From a 30,000-foot view, it might seem like payments and policyholder experience are two separate, unrelated aspects of business. But, for insurance organizations especially, this couldn’t be further from the truth.

The insurance industry has notoriously scarce customer touchpoints, which means one negative experience could result in a cancelled policy. It’s imperative for insurance organizations to evaluate and optimize the one, universal touchpoint every policyholder must engage with: making premium payments.

Last week, we shared the five major takeaways from a recent research report on policyholder experience in our webinar, “5 Tips to Improve Policyholder Experience and Reduce Customer Churn.”

If you weren’t able to make the webinar, don’t worry – we’re going to recap those five key insights right now (plus, we’ll share some fresh polling data from the webinar participants themselves).

Tip 1. Focus on the online payment experience

The survey results offered some good news in the way of e-adoption: most policyholders are already opting for online payments.

For their most recent insurance payment, 77% of respondents made an online payment, either through a one-time checkout route or AutoPay. And that number only grows if we look at the 87% of respondents under the age of 45 that made their most recent payment online.

These existing levels of adoption are, undoubtedly, a fantastic start. Online payment adoption helps take the burden of processing manual payments off your staff, helps reduce costs, and gives insurance organizations a head start in improving their overall payment experience.

But this leaves insurance carriers with an important follow up question: you have an audience that is willing to adopt online payment, so how do you capitalize on this?

The simplest answer? By engaging insureds during the payment process to drive the self-service adoption that makes your organization more efficient.

We asked our webinar attendees to share how they engage their policyholders and drive insureds to self-service. Here are the results of that live poll:

Poll: Which of the following billing and payment options do you offer today?

- AutoPay/Recurring payments: 39%

- Scheduled Payments (one-time future dated): 33%

- Turn off paper statement/paperless enrollment: 17%

- Interactive Voice Response (IVR) system: 11%

- None: 0%

Overall, it’s encouraging to see that every webinar attendee offered some billing and payment options! Of course, the more well-rounded your payment offerings are, the more success your organization will see in terms of adoption rates.

Tip 2. Find a solution that’s simple and easy to use

Now that we know policyholders are willing to pay online, we wanted to find out why.

When asked why they chose to make online payments, 38% of respondents said the convenience of paying online won them over. And 39% of policyholders said they paid online because they are already enrolled in automatic payments.

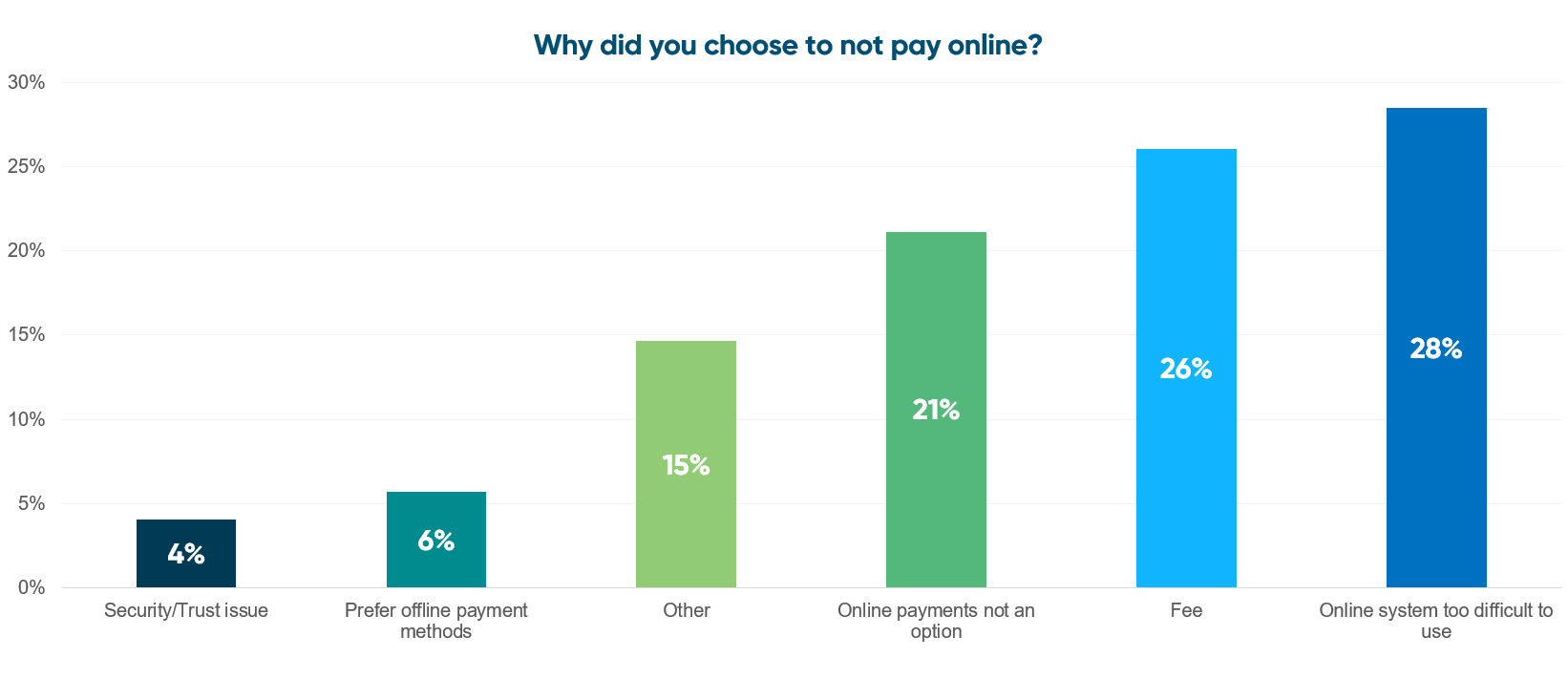

We were also curious to discover why some policyholders chose to not pay their bills online. 28% of respondents said their provider’s online system was too difficult to use, closely followed by insureds not wanting to pay fees (26%) and a lack of online payment options through their insurance provider (21%).

In all instances – for and against online payments – convenience was the largest deciding factor. So, we asked our webinar attendees if they offer one of the most convenient payment options available: one-time or guest checkout routes.

Poll: Do you offer a one-time payment or guest checkout route?

- Yes: 45%

- No: 28%

- Did not answer: 27%

This route is fantastic way to remove obstacles for policyholders paying their insurance bills. Not only is this a critical function to have, one-time payments are an offering that can (and should!) be optimized to produce the best possible results.

Tip 3. Make it easy to enroll in automatic payments and paperless billing

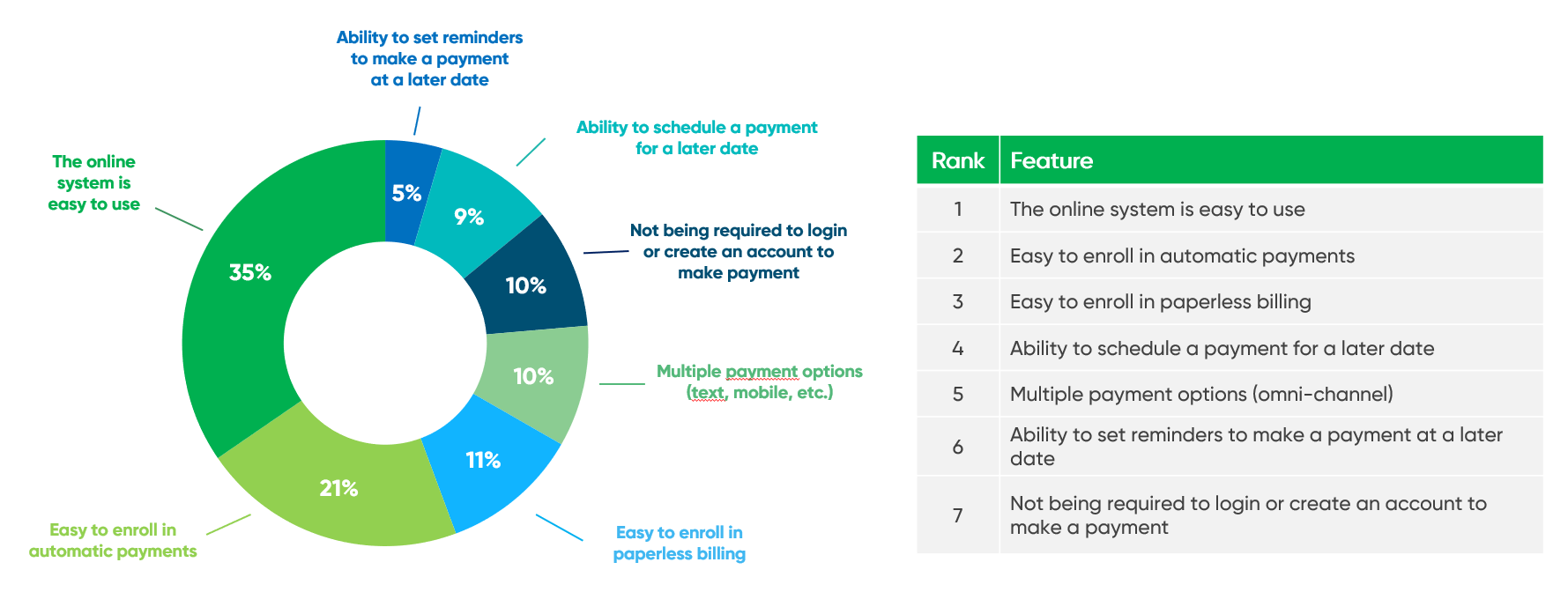

The trend of convenience as king held true when we asked respondents to rank the most important factors to an online billing experience. Out of seven options, 35% of policyholders stated that ease of use was the number one most important aspect of a great user experience.

You’ve heard it directly from the policyholders: your organization can provide an outstanding online payment experience by selecting an online payment system that’s simple and easy to use.

Reaching 100% e-adoption is the ultimate goal for billing and payments – and the quickest way to get there is by clearing a path to the payment options that drive results.

Tip 4. Optimize omni-channel payment options

Another key piece of creating a truly convenient policyholder experience is providing omni-channel payment options (i.e. omni-channel capabilities, where you can pay a bill on your phone just as easily as you can on your laptop). By making it simple for insureds to pay when, how, and where they want, you’re ensuring a straightforward route to e-adoption and consistent, monthly revenue for your business.

Having omni-channel features , however, doesn’t matter if your insureds don’t realize those options are available to them. Ultimately, it’s about how the design of your platform either engages or fails to engage the payer that makes all the difference.

Tip 5. Eliminate the “I forgot” excuse

Billing and payments professionals will tell you, there’s one age-old excuse that payers tend to give when they’ve missed a payment: “I forgot.” Those two words are effectively disrupting your organization’s internal efficiencies, diminishing your revenue flow, and increasing the chance of unwanted policy cancellations.

When we asked survey respondents why they missed a recent payment, their responses reiterated the pervasiveness of this excuse. 49% of respondents who have missed a payment said the primary reason was they forgot and 21% said the payment process was too confusing.

Either way, these policyholders are not being effectively engaged by their insurance provider’s payment platform. A great way to accomplish this engagement is through intelligent communications – like text, email, and calendar reminders – and using clear language to drive policyholders to self-service at every possible opportunity.

During the webinar, we asked attendees if they utilized any of these tactics to avoid payment delinquencies. Here are the results of that live poll:

Poll: Which of the following pay enabled events do you offer today to eliminate the “I forgot” excuse?

- Text: 5.5%

- Email: 16.6%

- Calendar/Reminders: 0%

- Outbound IVR: 0%

- None: 39%

Clearly, there is some ground to be made up when it comes to enabling policyholders to pay their bills on-time. But, luckily, your organization simply needs to find an EBPP solution that has designed their payment platform with this type of customer engagement in mind.

All in all, these were the five major points that stood out from the survey results – but they weren’t the only insights we collected. To watch the full recording of this webinar, click here.

Want to see the full results from the policyholder survey? Download the full research report below.