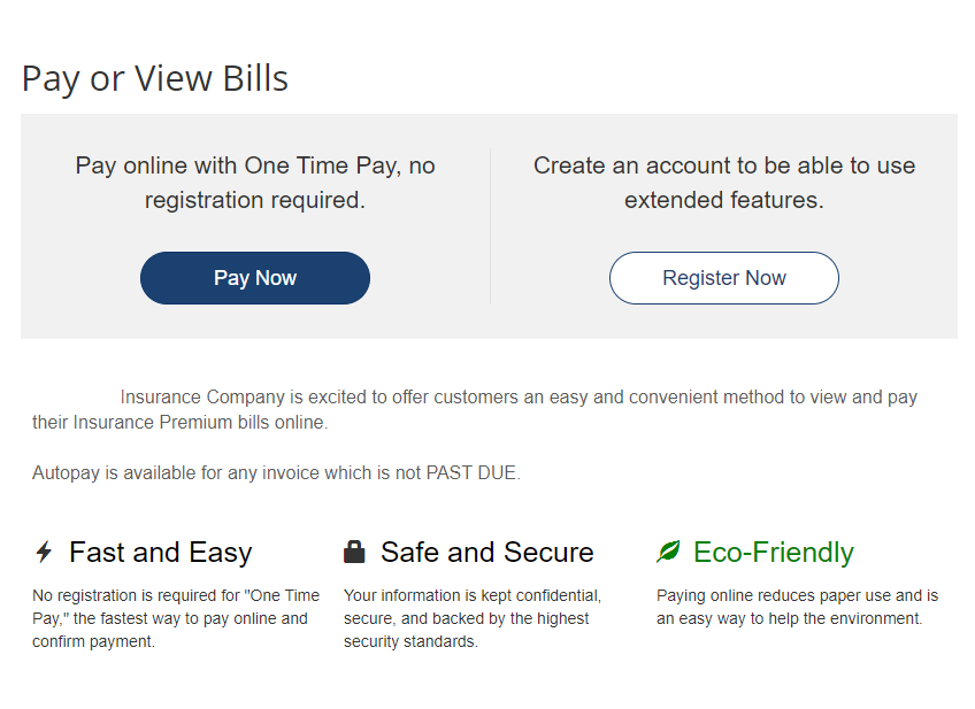

- How simple is it for policyholders to enroll in auto pay or automatic renewals? Your policyholders don’t want to search your site or register an account just to enroll in automatic payments and renewals. The ability to easily set up a payment and forget about it helps with both improving collections and increasing retention. At InvoiceCloud, we offer policyholders the option to enroll in these services both at the time of binding their policy, as well as during the One Time Payment route to make sign up as easy as possible.

Simple processes, easy enrollment and efficient payment routes all contribute to the policyholder experience. Too many online payment solutions provide clunky user interfaces that actually create more headaches for your staff and your customers. For this reason, you need to consider the entire policyholder experience and platform design when selecting a solution. High adopting platforms naturally drive policyholders to self-serve by providing the experience that your customers are looking for across many payment channels — lessening the customer service workload for your staff.

A One Time Payment option enables your policyholders to pay without having to register or sign-up for an account.

Challenge #2: Reconciliation

Many insurance companies grow over time through acquisition, which creates challenges when it comes to reconciling reports between disparate software systems. This reconciliation process requires a lot of manual work on the part of your staff, taking time away from higher priority projects. The right online bill payment platform will integrate with your existing software systems, improving the efficiency and accuracy of your reconciliation process, to reduce manual workloads and improve accuracy.

Challenge #3: Innovation

Increasingly, innovation is becoming an important focus for insurance companies as they try to remain competitive. In fact, agencies like AM Best Company have increased their focus on innovation by including it as part of carrier ratings. So how does this relate to your selection of online bill payment solutions?

Investing in payment technology that increases policyholder retention and drives higher revenue growth positions your organization as innovative and forward-thinking. Beyond that, true software as a service (SaaS) platforms, like InvoiceCloud, enable you to always have the latest technology. With a true multi-tenant, single instance SaaS platform, clients are all on the same stack of base code — meaning updates are rolled out effortlessly and without time-consuming upgrades required on your part. And, since InvoiceCloud offers a configurable solution that allows clients to select which features they want to turn on, the platform can easily adapt to your unique business needs.

Improve Efficiency with the Right Online Bill Payment Software

With the right online bill payment software, your organization can stay on top of changing policyholder expectations and industry advancements, with minimal additional effort on the part of your staff. It comes down to selecting a software partner that can deliver the latest technology and engage customers in the right place (at the right time) to drive adoption rates and create lasting efficiencies for your team.

To learn more about how the InvoiceCloud platform drives positive business results for organizations like yours, schedule a demo today.

*Source: Deloitte Survey: “Service Them Before You Lose Them”