Usually, when we talk about generational trends with digital payments, we’re talking about younger generations. What payment channels do Millennials prefer? How can you keep payments on-time and consistent with younger customers?

These are important questions to ask – but what about the other end of the generational spectrum? Are seniors adopting online payments at all?

When considering whether to invest in an online payment solution, some billers wonder if an older demographic would be willing to try or even adopt digital payments. This is understandable, considering that customers 61+ have likely been paying their bills through more traditional methods (in-person, mailed-in checks, etc.) for the majority of their lives.

In InvoiceCloud’s annual research report, The State of Online Payments, we surveyed ~2,000 customers like yours to get a better understanding of how people at all ages prefer to make payments, including this historically non-digital customer segment. Here are a few points from that research that should help answer whether your older payers would be willing to adopt digital payments.

1. Customers 61+ are Using Online Payments

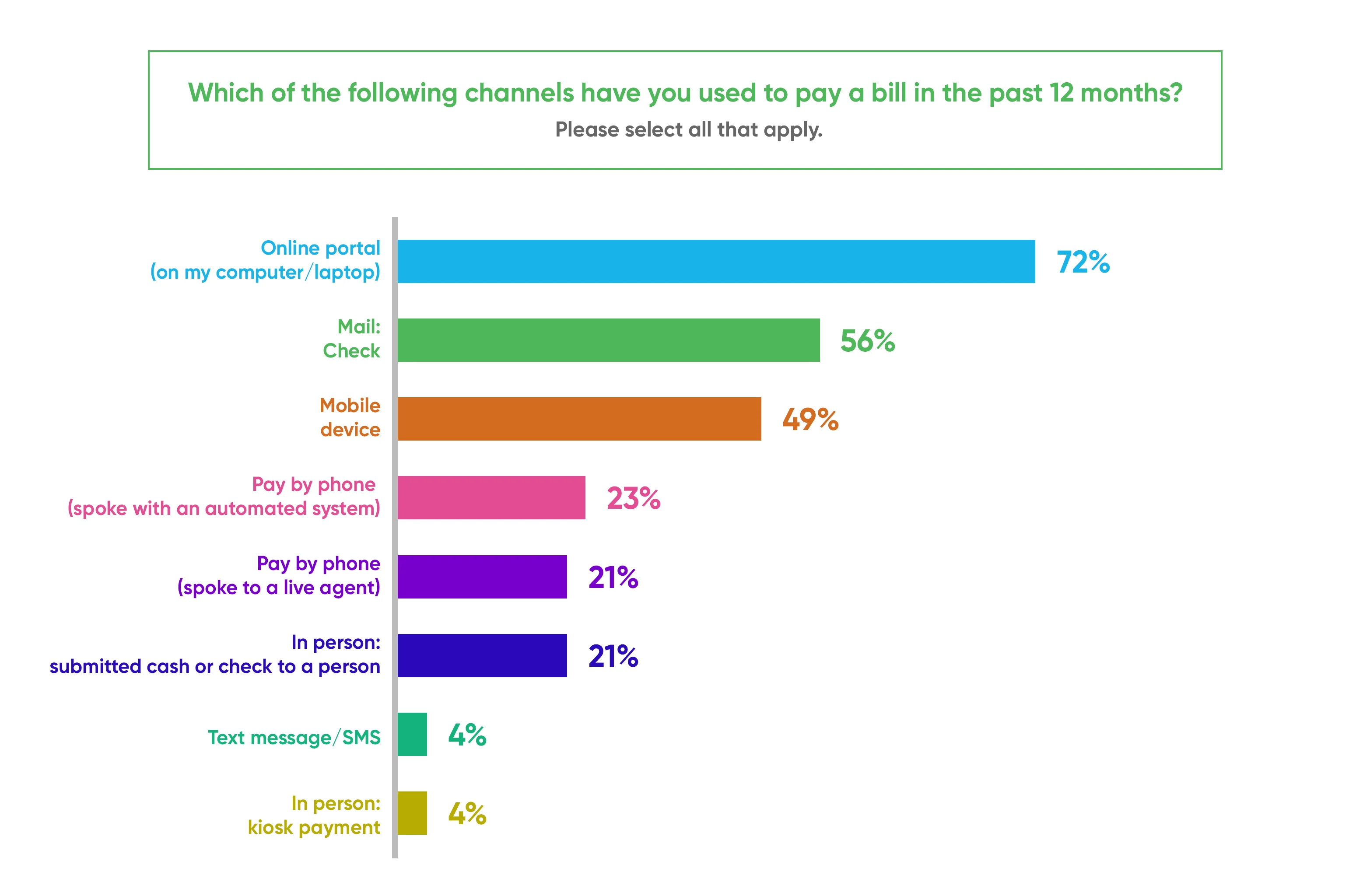

Contrary to popular assumptions, data from The State of Online Payments shows that customers ages 61+ use online or mobile payment channels more than any other channel. This graph (as well as all the graphs you’ll see below) offers a segmented look at just how respondents 61+ answered the following survey question.

We asked respondents, “Which of the following channels have you used to pay a bill in the past 12 months?” In response, 66% of respondents 61+ said “an online channel” and nearly 50% said “through a mobile device.”

For online payment usage, this percentage is right on par with the younger generations’ responses – in fact, about 64% of customers ages 18-29 have used an online channel to make a payment in the last 12 months, slightly less than customers from the 61+ demographic.

2. Customers 61+ are Comfortable Making Digital Payments

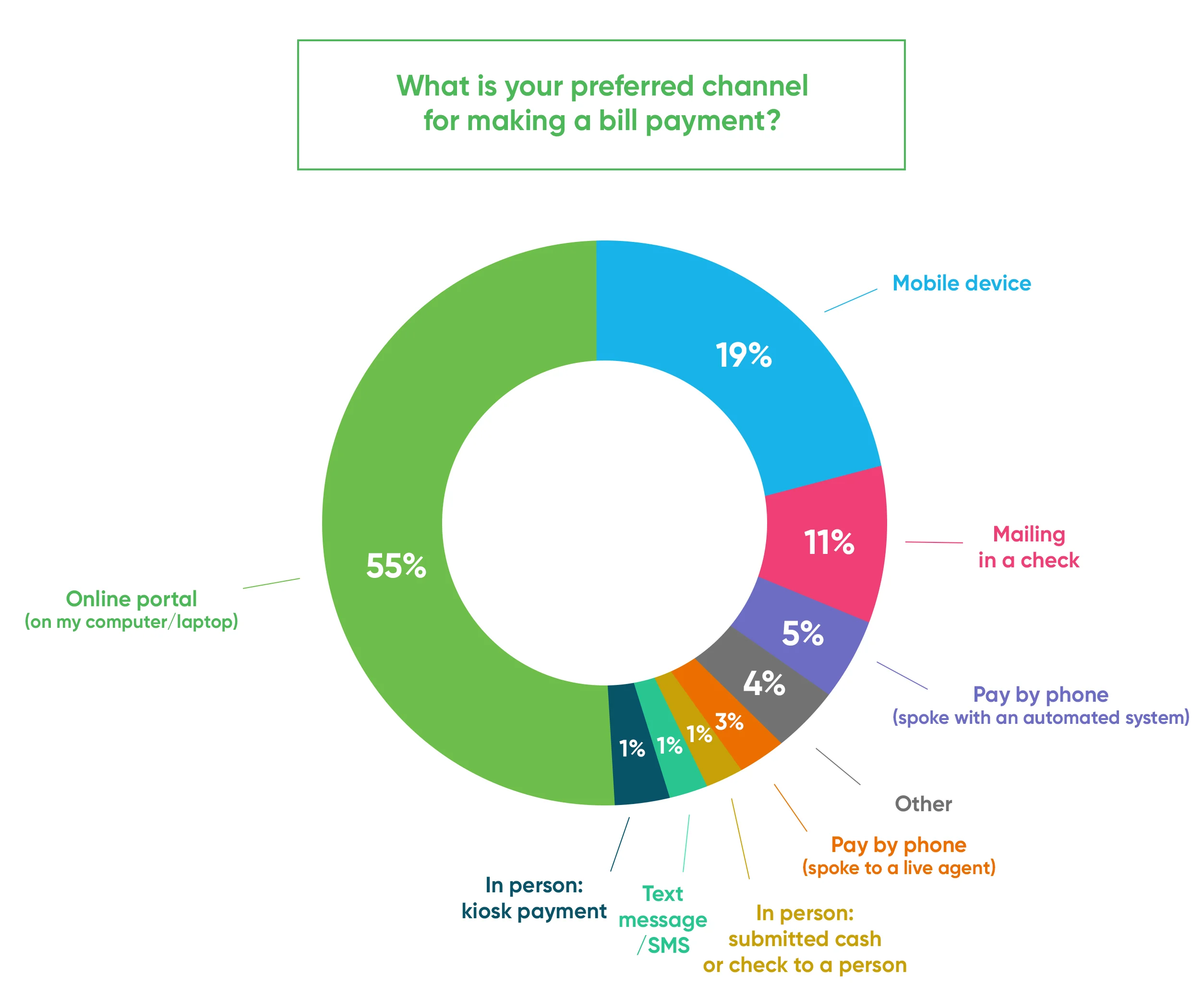

To determine if there is a rift between what payment channels are convenient and what payment channels are preferred, we asked respondents to share their go-to channel for making a bill payment.

When asked what their preferred channel was for making a bill payment, 54% of respondents age 61+ said an online portal and 22% of respondents 61+ said “a mobile device.” All in all, 76% of customers 61+ prefer a digital payment channel.

Again, this preference for digital payment channels was prominent across all age groups – but the 61+ demographic cited they prefer online bill payment more than any other age group, and by a sizeable margin, at that.

3. Customers 61+ Use Online Channels for All Types of Payments

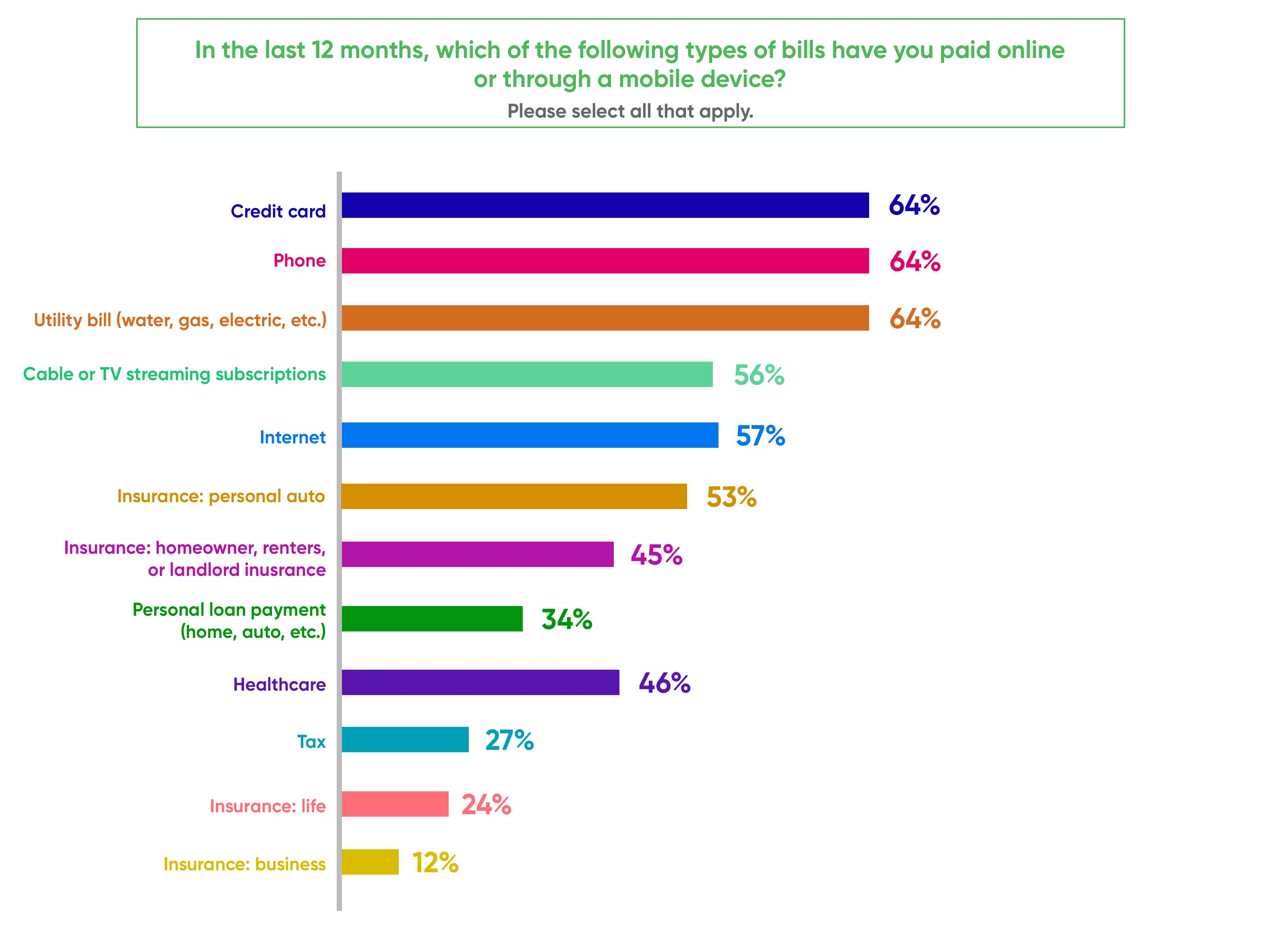

Finally, we wanted to explore what types of payments customers 61+ are comfortable paying online. For instance, does this segment prefer to pay their phone bill online but avoids paying utility bills digitally?

The survey data showed that, essentially, most 61+ payers prefer to make most payments through online or mobile channels.

Right in line with our previous findings, the 61+ demographic uses online or mobile channels to pay all the same bills as payers ages 18-60.

A few standout data points were in utility payments – for which, 62% of respondents age 61+ choose to pay through an online channel or mobile device – and insurance, where the oldest demographic was leading the pack in digital payments for P&C premiums.

How to Drive Higher Rates of Senior Digital Adoption

If you’re surprised by these findings – perhaps your older segment of customers has been resistant to digital innovation in the past – it’s worth noting that no demographic will adopt online payments unless it’s a simple, intuitive payment process.

In The State of Online Payments, we asked respondents to rank the most critical factors to a positive payment experience. Across all age groups, the number one answer was: “the system is easy to use.”

This ease of use is especially crucial when your organization is trying to get a historically non-digital demographic to adopt online payments. Here are a few ways your organization can improve this transition for those who are newer to digital payments:

- Make sure to mirror the details of your paper bill in your organization’s online payment portal, so customers know exactly what is due. This online bill should also have consistent branding, so customers can confidently identify that they’re paying in the right place.

- Promote online payments regularly with bill inserts and statement messages to inform customers who traditionally opt for manual payment methods about your organization’s online payment options. You can also utilize “envelope teasers,” providing information on your organization’s online payment options that’s featured on the outside of your billing envelopes.

- Don’t forget to provide relevant and timely bill payment reminders so these customers don’t worry about missing a payment. And, crucially, make sure you’re delivering those reminders through channels that this demographic is comfortable using, like direct mail, email, Facebook, or outbound phone calls.

To learn more about how your organization can cater to underserved populations like seniors, get your free copy of our research report, The 2025 Bill Payer Preferences Report.