In this fast-paced, digital age, it’s interesting to see how some people still hold on to their time-honored habits. One such example is the preference for writing checks to pay bills. While many of us have transitioned to online payments, there’s a portion of the population that prefers the old-school charm of pulling out their checkbook, jotting down the details, and mailing out their payments.

For these check writers, this preference can pose a significant challenge to using the self-service options that millions use to make monthly bill payments easier — a convenience that everyone should be able to experience. To empower this population, billers must first understand the unique challenges they face when it comes to digital payments and what options they can provide to make these options accessible to all.

InvoiceCloud collaborated with a third-party research firm to uncover insights into how billing organizations can drive adoption among digitally reluctant populations. You can get your copy of the free report below.

We hosted an exclusive webinar with our customers to share the top-level takeaways from that research – specifically focusing on those who prefer to write checks for bill payments. Keep reading to get a recap of the webinar, including insights into how billing organizations can encourage this population to try digital payment options.

How Else Do Check Writers Pay Bills?

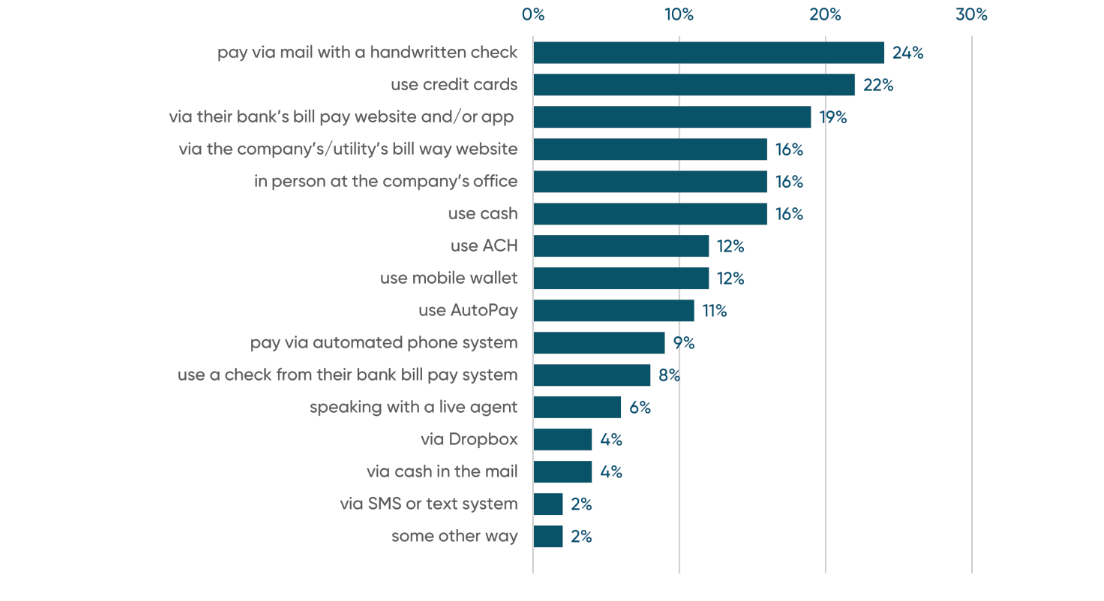

As the name implies, check writers tend to prefer checks – delivered either in person or in the mail – to pay their bills. But how overwhelming is this preference? Are there other payment options this cohort is willing to use?

Let’s take a look at the data.

Unsurprisingly, paying via mail with a handwritten check is the top way this cohort prefers to make bill payments. However, this preference is closely followed by using credit cards and their bank’s bill payment website, leaving billers with some opportunities for driving self-service even among this population.

Opportunities for Driving Self-Service

After looking at the challenges, preferences, and motivators cited by check writers, we were able to identify seven major opportunities to strategically drive self-service among this population. Here are just a few of those tactics:

1. Promote Security

When we asked this population to share the challenges that have prevented them from using digital payment options for bill payments, security concerns was the #1 challenge they cited. However, the data also revealed that security assurance would encourage 56% of non-English speakers to pay online.

An easy way to share information on your organization’s commitment to online payment security is including a “Payment Security” section on your website or payments landing page – just make sure there’s a translated option!

2. Enable Mobile Wallets

This demographic loves mobile wallets. Eighty-three percent of non-English speaking payers have used a mobile wallet to make a purchase and over a quarter already use one for bill payment. There’s opportunity for growth, too: 95% of those who do not currently would try using a mobile wallet to pay bills.

To open the door for this means of digital self-service, billers should ensure that they’re offering as many mobile wallets as possible — PayPal, Venmo, Apple Pay, and Google Pay are just a few of the more popular ones. Then share translated, educational materials in your office (since 13% of this demographic comes into the office to pay), on your website, or with QR code on bills.

3. Increase Payment Reminders

Since 27% of non-English speaking payers cite “remembering to pay on time” as a challenge, increasing the frequency of your payment reminders is critical for avoiding payment delinquencies among this population. InvoiceCloud customer data indicates that second and third payment reminders have a higher rate of success, so billers should aim to enable as many notifications as possible.

Ideally, your billing and payment system should allow for translated reminders to ensure success. It can also be helpful to share guides on how customers can easily enroll in payment reminders to make sure more customers are receiving these notifications.

Report: Digital Payments for All

For more insights on how to drive check writers to digital payment options, get your free copy of our report, “Digital Payments for All: Encourage Self-Service Among Digitally Reluctant Customers.” This resource includes all the data from our survey of bill payers from this population and a few other key historically non-digital cohorts: those 55 and older, check writers, and the unbanked.