What is CX vs. UX?

Tessa Newell

Tessa Newell

User experience (UX) and customer experience (CX) are words thrown around often when referring to customer service. But what is CX vs. UX?

While these terms may seem similar, they are in fact different. In simple terms, user experience is the experience a customer has while using a product or service, and customer experience is a customer’s overall experience with your product or service and your organization’s brand. These two experiences can have a major impact on a number of factors including customer satisfaction (CSAT) scores, retention, adoption rates, and more.

When it comes to choosing an online payment solution, it’s crucial for organizations to keep UX and CX top of mind and understand the importance of each. In this blog, we’ll explore CX vs. UX — explain the key differences and discuss why high-quality CX and UX can add tremendous organizational value when done well.

What is UX?

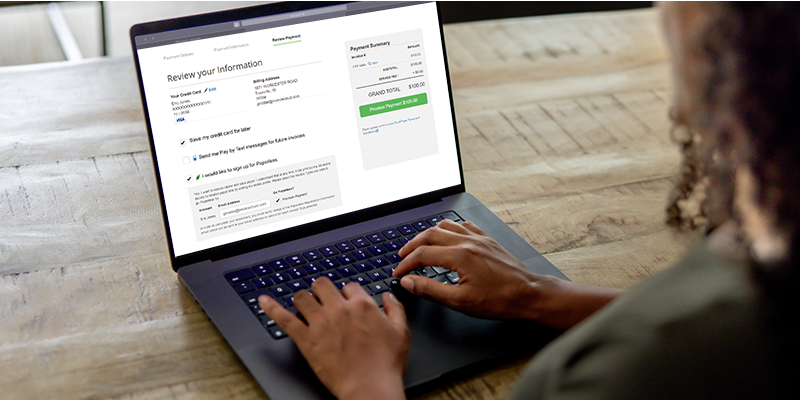

As we mentioned above, UX is the experience a customer has while using your product or service. Through a billing and payment lens, this is the experience your customer has while using and navigating your online payment platform. While most online payment solutions claim to have great functionality on paper, in reality they may have difficult-to-use interfaces that leave customers frustrated.

So, what does an online payment solution need to keep customer frustration at bay? Convenience is key. A recent survey conducted by Invoice Cloud found that the top reason people choose to pay a bill online is convenience. If the payment experience is difficult or confusing, the customer won’t take action — if it’s user-friendly and straightforward, they’re more likely to use it.

To ensure your online payment platform is simple and convenient, there are a few questions to consider:

- Can customers easily find where to pay a bill?

- Do customers know when and/or if they’re on the right website?

- How easy is it to navigate the online payment process itself?

Check out this previous blog to learn more about the importance of UX, including a UX checklist to consider when choosing an online payment platform.

What is CX?

CX is the overall experience a customer has with your organization and includes several components including personalization, communication, empathy, and more. Billing and payments are just one component of offering a great CX but arguably the most important pieces of the puzzle. While most of the payment experience pertains to UX, you can assess your CX by asking yourself the following:

- Is your organization utilizing payment reminders and other personalized communications?

- Are your customers able to receive reminders on the channel of their choice (email, text, or voicemail)?

Offering your customers an online payment solution that is designed with them in mind not only provides a great UX, but in turn, a great CX, too.

CX vs. UX: What’s the difference?

Now that we’ve defined both UX and CX, it’s important to understand the key differences of each when it comes to billing and payments. As we’ve mentioned, CX is a combination of many factors that make up the entire experience, which includes all payment and communication channels. On the other hand, UX is more specific to the experience a customer has while using your payment solution.

The quality of the two are also measured differently. CX is largely measured by how happy or frustrated your customers are. More specifically, by tracking metrics like CSAT scores and customer loyalty by tracking metrics like churn rates, retention rates, customer lifetime value (CLV), customer effort score (CES), and net promoter score (NPS). Customer frustration can have a major impact on these metrics — in fact, a recent study showed that 59% of consumers will abandon a company or product due to several poor customer experiences.

Unlike CX, UX is a bit more difficult to measure, as you’ll need to analyze the usability of a product and how users rate their experience interacting with it. One way to measure the quality of your UX is to ask your customers to describe their online payment-making experience.

Why billers need to think of CX and UX in tandem

Ultimately, UX is just one component of your organization’s CX but a very critical one, as a poor UX can lead to frustrated, unhappy customers. In relation to online payments, a high-quality user experience can not only improve CSAT scores, but also decrease costs, increase efficiencies, and decrease staff workloads.

In order to see these results and offer high-quality UX, it’s crucial that your online payment platform has a user interface that is simple, easy to use, and prompts customers to take certain actions like enroll in online payments or other self-service options.

And, while these two experiences are different, over time they will become more synonymous as technology continues to raise the bar on consumer expectations. One example of how we’re already seeing UX and CX collide is omni-channel payments. Payers now expect a seamless experience across their biller’s organization, whether it’s their online payment portal, IVR phone line, or mobile platform. Offering this omni-channel experience allows payers to pay whenever, wherever, and however they want. This type of seamlessness is great for CX, but only if the experience of making the payment is simple and easy, which means the UX for the payment channel has to be outstanding, too.

Overall, providing your customers with both high-quality CX and UX can not only make for happier customers, but can offer significant organizational value such as:

- Higher online payment adoption: Solutions designed with the user experience in mind are more likely to see higher e-payment and self-service adoption.

- Reduced call volumes and staff workloads: If your customers can easily make payments through your online platform, they’ll spend less time calling your customer service team. This not only helps your customers but reduces workloads and enables your staff to focus on high-priority projects.

- Reduced costs: With a user-friendly and well-designed online payment solution, customers are more likely to pay online and enroll in paperless billing, ultimately reducing your organization’s costs on printing and mailing paper bills.

- Improved customer satisfaction: Simplifying the payment process and offering customers a positive user experience and overall customer experience will produce happier customers, which in turn produces improved CSAT scores.

To learn more about selecting an online payment solution that will provide customers with both a high-quality user experience and customer experience, download our Guide to the Best User Experience for Payments below: