In an industry with infrequent customer touchpoints, like insurance, every policyholder interaction holds a lot of weight. Your organization only has so many opportunities to connect with insureds, which means one negative experience could result in a cancelled policy or, worse, customer churn.

With stakes this high, it’s imperative for insurance organizations to evaluate the one, universal touchpoint every policyholder must engage with: making premium payments. This is one of the few moments your organization has a policyholder’s attention, so evaluating and optimizing your insurance payment experience could be monumental to organizational success.

Since the policyholder payment experience is critical to the success of insurance organizations everywhere, we decided to uncover what this experience is truly like. We conducted an online survey in June of 2020, through which we asked policyholders about their recent payment experiences, payment preferences, and what contributes to a good user experience.

After digging into the results of the survey, we discovered a few key points that are impacting the insurance payment experience in both positive and negative ways. Here are a few of the biggest, standout takeaways we gleaned from the survey results.

Policyholder retention is key

Combating customer churn and policy cancellations are well-known challenges in the insurance space – and those pain points were represented in our survey results.

To gauge overall satisfaction with their current insurance provider, we asked the survey respondents how likely they were to look for a new provider in the next 12 months. In total, 45% of respondents said they are “likely” or “very likely” to search for a new insurance provider in the upcoming year.

And for those of you wondering how generational differences affected this telling response, it was ultimately consistent across age groups. Fifty percent of respondents under the age of 30 and 52% of respondents ages 30-44 said they are also “likely” or “very likely” to look for a new provider.

The key takeaway: Nearly half of policyholders are actively looking to switch carriers – which means retention and satisfaction should be major focus areas among insurance organizations.

Convenience drives online payments

Since premium payments are the universal touchpoint for policyholders, we decided to specifically dig into how the respondents felt about their insurance provider’s payment experience.

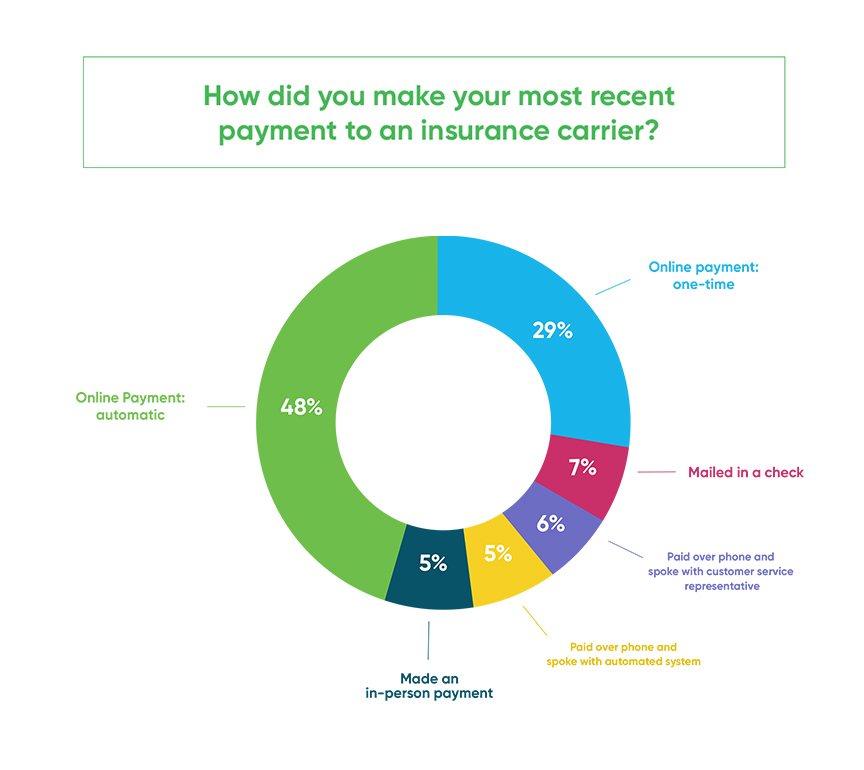

When asked how they chose to make their most recent insurance payment, 77% of respondents said they made an online payment, either through a one-time checkout route or automatic payments (like AutoPay). This response was consistent across all age groups, if not higher; 87% of respondents under the age of 45 made their most recent insurance payment online.

Already, it’s clear that online options are the most popular choice for the majority of insureds.

Next, we asked why this majority chose to make a payment online, rather than mailing in a check or calling their insurance provider. Overall, convenience was king.

Thirty eight percent of respondents chose the online option because they felt it was convenient, while 39% of respondents were already enrolled in AutoPay. This proclivity towards online payments is a fantastic trend for insurance providers; more insureds opting to make payments through self-service options ultimately means less work for your organization and, likely, a decrease in print and mail costs.

But, before you get too excited about those results, there is another side to that coin we must consider.

While online or AutoPay options appealed to many policyholders, we also found that payment platforms that aren’t user-friendly actually deterred online payments. Twenty eight percent of respondents cited they chose not to pay online because their provider’s system was too difficult to use.

So, while many insureds would prefer to make payments online, they may opt for a manual method if the online payment experience offered to them is subpar.

The key takeaway: Optimizing the online payment experience is critical; simply having an online payment option does not mean your organization is automatically providing a positive user experience.

Policyholders expect omni-channel offerings

We also wanted to get a sense of how satisfied insureds are with the omni-channel payment options (i.e. omni-channel capabilities, where you can pay a bill on your phone just as easily as you can on your laptop) their insurance provider offers. Overall, policyholders are satisfied with their options, with 46% responding “very satisfied” and 28% responding “satisfied.”

While it’s encouraging to see satisfied insureds, this feedback means a lack of omni-channel options could be a dealbreaker for your policyholders. If your organization is unable or unwilling to provide the flexibility of omni-channel offerings (where many of your competitors likely are), it could result in unwanted customer turnover.

The key takeaway: Omni-channel offerings aren’t an option anymore, they’re expected for insurance payments.

These results are just scratching the surface of the biggest takeaways we gathered from the survey results. To view the full results – and learn how to address the major pain points we uncovered – download our ebook below.