6 Digital Payments Trends to Watch in 2022

Tessa Newell

Tessa Newell

Another year is (almost) behind us, and it’s time to look forward to 2022. For billing and payment professionals, the end of the year brings up a critical question: what trends will shape the payments industry this year?

While it’s impossible to know for sure, we do know that the payments industry will rely heavily on customer experience and digitization. Simply accepting online payments is no longer unique, as most major billing organizations have incorporated online channels into their payment offerings. Overall, you’ll notice that next year’s payment trends all serve to address your customers’ expectations of those essential digital experiences.

From digital wallets to “buy now, pay later” services, the future of payments is all about providing customers with a world-class payment experience. Let’s look ahead to forecast some of the 2022 payment industry trends that we expect to make waves.

1. The concept of “the one-stop shop” payment experience will evolve

When we think of convenient consumer experiences, we might picture the cliché of the “one-stop shop,” an Amazon or Target-like retailer that offers a wide variety of products. The term can – and should! – apply to bill payment experiences, as well.

In the new year, billing organizations can expect increased pressure to offer that “one-stop” payment experience. Generally, this experience involves multiple services within the parameters of billing and payments (like bill presentment, balance reporting, payment processing, accounting software, data analytics, etc.) and beyond. For example, InvoiceCloud’s insurance solution allows policyholders to renew policies right within our platform. Insurers that leverage our solution can offer this major convenience to their customer base while securing a higher rate of policy renewals.

Although this may not directly relate to paying a premium, offering this range of services in one convenient place is a great way to meet the expectations of bill payers; after all, consumers today expect the best value. They want the fastest, easiest, most efficient, and most secure way to do things, and adding a few extra bells and whistles like reporting and charts doesn’t hurt. And can you blame them? On the verge of 2022, we have cars that don’t need a driver — why shouldn’t consumers have a one-stop-shop for payments and their other service needs?

In 2022, we expect this concept to continue to evolve, gradually integrating more pieces of the payment experience – and beyond – that are currently disjoined or offered in separate solutions.

2. Digital wallets will continue to expand into new verticals

The advent of digital wallets started with the release of Apple Pay in 2014, and this digital payment method has quickly become a payments staple in the years since. Digital wallets have quickly evolved from a hot payment trend to an essential channel for a well-rounded, omni-channel bill payment experience.

In 2020, digital wallet adoption rose to 55% of consumers worldwide, and industry experts predict that this global adoption will reach 75% by 2025. With this in mind, we don’t expect digital wallets to go anywhere in 2022.

It’s safe to say that this payment channel will continue to expand into verticals that it has not yet reached and, overall, will become a more accepted and highly utilized payment method.

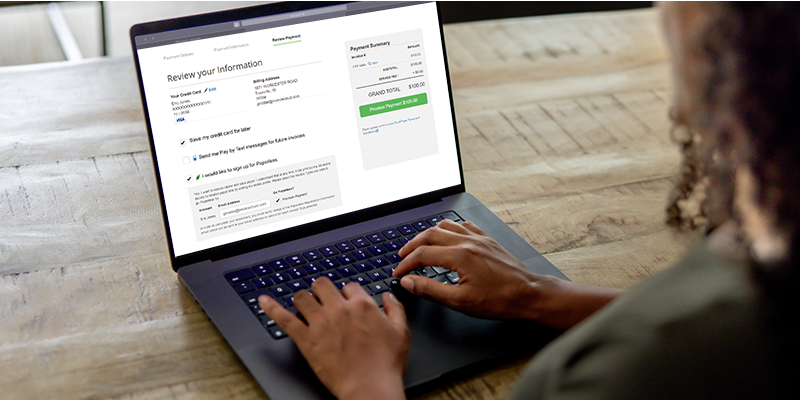

3. Perfecting payment experiences will be crucial

From reduced costs and decreased staff workloads to accelerated collections and more, we know it’s critical to provide a great payment experience. (Not just critical, but rewarding, as this happy user will tell you.) Providing a great payment experience is one thing, but perfecting the payment experience will continue to include more of the steps that we, as consumers, now seek elsewhere.

Here are a few clues that signify a payment experience that’s on the right path:

- The payment platform won’t require the user to go to multiple places or open up multiple tabs to find an invoice or view the balance they owe.

- The payer won’t need to make an account to access fully access the payment portal.

- If a payer makes an account change through an online portal, the payment platform should update that change across all other channels.

- Payers should be able to make payments directly from links in their payment reminders.

You get the idea: the fewer steps, the better your customers’ experience.

As the ideal payment experience continues to be perfected in 2022, we’ll see these unnecessary steps be stripped away in favor of a more streamlined bill paying experience.

4. Merchant onboarding will continue to improve

The merchant boarding process, also known as merchant onboarding, signs up merchants to payment processors through independent sales organizations (ISOs).

Merchants may be uncomfortable choosing a new payment processor solely because they’re unfamiliar with the process of setting up and maintaining it; it can seem like a pretty daunting proposition on the outset. Because of this, while it’s possible for merchants to directly onboard with payment processors, most choose to sign up through ISOs.

As we head into 2022, we expect technology surrounding merchant onboarding to significantly improve. This will mostly include more tools that enable the transmission of data to the processor to improve timeliness and reduce merchant process time.

5. Buy now, pay later services will boom

The trend of buy now, pay later services has existed for a few years but has taken off in the wake of COVID-19 (understandable, considering this is often a contactless and financially inclusive way to make payments). You may have heard of apps like Klarna, which allow consumers to purchase items by paying installments over a period of time, much like the process of paying on credit.

Well, in 2022, we expect the buy now, pay later model to gain steam in the bill payment space.

Buy now, pay later services offer a win-win for billing organizations. Payers won’t default on payments, won’t see their credit scores negatively impacted, and won’t lose out on the services they enjoy. From the biller’s perspective, their organization is paid in totality all at once — no late fees to assess, no notices to send or collections agencies to deal with, and no balances to compile. PayPal offers several services, such as Pay in 4[1] or PayPal credit[2], that offer this kind of flexible bill payment structure. As we head into 2022, we will definitely see more of the buy now, pay later model, and with that we anticipate a drop in payment delinquency (at least for the billers offering these payment options).

6. Demand for digitization among small and mid-sized businesses will grow

We can definitely expect to see a growing demand for digitization among small and mid-sized businesses, and the demand comes from both ends — the consumer and the merchant. Consumers want to reach and support small and medium-size businesses with the ability to easily explore the options they offer. On the other hand, these small and medium-size businesses are also looking for ways to be reached by a larger target market.

The past few years have brought several new avenues that allow these types of businesses to expand their exposure. One great example? Etsy. Etsy offers a digital marketplace for small businesses to reach an audience, accept payments, and ship globally. Another example is Amazon, as they offer a digital space for retailers who may otherwise not be able to obtain or support an online store.

We’ve talked about COVID a lot, but it’s important to mention it here, too. The pandemic has certainly forced a digital presence when a physical presence wasn’t possible. Especially in this day and age, digital is the only way to survive. This doesn’t mean that businesses should cease to physically exist, but it does mean that regardless of their physical presence, digital is now the most common path to profitability and success.

Get the 2021 State of Online Payments report

If your organization hopes to receive more on-time collections or see customer satisfaction skyrocket in 2022, it’s critical to address each of these trends in your billing and collections strategy.

Want to hear more about what bill payers are expecting in 2022? We surveyed nearly 1,300 of them nationwide and compiled the findings in our 2021 State of Online Payments report.

To learn how you can improve customer communications and reduce late or delinquent payments, get your free copy of the report right here.

[1] About Pay in 4: Loans to California residents are made or arranged pursuant to a California Finance Lenders Law License. PayPal, Inc. is a Georgia Installment Lender Licensee, NMLS #910457.

[2] PayPal Credit is subject to consumer credit approval.