Since the start of the pandemic, it’s likely that you’ve nervously wandered into your favorite restaurant or coffee shop, maybe for the first time in months. If so, you’re probably used to viewing a menu or placing an order via a QR code; digital or printed squares that, when scanned by a mobile device, pull up a linked webpage.

These unique codes serve many purposes, from buying that morning coffee to learning more information about an advertisement, all while limiting in-person contact.

But what exactly are QR codes? And do they have a place in billing and collections? As we grow more accustomed to QR codes in our daily lives, let’s explore the effectiveness of QR codes in billing and collections strategies.

What are QR codes?

QR codes were founded by Japanese developers in 1994 and are designed to be scanned with a smartphone or smart device camera. Once scanned, the web address or information embedded in the code will immediately pop up on your device for you to view. This kind of speedy interaction gives QR codes their formal name, “quick response codes.”

For billers, these codes tend to simplify collection processes (for staff and customers) by providing a frictionless user experience with very few barriers to payment. Ideally, for bill collections, these codes should lead the user directly to their bill or directly to a payment screen. This superior ease-of-use makes QR codes one of the most user-friendly payment options out there — but how can billing organizations use these codes to boost e-payment adoption?

How can Billing Organizations Leverage QR Codes?

Here are just a few impactful ways billing organizations can utilize QR codes to drive e-payment adoption and, overall, receive more consistently on-time payments:

Directly on the Bill

Placing a QR code right on the bill is a direct and simple route, as the user won’t need to look elsewhere to find it. Many InvoiceCloud users have found this method effective, including a city in northern Virginia that saw great success by putting QR codes directly on their bills with instructions in both English and Spanish.

Bill Inserts

Bill inserts are slips of paper that are placed in an envelope to accompany bills. Some billing organizations may choose to incorporate these inserts, separate from the bill, that features a QR code with instructions on how to quickly access their bill or make a payment.

Envelope Teasers

Envelope teasers are messages placed on the outside of billing envelopes. Since this eliminates yet another step in the payments process (opening and reading a paper bill), this QR code placement tends to be very effective, greatly increasing the likelihood of payment even if customers ignore or forget about the bill.

Postcards

Sending a standalone postcard with a QR code and payment instructions, rather than an entire envelope of bills and notices, not only saves time but conserves paper and decreases printing and mailing costs, too.

Another InvoiceCloud user, Mishawaka, IN decided to conduct an A/B test on the QR-coded postcards our team created for their billing efforts. One set of cards included a QR code with the text “save time, pay online,” and another included the QR code with the text “pay from your mobile device.”

Interestingly, the postcard with the wording around paying from a mobile device performed better overall, giving us the impression that payers are generally excited to make quick, easy payments right on their smartphone.

Posters

Creating QR-coded posters to feature in your organization’s area can create a lot of buzz around using these codes for bill payment. One of the largest cities in Alabama (also an InvoiceCloud user) saw tremendous success by placing posters provided by our team at the desks of their service representatives, cashier windows, vestibules for drop-off payments, and in a local courier print ad. Utilizing local news publications can increase the reach and awareness of your QR codes, and including these codes in-office gives customers who tend to make payments in person a taste of the convenience of digital payments.

Encouraging Customers to Utilize QR Codes

When it comes to crafting messaging to your customers, it’s crucial to highlight the convenience of using QR codes to pay bills. Impress upon your payers that if they want to quickly get their bills paid and checked off their to-do list (right from the device they have on them at most times) QR codes are their new best friend. Using this type of language can help customers understand the real-life convenience of QR codes and, hopefully, will drive them to make more digital payments via this channel.

What does more e-payments mean for billing organizations? For starters, automating time-consuming processes related to billing and payments saves staff members tons of valuable time (our recent survey report found that government employees spend 10-20 hours per week fielding payment-related calls), allowing them to be more productive and less burnt out. Not to mention, saving funds that can go right back into your operational budget.

And leveraging QR codes to drive that meaningful e-payment adoption and is where InvoiceCloud can help.

QR Code successes in Digital Adoption Efforts

Since rolling out this feature in August of 2021, 175 InvoiceCloud users have implemented QR codes into their billing strategy, all of which were created by our Customer Marketing team — a dedicated team of marketing professionals that are devoted to helping InvoiceCloud users increase their e-payment adoption. The Customer Marketing team creates all QR-coded materials, including deep link codes that are individualized for each payer. The team also helps users create marketing materials and create messaging to educate and encourage the use of these codes among their customer base.

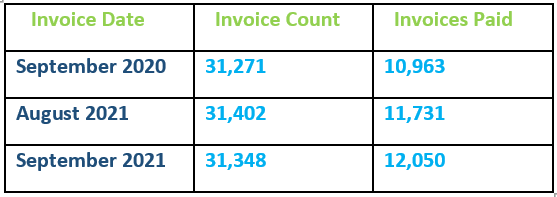

Among the InvoiceCloud users who have implemented QR codes, we’ve seen a correlation with higher online payment adoption rates. For example, Mishawaka, IN sent those two batches of QR-coded postcards in late August 2021, resulting in 826 QR code scans. Since mailing those cards (in August and September of 2021) Mishawaka Utilities saw 1,082 new payers — a 31% increase from the previous two months. Additionally, in September of 2021, 38% of their invoices were paid electronically.

In the digital age, and in the age of COVID-19, offering easy, contactless payment channels like QR codes are essential. To learn more about different billing practices your organization should consider in today’s day and age, download our guide, the New Biller Best Practices: How COVID-19 has changed billing and payments.