3 Billing and Payment Resolutions for Easier Collections

InvoiceCloud Team

InvoiceCloud Team

Happy New Year! 2022 is in full swing and, if you’re anything like us, you’ve likely taken some time to reflect on your personal goals for the year – but what about your billing and payments resolutions? Have you considered how you might make your daily collection-related tasks easier or more efficient?

If you need a place to get started, we have a few ideas based on feedback we collected from over 1,200 bill payers across the country for our 2021 State of Online Payments research report. The data touches on today’s payment preferences, evident roadblocks in the collection process, critical customer service expectations, and more, but let’s start with three that really stood out.

1. Incorporate more flexible payment options for customers

As a consumer, payers are very accustomed to the concept of having flexible payment options at their disposal for buying goods and services. From making payments on layaway items at Walmart to using apps like Klarna that allow for installments on retail items, or even using on-the-go payment methods like digital wallets, these examples of payment flexibility are merely table stakes in 2022.

For the 2021 State of Online Payments report, we asked respondents to share their preferred channels for making bill payments. An overwhelming majority, 80%, prefer to make payments on digital channels (via online portals, mobile devices, and text messages).

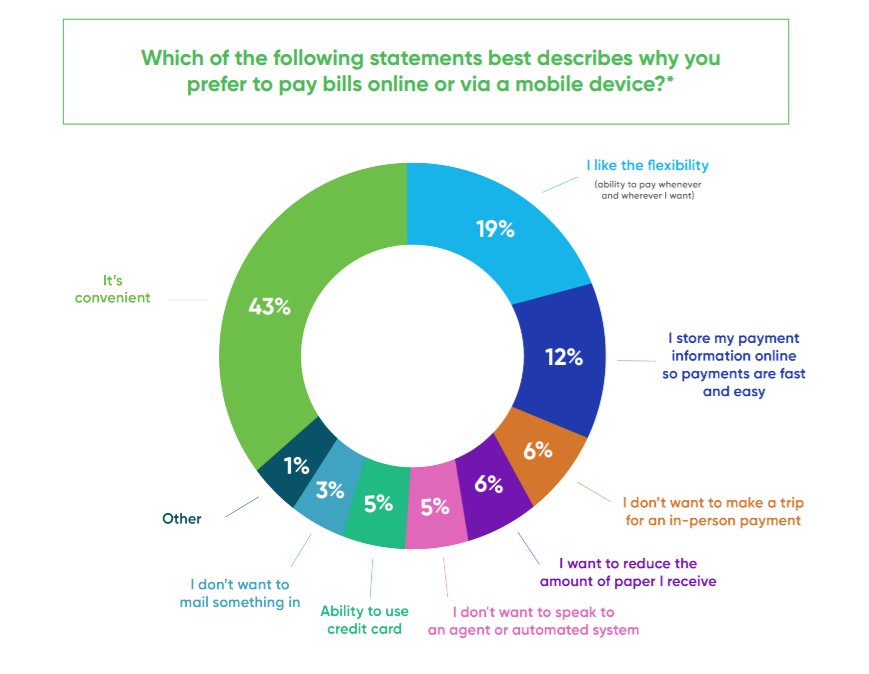

When asked why these digital channels were their preference, the majority of this 80% stated that flexibility and convenience were critical.

Based on this data, if your organization wants to enable the digitally inclined to self-serve with online payments (therefore making your future collections much easier!) offering as many flexible payment options as possible is key. For example, InvoiceCloud enables our billers to offer their payers options like PayPal’s Pay in 41or PayPal credit2, through which billers collect funds upfront while allowing flexibility for payers who are underbanked, unbanked, or living paycheck to paycheck. The State of Online Payments survey found 51% of respondents are using digital wallets to pay bills, so offering a variety of digital wallets (ApplePay and GooglePay, to name a few) widens the pool of customers you can cater to.

2. Take customer communications up a notch

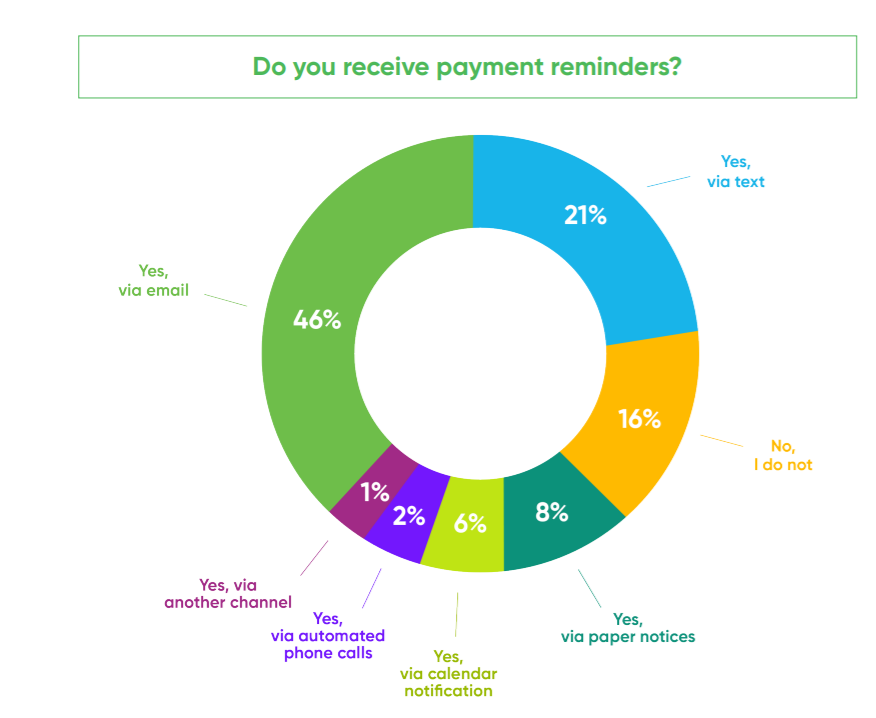

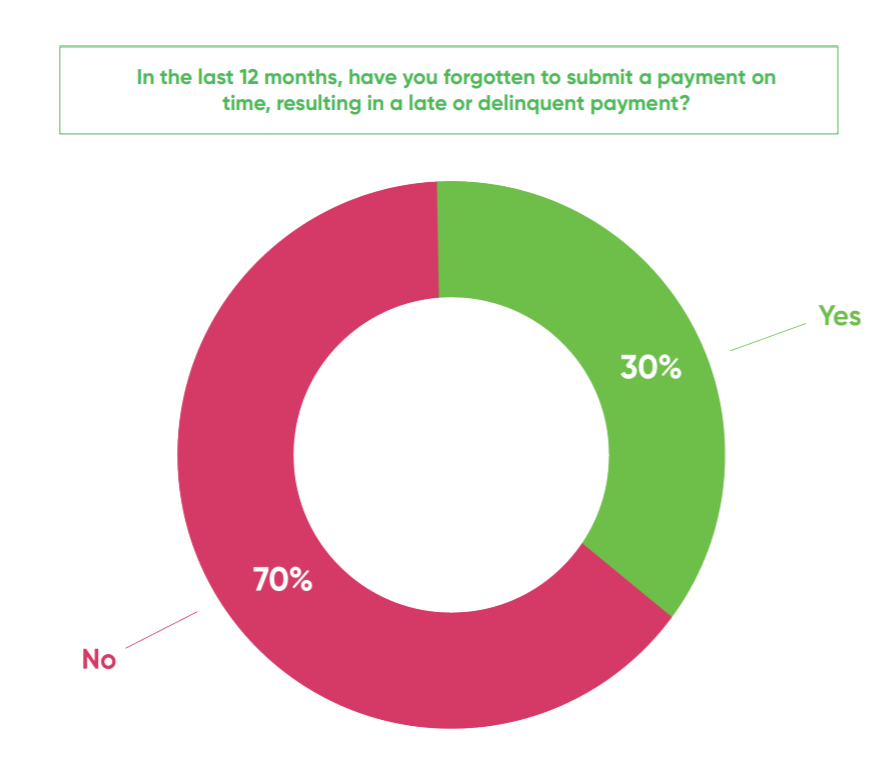

If you want to spend less of your year chasing down late or delinquent payers, improving customer communications is a great resolution to take up. In the State of Online Payments report, we saw an extremely promising correlation between payers who signed up for payment reminders and a drop in late or delinquent payments.

You can see, only 16% of respondents have decided not to enroll in payment reminders for any of their monthly bills. When that same group was asked if they’ve submitted a late payment or skipped payments in the last year while receiving payment reminders, the majority claimed their bill payments were timely all year.

To achieve these low rates of payment delinquencies, it should be easy for your customer to sign up for payment notifications across a variety of channels — and not just for standard bill payments, but for scheduled, automatic payments (AutoPay), as well.

Our report found that AutoPay remains popular among payers, with only 12% of respondents choosing to not enroll in the service for any bills. When asked why they’ve chosen not to enroll in AutoPay, the most common answer from this minority was actually a write-in comment: “I’m living paycheck to paycheck so I can’t risk enrolling in AutoPay, as the money may not be in my account.”

This fiscal reality underlines the need for a robust notification system in place to keep all customers abreast of upcoming payment deadlines with constant communication across multiple channels. With InvoiceCloud’s electronic billing and payment system, for example,

customers receive payment reminders even if they’re enrolled in AutoPay, allowing

them to make adjustments to their payment method if necessary in advance of withdrawal.

3. Ditch login walls and other friction points

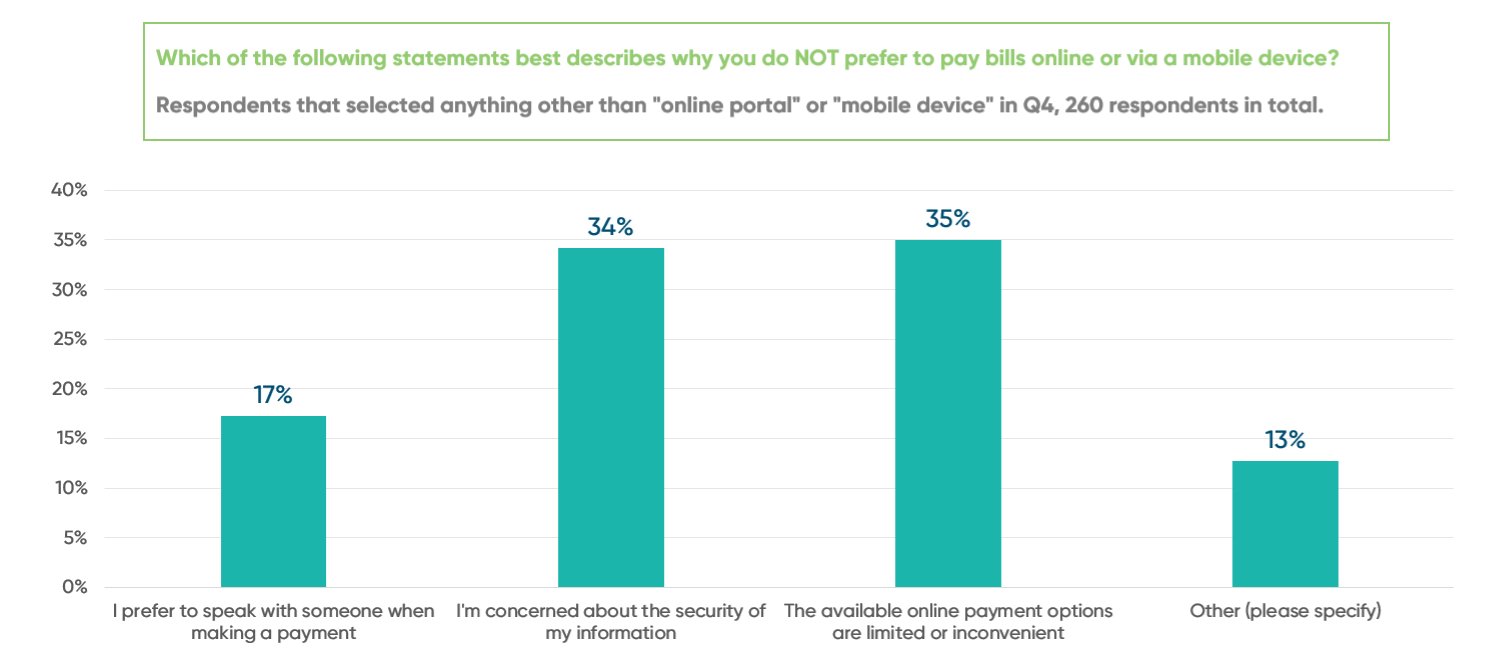

Let’s shoot to make 2022 the year of less friction! From a billing and payments perspective, that means removing points of friction from the billing process, and it’s well-represented in the State of Online Payments data. When we asked survey respondents who do not opt to pay bills via a digital channel what might convince them to convert, it became clear that they were looking for easy, secure online payment experiences.

When we pried a little deeper and asked what specific features would offer a compelling online payment experience, here were a few of the top answers:

- If it were easier to pay bills online

- If I could make payments in one-click

- If I could make payments without having to make an account

By evaluating your payment processes, identifying friction points, and eliminating them, your team could completely transform your payment experience in 2022. Not only will this thrill your digital-minded payers, an easier payment experience will encourage all types of customers to utilize your online system, relieving your team of hours of weekly, manual work.

Keep goal setting with the 2021 State of Online Payments

Want more insights into what your customer base loves (and hates) about making bill payments online? Download your free copy of the 2021 State of Online Payments report below.