In parts one and two of this series, we delved into understanding what ACH payments are and explored the importance of offering ACH payment options for both billing organizations and payers. Today, we will conclude the series by discussing three benefits that come with consolidating ACH payments into one cohesive payment system, with a primary focus on security, biller experience, and customer satisfaction.

1. Security & Compliance

In an ever-evolving landscape of compliance standards and cybersecurity threats, billing organizations and their technology partners must take extra precautions to protect sensitive customer data. By integrating ACH payments into a compliant billing and payment system, much of the burden is lifted from billers and their core systems. Leveraging Software-as-a-Service (SaaS) technology ensures that the ACH payment option remains continuously compliant with new Nacha rules and any future changes.

Data breaches and security concerns are a constant worry for billers handling customer data. Storing data on work computers, transmitting it, and sharing it internally can only increase the risk of potential threats. In fact, some billers have even faced higher insurance premiums due to handling ACH transactions. Core billing systems and technology partners are also hesitant to offer ACH capabilities independently, as it exposes them to threats and liability. By embracing a unified payment system, these concerns can be significantly minimized, enhancing overall security, and taking the burden off billing teams.

2. Improved Biller Experience

Consolidating ACH payments into a single system brings several advantages that greatly improve the biller’s experience. One such benefit is the availability of additional ACH reporting and reconciliation tools, streamlining the payment management process. Moreover, handling ACH transactions automatically within the billing and payment system reduces overhead costs, saving valuable time and resources.

A well-designed billing and payment solution can also facilitate increased ACH adoption among customers, even those that have historically preferred to write checks for bill payment. This means more self-serving customers who manage their transactions independently, freeing up time for the billing organization to focus on high-priority projects. For instance, InvoiceCloud’s adoption-focused approach enables billers to reduce manual processes and cut costs, optimizing their operational efficiency.

3. Customer Satisfaction

Customer satisfaction is paramount for any billing organization, and ACH payments play a significant role in this regard. Centralizing ACH payments offers customers a seamless, self-service experience that includes easy enrollment, un-enrollment, automated reminders, transaction receipts, and the ability to view payment history online through the payer portal.

Customers appreciate the autonomy to manage their ACH accounts, as it provides them with greater control over their finances. Additionally, an effective communication engine is vital for keeping customers updated and satisfied. Without a unified system, billers handling ad hoc ACH transactions struggle to communicate efficiently with their customers. By contrast, a consolidated payment system enables automated notifications and ensures vital information reaches customers in a timely manner.

Importantly, a smooth conversion process is key to maintaining customer satisfaction. Moving ACH payments into an existing billing and payment system eliminates the need for re-registering or sending additional emails to use ACH functionality. This seamless transition prevents any interruptions in payer services and contributes to an overall positive experience for customers.

Hagerstown, MD Saves Time and Money with InvoiceCloud

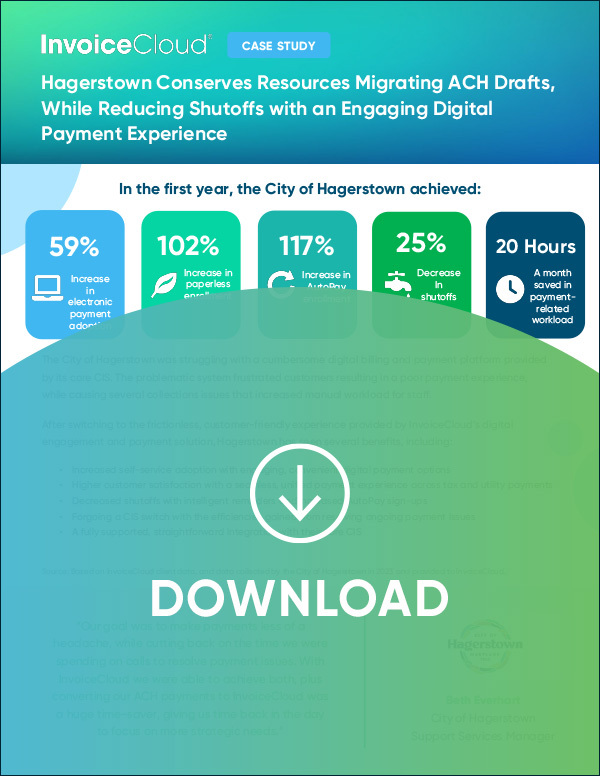

Since migrating its ACH drafts to InvoiceCloud’s digital engagement and payment solution, the City of Hagerstown, MD has significantly conserved resources and enhanced customer satisfaction.

This shift has brought about several tangible benefits for the organization, including a 59% increase in self-service adoption. By offering a frictionless and customer-friendly experience, Hagerstown has empowered its customers to manage their payments independently, leading to higher engagement and satisfaction rates. The town has also seen a 25% reduction in shutoffs due to higher enrollment in AutoPay. With more customers opting for automatic payments, late or missed payments are minimized, leading to a more stable revenue stream for Hagerstown.

The implementation has also significantly lightened the manual workload for Hagerstown’s staff. The platform’s integration with their core Customer Information System (CIS) has made the migration of ACH payments a smooth and efficient process. This means fewer resources are dedicated to managing payments, allowing the organization to focus on other essential tasks and improving operational efficiency.

Offering ACH Through InvoiceCloud

By migrating AutoPay ACH to InvoiceCloud, billing organizations can experience a host of benefits that transform their payment processes. The platform ensures enhanced security, as credit card and one-time ACH payment data are stored and processed through Level 1 PCI and SOC Compliant solutions, guaranteeing top-notch protection against potential threats. InvoiceCloud’s true SaaS capabilities continuously keep billing organizations compliant with evolving regulations and hacking techniques.

With a seamless and frictionless process, InvoiceCloud facilitates increased paperless enrollment and AutoPay adoption through customizable marketing resources. The platform’s real-time capabilities and user-friendly enrollment process contribute to healthier customer satisfaction scores. Unlike other providers, InvoiceCloud offers modernized capabilities to all payers, ensuring that everyone enjoys the full range of functionalities.

To unlock the full potential of ACH payments and revolutionize payment experiences, billing organizations are encouraged to schedule a call with InvoiceCloud’s payments expert.