The Key to Timely County Tax Payments (+ Free Resources)

Patty Melton

Patty Melton

Seventy-three percent of local governments surveyed for a recent InvoiceCloud report confessed that they struggle with late property tax payments every collection cycle. For any tax collectors, treasurers, or other government employees, this probably comes as no surprise: stemming late, delinquent, or even last-minute payments is a major challenge for many counties or CVT (cities, villages, and townships).

The InvoiceCloud team has helped countless municipalities nationwide streamline their property tax collections and significantly reduce late or delinquent payments. Through that on-the-ground experience, we’ve uncovered a connection between solid constituent communications and routinely on-time tax payments.

So, how is improving resident communications a major step towards collecting more on-time property tax payments? And how can your team strengthen its communication strategy to free up employees for high-priority tasks, conserve resources, impress your constituent base, and more? Let’s dive right in.

Why are late property tax payments so disruptive for local governments?

Put plainly, late or delinquent payments cost local governments more than revenue – they also cost valuable employee time and budget to send notices, track down the payers, and collect payments well past the due date. Even if late or delinquent payments aren’t a major issue, many tax collectors still struggle with that dreaded line of cars – often snaking its way out of the parking lot – on the final day of property tax collections. This spike of last-minute payments, whether made via mail, phone, or in person, often forces local governments to hire temporary staff to field the influx.

Obviously, time and resources are at stake but, maybe more importantly, so is your constituent’s satisfaction. No one necessarily likes to pay property taxes; it’s easy to put this often-stressful task out of your mind. That being said, your forgetful residents likely won’t appreciate being chased down for late property taxes, especially if they feel they haven’t been communicated with properly. This level of frustration can increase customer service call volumes, and could even have an impact on the perception of elected officials who handle property taxes.

Let’s explore a few ways thoughtful communication with constituents can help keep these challenges (and many more) at bay.

1. Leverage notifications for earlier tax payments

Maintaining strong lines of communication with constituents can not only result in receiving tax payments on-time, but more consistently throughout the billing period. That’s right, we mean collecting more payments well before the final due date.

For tax collectors that bill twice a year, receiving payments on-time can be even more of a challenge, as the second payment is often due months after the initial billing. And if a local government office isn’t utilizing payment reminders, especially if there’s a long period between billing and the due date, it’s easy to see an overflow of late or delinquent payments.

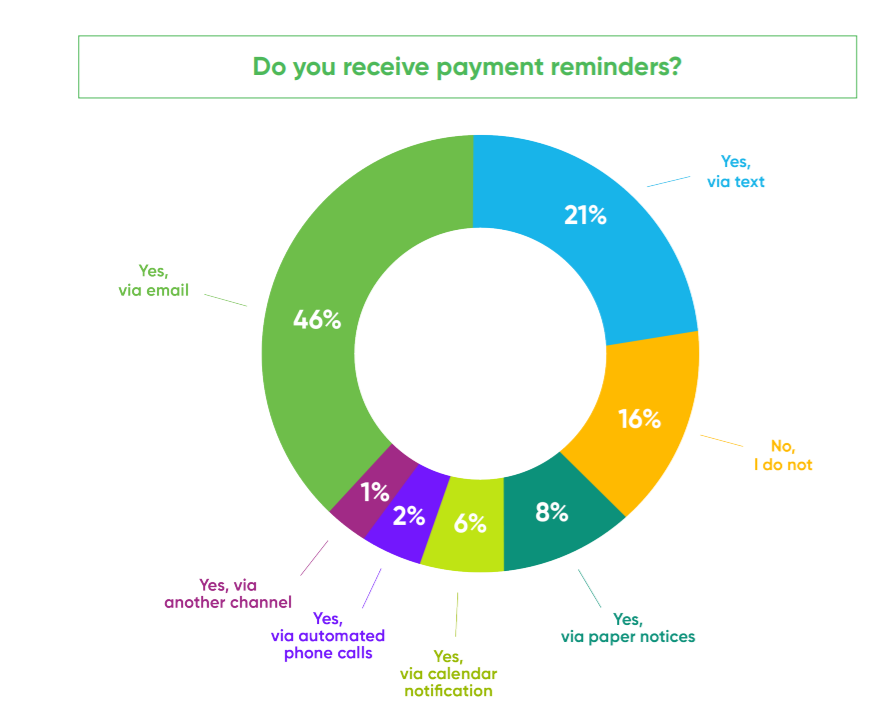

In fact, our 2021 State of Online Payments research report showed a promising connection between payment notifications and timely bill payments. For starters, when we asked over 1,200 survey respondents if they’re signed up for billing and payment notifications, 84% of them said yes, they are, across a variety of channels.

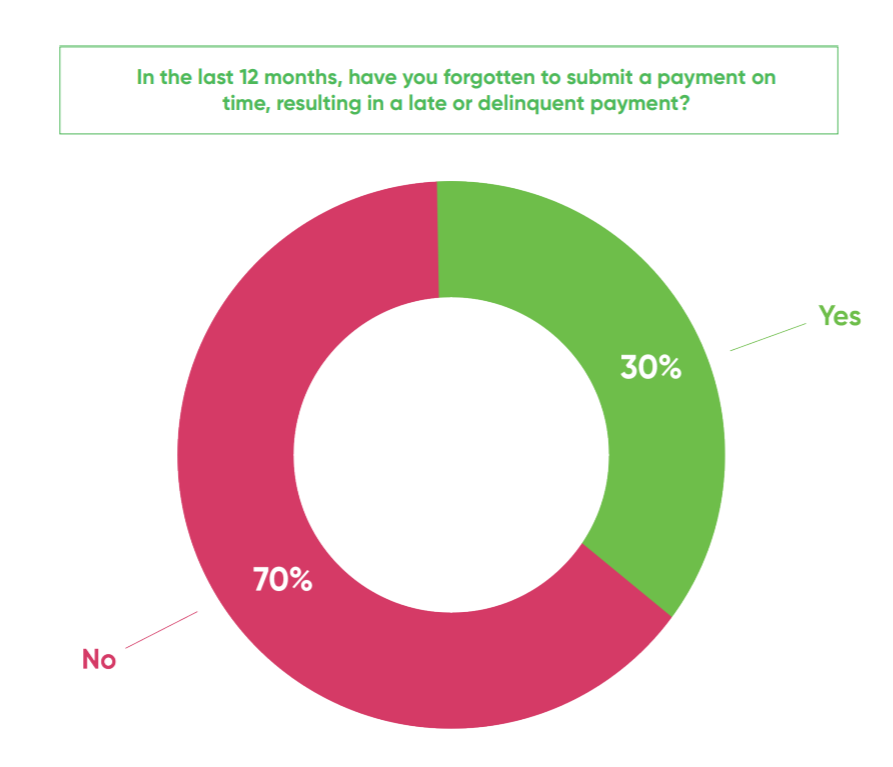

Next, we asked that same group how often they’ve submitted a late payment or not paid a bill at all in the last year.

While over a quarter of respondents are guilty of late or non-payment, the majority have prevented delinquencies with the notifications they have in place.

2. Go beyond payment reminders

While payment reminders are important for avoiding late or delinquent payments, it’s essential to communicate with your customers for other reasons, too. For instance, InvoiceCloud’s Outbound Campaigns functionality allows billers to leverage customer information (geographic location, account type, etc.) to notify customers of events that go beyond bill reminders and late payment notices.

These messages keep payers informed of things like COVID-19 updates or emergency communications, and establish a consistent channel through which you can communicate with your customers. Having a reliable comms channel like this at your disposal is a critical piece to avoiding interrupted collections, spikes in call volumes and service visits, or decreased rates of customer satisfaction.

3. Offer a wide range of options for payment reminders

By now, you understand the importance of payment notifications – but what about how you send out those reminders? The more channels you can offer for payment notifications the better, as you’ll appeal to more constituents. For example, some residents may prefer text notifications while others may respond better to phone calls, emails, or mail reminder.

Those enrolled in automatic payments (AutoPay) doesn’t mean they should be left behind. AutoPay is a great self-service option for many residents and can significantly reduce the amount of late or delinquent payments your municipality receives. However, the 2021 State of Online Payments report revealed that some people are hesitant to enroll in AutoPay out of fear of not having enough funds available. When asked why respondents were not enrolled in AutoPay, one of the most common responses was a write-in comment: “I’m living paycheck to paycheck so I can’t risk enrolling in AutoPay, as the money may not be in my account.”

To make the AutoPay route accessible to more people – and see more payments automatically collected every cycle – it’s imperative to give customers control over the details of their monthly payments (i.e. the ability to change their scheduled payment date or their payment method).

Finally, for tax collectors that want to offer AutoPay or payment plans, make sure your online payment system takes care of the heavy lifting for you and your customers. That means finding a system that makes sure the full amount due is paid at the end of an AutoPay or payment plan options, so your team is wasting time correcting or double checking the math of constituents.

4. Make notification enrollment as easy as possible

By now, we see the equation: the more constituents receiving payment reminders = the more on-time (and early!) payments your county or CVT will receive. And this means easier collections, resources saved, and employee time redirected to high-priority projects.

However, to drive as many residents to these routes as possible, your payment system should be designed to engage with constituents on their preferred channels and actively encourage them to enroll in notifications at every opportunity.

This can look like an option to sign up for payment notifications on the payment screen, throughout the checkout route, on payment confirmation screens, and even via QR codes on paper bills.

Access the Property Tax Toolkit

Want more resources that can help decrease late payments, improve your taxpayer’s experience with your office, and save money? Access our free Property Tax Toolkit below or schedule a 30-minute meeting to find out if our tools can help you.

The toolkit is chock full of research reports, case studies, product sheets, and ebooks, including our Ultimate Guide to Engagement and more. Curated by our internal tax experts, this toolkit is designed to help anyone involved in property tax collections make their annual collections easier than ever.