When it comes to policyholder experience, the claims payment process is the moment of truth. From an experience perspective, consider the worst-case scenario: a family without a place to stay due to a catastrophe, the business owner who loses the retail space and all their inventory via hurricane, tornado, fires, flooding, or whatever it may be. The expectation in that moment is the claimant has paid their premium for years and the insurance carrier is now going to provide the lifeline that’s going to help them protect what’s most dear. That may mean getting them food, a place to stay for the evening, or even inventory to get back up and running. Whatever the need, this is the moment when the insurance companies are expected to roll in like the white knight.

With the high stakes of this customer experience, it’s essential to understand policyholder expectations and preferences for receiving this critical payment. Any incident that warrants a claim is typically a challenging and delicate situation, so policyholders will be extra sensitive to whether their needs were met.

A recent study by LexisNexis Risk Solutions found that one in three policyholders switch insurance providers after receiving a claims payment because they were dissatisfied with the process. Clearly, the speed and ease of receiving these payments can dictate not just customer satisfaction, but policy retention as well.

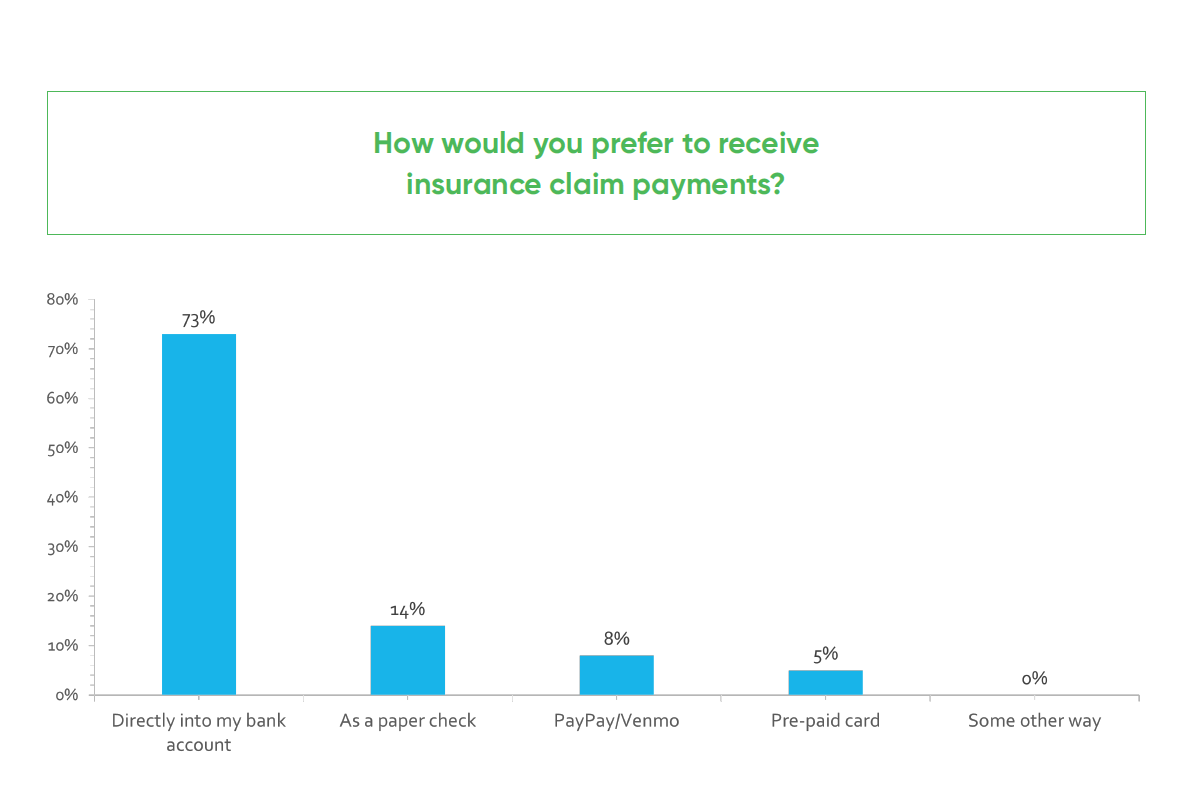

For our annual State of Online Payments report, we asked over 2,000 Americans how they prefer to receive and pay their monthly bills, including insurance payments. Of those who make insurance premiums digitally, we inquired how they prefer to receive their claim payments. Let’s take a look at how this segment of average policyholders responded.

How do Americans prefer to receive claims payments?

In response to our question regarding claims payment preferences, almost three-quarters (73%) stated they would prefer to receive insurance claim payments directly into their bank account while smaller numbers would prefer to receive them as a paper check (14%), through PayPal or Venmo (8%), or on a pre-paid card (5%).

Note that while everyone who participated in this survey had paid a bill digitally in the last year, this group contains people from all major demographics. Payers from ages 18 to over-65 are represented here, as well as people from all household incomes, areas of the country, and more.

There are several credible reasons why direct deposit is the preferred method for receiving claim payments. Security, for one. Paper checks are subject to nearly twice as much fraud risk than any other payment method, with US $1.3 billion lost to check fraud in 2022.

As its name would suggest, direct deposits are expedited by nature. A 2021 U.S. Property Claims Satisfaction Study showed that carriers who implemented outbound digital payments reduced the average time to payment by up to 5.5 days and drove an all-time high in customer satisfaction scores.

Ultimately, the key is convenience – our survey results show “convenience” is the number one reason why respondents choose digital channels in the first place – and it doesn’t get more convenient than quickly receiving an insurance claim directly to your bank account.

What are Outbound Payments?

The InvoiceCloud digital outbound payments solution enables you to digitally pay claims, vendor payments, return premiums, and agency commissions quickly and easily. Our seamless lienholder and multi-party capabilities simplify the payment endorsement process, eliminating policyholder frustration and disbursing funds faster.

- Increase policyholder satisfaction and retention by allowing claimants to receive payments quickly according to their preferences.

- Lower your payment processing costs while increasing operational efficiencies.

- Reduce escheatment and avoid costly audits and issues.

- Simplify the multiple-endorsement process with multi-party and lienholder capabilities and reduce claimant frustration, lost checks, and incoming call volume.

Outbound Payments offer a digital advantage that puts insurers in an ideal position to better meet the changing expectations of today’s policyholders. Schedule a demo today to learn how your organization can take advantage of InvoiceCloud’s Outbound Payments feature, or download the State of Online Payments report to learn more about today’s policyholder preferences.