Event Recap: Duck Creek Technologies’ Formation ’25

InvoiceCloud Team

InvoiceCloud Team

Duck Creek Technologies’ annual Formation conference is a pivotal insurance event, where nearly 800 insurance and technology leaders strategize about the evolution of the industry and how to enhance customer service capabilities. The 2025 event, which took place May 19-21 in Orlando, Florida, was premised around the theme of: Innovate. Adapt. Lead.

A Quick Look at Formation ’25

As a platinum sponsor, the InvoiceCloud team was thrilled for this unique opportunity to engage with global industry experts and thought leaders! Not only were we able to join in on knowledge-sharing and discussions on emerging opportunities, our own Angela Abbott hosted a session with Satvinder Kaur, Head of Enterprise Project Office at The Doctors Company, the nation’s largest physician-owned medical malpractice insurer.

Missed the session? Here are the key takeaways of Angela and Satvinder’s discussion at Formation ’25.

Session Recap: Balancing CX and Efficiency

Today, the pressure for insurers to enhance the customer experience (CX) while managing operational costs has never been greater.

Carriers are expected to deliver seamless, personalized, and efficient service across multiple channels, all while navigating tight budgets, modern policyholder expectations, and increased competition.

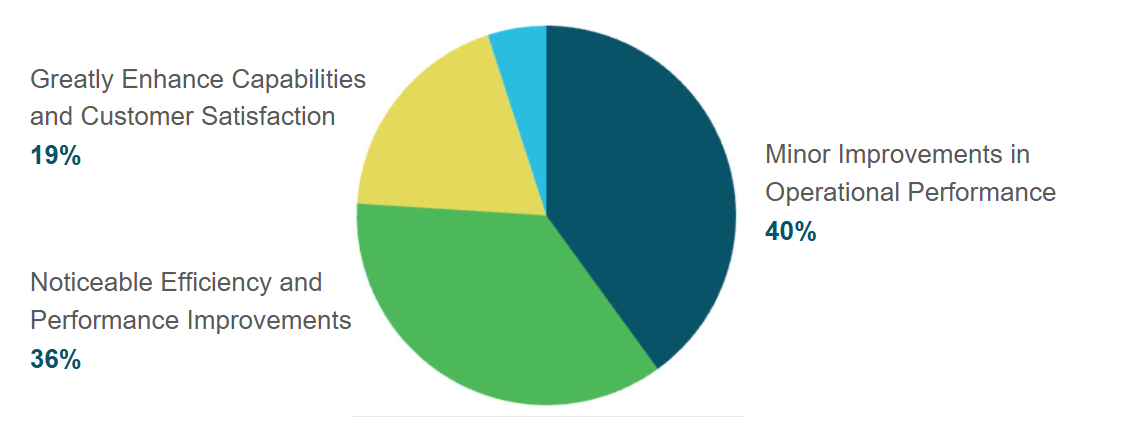

Billing and payment automation technologies are helping insurers strike this difficult balance, specifically the dual objectives of improving CX while driving operational efficiency. Automation can streamline the customer journey, from the most frequent interaction (premium payments) to the most sensitive (claims), and make these critical touchpoints quick and convenient for policyholders.

These expectations for an enhanced CX throughout the customer journey aren’t going unnoticed — in fact, they’re actively shaping digital priorities. According to the latest research from Digital Insurance, improving the overall CX is the most important factor influencing digital strategy for 2025. Enhancing the claims process and reducing operational expenses are also key areas of focus.

Furthermore, more than half (55%) of insurance professionals say that having constant access to the most up-to-date version of each software without any system downtime, additional cost or need for IT resources would meaningfully improve their operations.

Furthermore, more than half (55%) of insurance professionals say that having constant access to the most up-to-date version of each software without any system downtime, additional cost or need for IT resources would meaningfully improve their operations.

Choosing software that uses a true SaaS infrastructure ensures that carriers are always using the latest technology, staying compliant with regulations, and delivering optimal customer experiences. SaaS platforms also provide scalability and flexibility, allowing insurers to grow and adapt as new tools emerge.

Duck Creek Technologies Partners with InvoiceCloud

Through its partnership with Duck Creek, InvoiceCloud addresses critical challenges in the insurance sector, providing innovative solutions that simplify the premium payment process, enhance the policyholder experience, and reduce operational inefficiencies for carriers. This collaboration enables carriers to offer policyholders a secure, intuitive, and self-service payment journey that supports AutoPay, mobile wallets, and other convenient options — driving higher digital adoption and reducing delinquencies.

“Our mission at InvoiceCloud is to make digital payments easily available to everyone,” said Kevin O’Brien, CEO of InvoiceCloud. “Our partnership with Duck Creek Technologies helps insurers to modernize billing and payment touchpoints while improving the policyholder experience. By offering accessible digital payment options, carriers can improve efficiency through increased self-service and provide a convenient experience for all policyholders.”

Head here to learn more about Duck Creek Technologies’ partnership with InvoiceCloud and how we’re working together to deliver digital transformation to insurers nationwide.