5 Steps to Better Constituent Engagement

Patty Melton

Patty Melton

In today’s digital age, a county tax offices’ ability to actively encourage constituent engagement plays a crucial role in ensuring on-time payments and avoiding the pitfalls of late collections. Earlier tax payments are of paramount importance to the people working in county tax offices as they directly impact the smooth functioning of essential public services. By receiving tax payments on time, counties can ensure a stable and predictable flow of funds, allowing them to efficiently allocate resources, plan budgets, and meet the needs of the community they serve. Furthermore, timely tax payments help reduce the administrative burden on county staff, as they can focus their efforts on providing quality service and support to constituents, rather than dealing with the repercussions of delinquencies.

Encouraging digital self-service (i.e. using online payment methods or signing up for payment reminders) from your constituency is the key to all of this – but it’s easier said than done.

Some demographics are more resistant to digital routes than others. Seniors have been known to avoid online payments, which is understandable considering they have likely been paying their bills through more traditional methods (in-person, mailed-in checks, etc.) for most of their lives. And seniors aren’t the only ones slow to adopt digital options. According to our most recent State of Online Payments data, the lowest income bracket surveyed ($0-$9,999) is the least likely to pay bills online when looking at household income.

So, how can you effectively engage these (and all) demographics to encourage digital payment adoption? Here are 5 steps county tax offices can take to move the needle on constituent self-service.

1. Consider Your First Impression

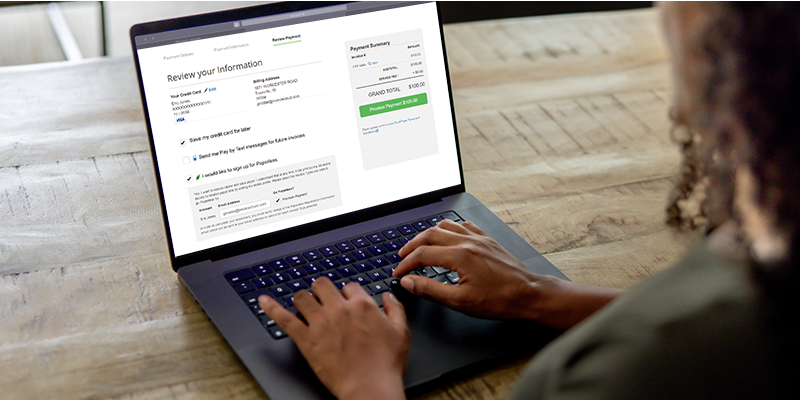

First impressions are everything, so making things as simple as possible is critical. Removing barriers to entry is a great way to start off on the right foot. For example, the InvoiceCloud solution allows customers a quick way to view invoices and pay bills without having to remember any login information. This is also known as “One Click Pay,” or guest checkout.

Customers care about convenience when it comes to online payments, and forcing your constituents to register an account to pay a bill is the opposite of a convenient experience. Optimizing the one-time checkout route for quick, digital payments with no strings attached is the most effective way to drive adoption from all demographics, including those that are historically internet-adverse.

2. Institute the “Candy Aisle” Methodology

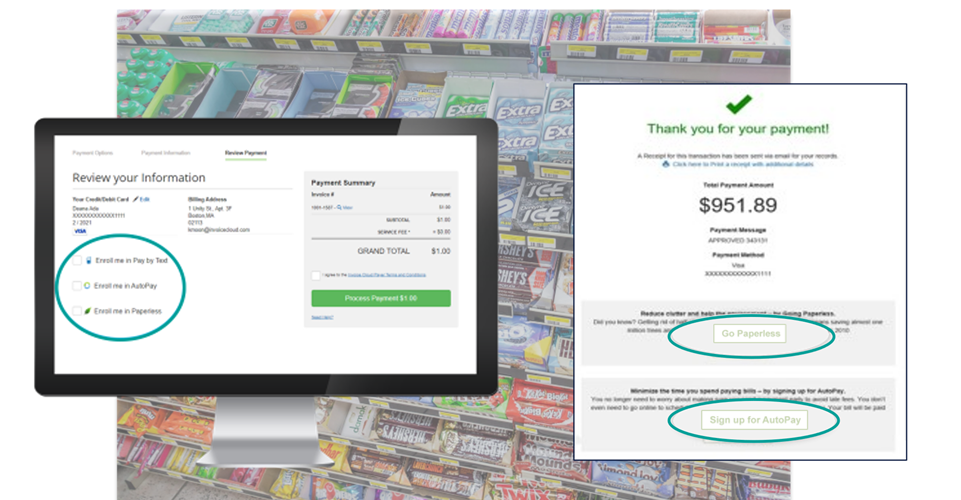

We’ve all been there — standing in the grocery store checkout line, with stacks of candy, gum, magazines and more staring at us. While we wait, it’s near impossible to not pick up something extra to add to your cart. It’s too appealing and simple! Just as grocery stores place these items by registers to entice shoppers to make an impulse buy, the same methodology can be applied to self-service options for digital payments.

By offering self-service options (like enrolling in paperless billing or signing up for text reminders) that are quick and easy to opt into at checkout, customers are more likely to select them and set themselves up for easy payments in the future. This removes friction from future payment experiences, shaping taxpayer behavior for the better. It also helps to assure timely payments, cost savings on print and postage, and less work for county tax offices.

3. Meet Customers Where They Are

To cater to a diverse customer base, it’s crucial to recognize not everyone prefers or is able to pay through the same channel or with the same payment method. Meet all constituents where they are by offering omni-channel payment options.

For instance, underbanked communities can greatly benefit from the convenience of paying bills in cash at local retail stores. And, while research suggests that seniors are open to digital payments, they may still prefer making payments over the phone or visiting the office to utilize a kiosk. The key is to provide a range of user-friendly options that appeal to all demographics, thus encouraging prompt payments while minimizing unnecessary manual work for county staff.

However, the success of omni-channel offerings hinges on maintaining a consistent and seamless experience across all channels. Customers should be able to initiate a payment online and seamlessly continue the process later via phone, without encountering any issues. The Software-as-a-Service (SaaS) delivery model plays a pivotal role in enabling this cohesive experience, ensuring that customers can effortlessly transition between different payment channels without disruption.

4. Be the Voice of Reason

In today’s fast-paced world, life can be hectic, and the lives of your constituency are no exception. That’s why implementing intelligent communications is a powerful tool that can make a big difference.

Tailoring payment notifications to each individual’s specific circumstances (like personalized information about the amount owed) can foster a sense of trust within your community. Intelligent notifications not only serve as helpful reminders but also serve as a gentle nudge to encourage on-time payments. Additionally, they play a crucial role in reducing the workload for your staff, as they eliminate the need for manual reminders or sending late notices.

5. Prioritize Teamwork

In order to optimize efficiency for both your staff and taxpayers, look for integrated digital solutions that harness the strengths of various platforms to your advantage, like coordinated client support and reduced data entry. At InvoiceCloud, for example, biller support is an essential part of our offerings, meaning your relationship with us extends far beyond the day you decide to partner with us. From implementation and onboarding to day-to-day operations and support, we continue to offer our expertise with direct access to our support teams.

Plus, InvoiceCloud collaborates with leading tax software providers to offer integrated solutions that allow taxpayers to pay bills in more convenient ways including mobile wallets, PayPal, Venmo, AutoPay, Pay by Text, Pay by Phone, and traditional payment routes. The success of InvoiceCloud’s omni-channel solution is deeply rooted in our strong partner ecosystem, resulting in integrations built with your software for a consistent and seamless taxpayer experience.

InvoiceCloud for County Tax Offices

InvoiceCloud is revolutionizing how tax organizations handle payments and interact with their constituents. Learn more about how we’re working with county tax offices to increase constituent engagement and drive self-service and request a demo with one of our industry experts today.