Despite the convenience online payments offers many people, these digital options have historically been met with reluctance from specific groups. This includes the 55+ population, whose hesitancy can be traced back to several factors.

To uncover insights into how billing organizations can engage these digitally resistant groups, InvoiceCloud collaborated with a third-party research firm to survey four populations that tend to avoid digital payment options: those 55+, non-English speakers, check writers, and the unbanked. Our goal is to bridge the ever-growing digital divide, to ensure that everyone can reap the benefits of modern technology without feeling overwhelmed or left behind. But this inclusive, digital future can only be accomplished by surveying these populations to understand their concerns, challenges, and motivators.

In this post, we’ll explore insights from our new research for the 55+ demographic, including how this population currently pays its bills, apprehensions that the 55+ age group may have towards online bill payments, and resources for addressing these concerns to drive digital adoption within this population.

How Do People 55+ Make Bill Payments?

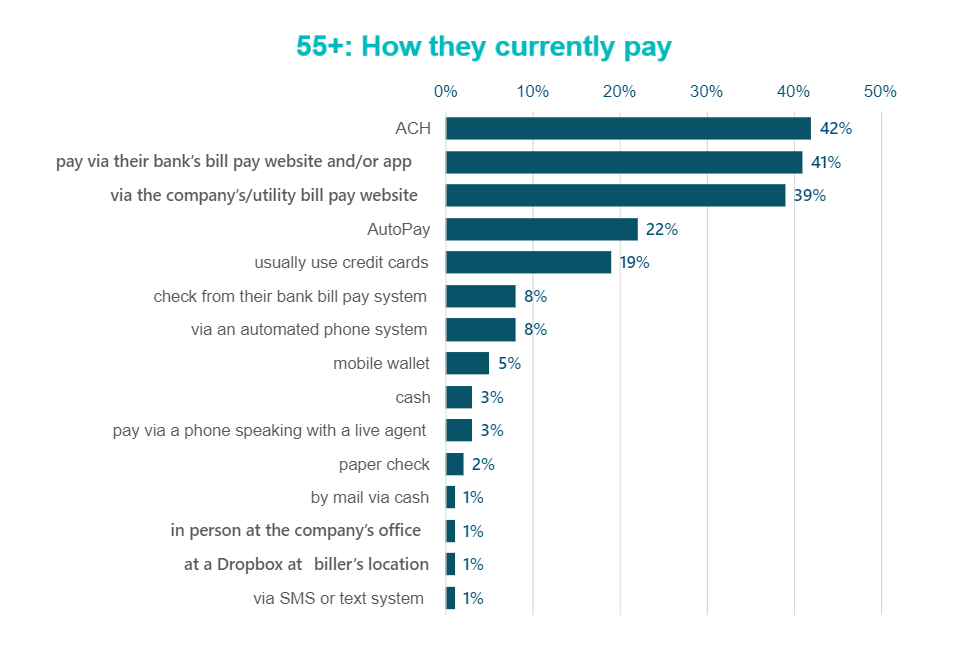

It’s important to note that not everyone from this population is opposed to digital payments. Our research found that large segments of those 55+ are actively choosing digital options for paying bills, most commonly through ACH, via their bank’s bill payment website or app, and via the biller’s bill payment website.

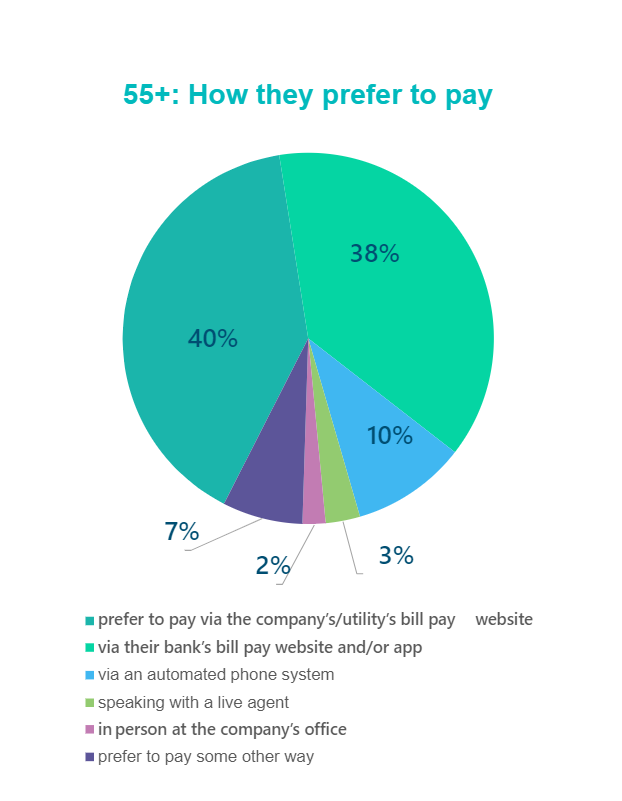

What’s more, those opting for self-service aren’t being forced into the decision. The data shows that a large majority of those surveyed from 55+ cohort prefer to use these popular, digital options.

According to the research, the top two preferred bill payment options for those 55+ are via the biller’s payment website and via their bank’s payment website or app. That means 78% of this population are actively choosing – and even enjoying – digital options for bill payments.

An additional 10% even cited a preference for paying bills via an automated phone system, also known as IVR. While we might not think of this as a traditionally “digital” option, it actually is! IVR allows customers to self-serve, which saves billing organizations valuable time and resources that would have otherwise been spent receiving and processing these payments manually. This automated phone option also keeps billers PCI compliant by not having a human take credit card information over the phone, which could possibly compromise the payer’s payment information.

Why is the 55+ Population Resistant to Digital Payments?

For those that are resistant to digital payments, we wanted to explore what’s keeping them from trying online options. Overall, these were the major concerns those 55+ cited about digital payment options:

1. Security concerns

Older adults may find digital technology intimidating or challenging to use. They are also more likely to be subject to predatory financial scams that can create distrust towards online payments. Providing this population with educational resources on safely navigating digital options and the dangers of mail fraud can help.

2. Ease of use

Some 55+ payers may be slow to adopt digital payments because they’re simply not as accustomed to the technology, and the research shows they’re handling these payments on their own. Nine in ten of respondents 55+ (87%) say no one helps them with their bills, which means it’s key to offer user-friendly interfaces designed with clarity and accessibility in mind. This can influence reluctant payers, as well; 36% of those 55+ who are not currently using digital options said they would if they were easy to use. Beyond an interface that’s simple to navigate, how-to guides highlighting the convenience of digital payments can also make a huge difference, particularly for IVR channels, which research shows this population is more amenable to trying.

Report: Digital Payments for All

As is the case with all non-adopting populations, you cannot begin making digital payments accessible without input from those groups. Truly meeting the needs of underserved cohorts involves gathering feedback about their specific drivers and concerns, then offering digital payment solutions that meet those needs.

Change can be difficult and intimidating, especially when it comes to the sensitive matter of finances. By understanding the root causes of this resistance, we can more effectively encourage everyone to embrace the convenience of digital bill payments.

Want a breakdown on how each population is currently paying their bills, prefers to pay their bills, and where each group would be willing to adopt more digital options? Get your free copy of our report, “Digital Payments for All: Encourage Self-Service Among Digitally Reluctant Customers,” which includes all the data from our survey of bill payers from these historically non-digital populations.