Whether it’s online, on the phone, or on a mobile payment platform, allowing your customers to submit payments on the channel of their choice is key to increasing online payment adoption. This adoption strategy is also known as omni-channel, or the ability to tie together customer experience touchpoints across multiple channels.

While they may seem similar, omni-channel and multi-channel offerings actually provide very different experiences. A multi-channel experience simply allows customers to interact on different channels, whereas omni-channel provides a consistent experience from one channel to the next (i.e., a customer can begin an interaction on the phone and pick it up later online without losing any context).

To be truly effective for payments, your organization’s omni-channel options must be optimized to deliver the same, simple experience across every payment channel.

In this post, we’re going to explore how to best optimize a payment channel that’s particularly on the rise: the mobile payment platform. Let’s dig into the benefits of offering mobile payments and what your organization should look for in a fully optimized mobile payment platform.

Why are mobile payments so important?

Mobile devices are quickly becoming a popular payment channel for many demographics. According to Invoice Cloud research, 66% of consumers have paid a bill through a mobile device (76% if you isolate consumers aged 30-44) and 34% of consumers prefer to make payments on their mobile device over any other channel.

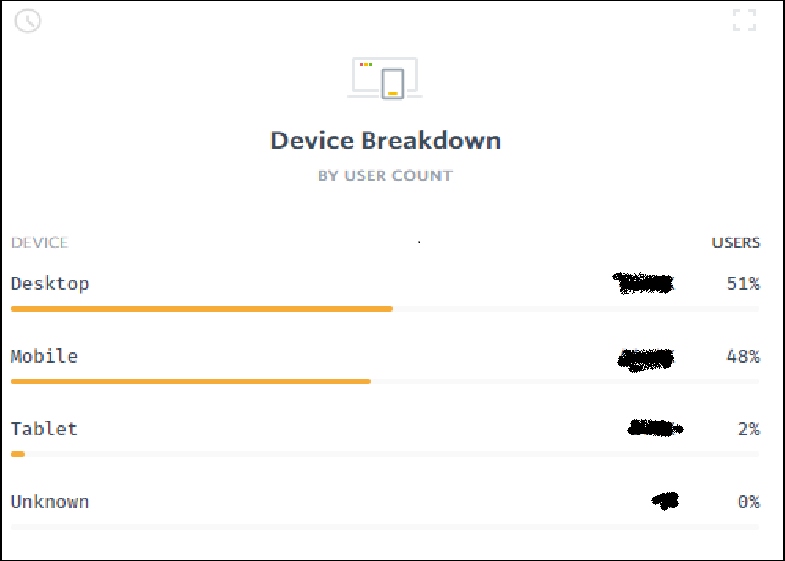

At InvoiceCloud, we’ve found this to be true with our own clients – 50% of web payments made through InvoiceCloud’s solution are actually made on a mobile device.

Additionally, offering mobile payments is critical for your organization’s Millennial customer base. With a population of over 72 million, Millennials are currently the largest generation in North America, and the buying power of this generation has compelled many industries to modernize their practices. Most critically, this generation of consumers expects exemplary customer experiences – they also prefer to pay their bills and interact digitally.

For example, a recent Invoice Cloud survey found that 41% of Millennial insureds have purchased an insurance policy on their mobile device. In that same survey, we found that 30% of Millennialsplanning to switch insurance carriers are looking for better customer experiences, including a carrier who offers mobile channels for premium payments.

While this survey focused on the insurance space, the concept holds true across all industries: to keep pace, it’s critical for all organizations to see technology as an opportunity rather than a threat. And expanding your digital payment options is an easy way to provide customers with those tech offerings they’ve clearly come to expect.

The mobile payment platform optimization checklist

When considering how to optimize your mobile payment channel – or when evaluating the quality of an online payment solution’s mobile platform – there are a few key factors your organization must keep top of mind.

Here’s a quick checklist, to get you started:

Design

Design

To offer a fully optimized payment experience, your organization cannot overlook the design of all its payment channels – especially its mobile channel. It may seem obvious, but mobile payment platforms should be designed specifically for mobile devices.

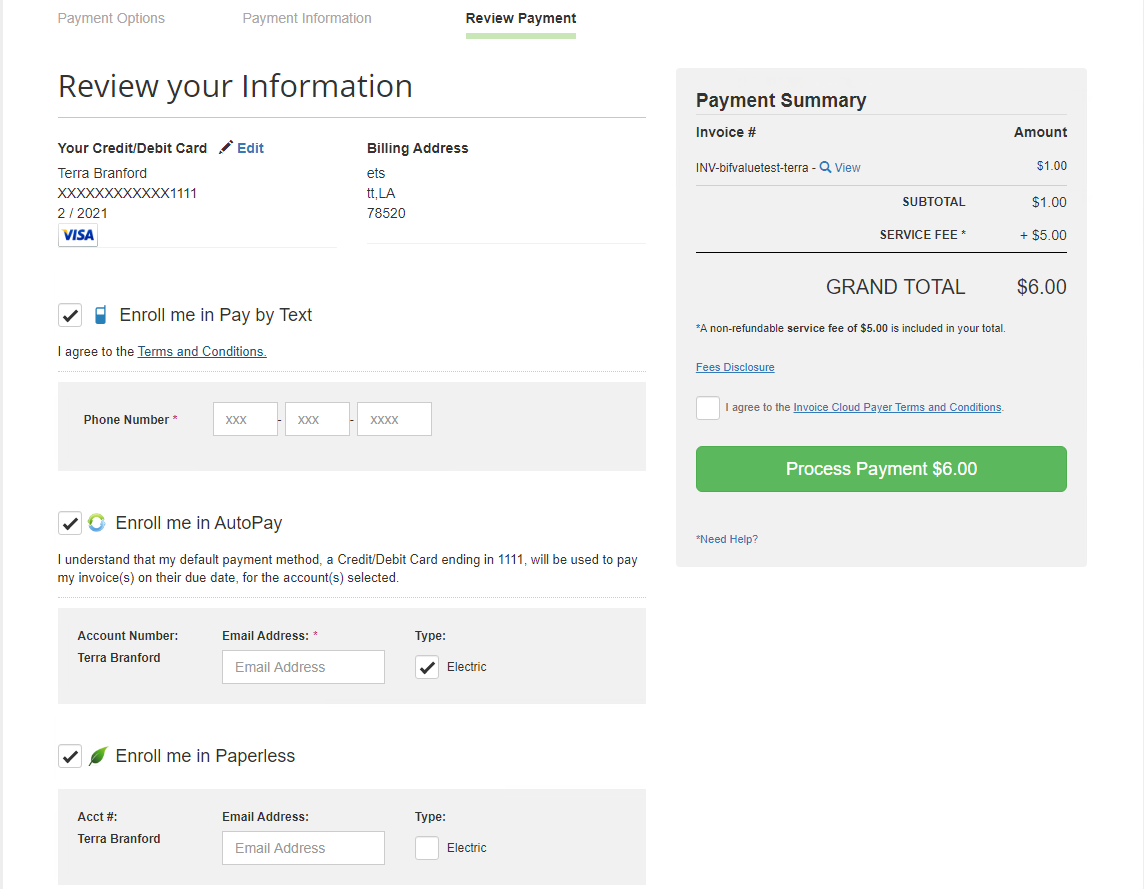

This means designing the platform with dimensions that are appropriate for a smaller, vertical screen. It should also use direct, succinct language (as too much text on a small, mobile screen can be distracting) and should encourage customers to enroll in self-service options like paperless billing and automatic payments (AutoPay) at every opportunity.

Thoughtful communication

Thoughtful communication

Communication and customer engagement is a large part of the customer experience. When it comes to payments, this means keeping customers in the loop about when their payments are due and offering ways to easily make payments. Sending pay by text reminders are not only great for customer engagement but can help your organization decrease delinquent payments. According to our study, The State of Online Payments, 60% of respondents have missed a bill payment, and half of them agreed receiving a reminder in a text message would have prevented the delinquency.

In the same token, outbound campaigns are also a great way to communicate with your customers. These campaigns allow your organization to notify customers on information beyond bill reminders and late payment notices, like shut off notices, updated COVID-19 hours, or emergency communications. Similar to pay by text reminders, outbound campaigns not only improve the customer experience and increase online adoption rates, but also decrease your organization’s volume of late or missed payments.

Mobile wallets

Mobile wallets

With services like Apple Pay and Google Pay becoming increasingly popular, the use of mobile wallets has been gaining a lot of momentum in the past few years. In fact, we’ve predicted that mobile wallets will be one of the 5 biggest payment engagement trends for 2021.

Mobile payments are a truly omni-channel experience — customers only need to enter their payment information in their mobile wallet once and the stored payment information is then accessible for all online payments. Moving forward, mobile payments and mobile wallets will be a billing essential, especially as the tech-savvy Millennial generation continues to transform consumer expectations.

Invoice Cloud has the mobile payment platform you need

Overall, offering an optimized, mobile payment channel is one of the best ways your organization can provide customers with a no-hassle, convenient payment experience. Unfortunately, many billing organizations still do not offer optimized mobile payment platforms, which is a major deterrent for their digital payment adoption.

Invoice Cloud offers a fully optimized mobile payment platform, designed to leverage all points of customer engagement and encourage payers to enroll in self-service routes like paperless billing and AutoPay.

Our mobile platform also enables billing organizations to maintain strategic communication with customers through outbound campaigns, pay by text reminders, and more — just a few reasons why Invoice Cloud achieves 2-3 times higher adoption rates than any other online payment solution.

Most recently, we announced our exciting partnership with PayPal, one of the most trusted names in digital payments. This is a major milestone in our effort to provide billing organizations with the most complete and convenient online payment solution possible, and bolsters our already superior mobile payment experience.

To learn more about what customers are expecting from your online payment experience, check out our research report, The State of Online Payments.