The 2023 Payment Experience Checklist

Tessa Newell

Tessa Newell

The New Year is upon us, which means it’s officially time to take stock of all your organizational successes and, of course, areas for improvement. Once again, improving billing and payment processes is top of mind for many organizations – and for good reason! Besides this touchpoint being critical for revenue collection, research shows that billing and payment experience is considered the most important touchpoint for customer satisfaction.

To help billers stay aligned with customer payment preferences, InvoiceCloud ran an online survey in October of 2022 with the goal of better understanding payment trends and general behaviors around making bill payments. The nature of this annual survey (previously conducted in 2021 and 2020) allows us to directly compare how certain payment habits have diverged or stayed consistent year-to-year. In total, we collected over 2,100 qualified responses from consumers that have paid at least one bill online in the past 12 months.

Based on this survey data, we compiled a checklist of considerations for organizations like yours. Here are just a few of the takeaways from the report to help inform your plans for 2023.

☐ Prioritize the ease of the mobile payment experience

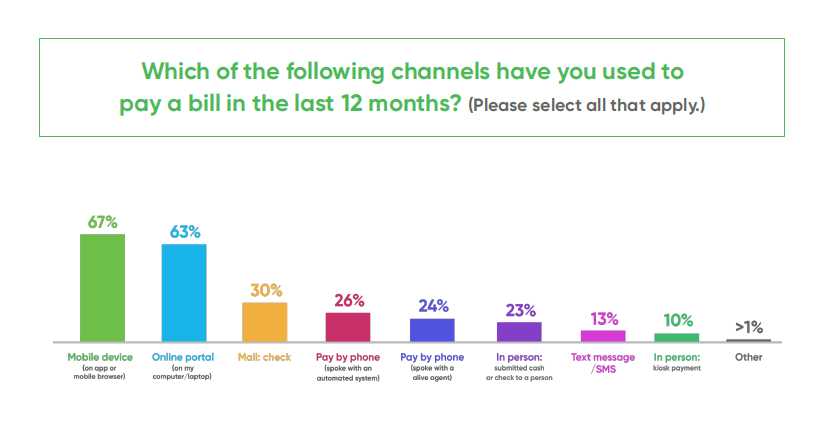

For the last two years of our annual survey, when gauging which payment channels are the most used and most preferred by customers, “Online portal (on my computer/laptop)” has always taken the top spot. However, for the first time, “Mobile device (on an app or mobile browser)” has overtaken “Online portal” in both usage and preference.

Both preference and usage for “Online portal” is significantly down, having shrunk by 15% since 2020. It’s also interesting to note that “Text message/SMS” usage (another type of mobile payment) is up 3% since last year.

Considering its ranking as one of the most preferred payment options among all respondents, your organization should focus on providing an easy, intuitive mobile payment experience. Here’s an interesting example from the details of this survey data: the vast majority of respondents — 92% — took this survey on their phone, yet only 30% say mobile devices are their preferred method for making a bill payment. Clearly, payers are very comfortable using their mobile phones for many things, but the mobile payment experience must leave something to be desired if payers are going to their computer/laptop to pay bills at nearly the same rate.

For example, InvoiceCloud improves the feel of the mobile payment experience by adapting our payment platform to the dimensions of a mobile screen. We also help billing organizations remove friction from the mobile payment experience through tactics like removing login screens and offering frictionless options like one-click payment or reminders via text, email, or voicemail. Efficiency-boosting features like these can help encourage mobile payment adoption and thrill customers who prefer mobile channels.

☐ Push automatic payment enrollment, especially to customers 60 and older

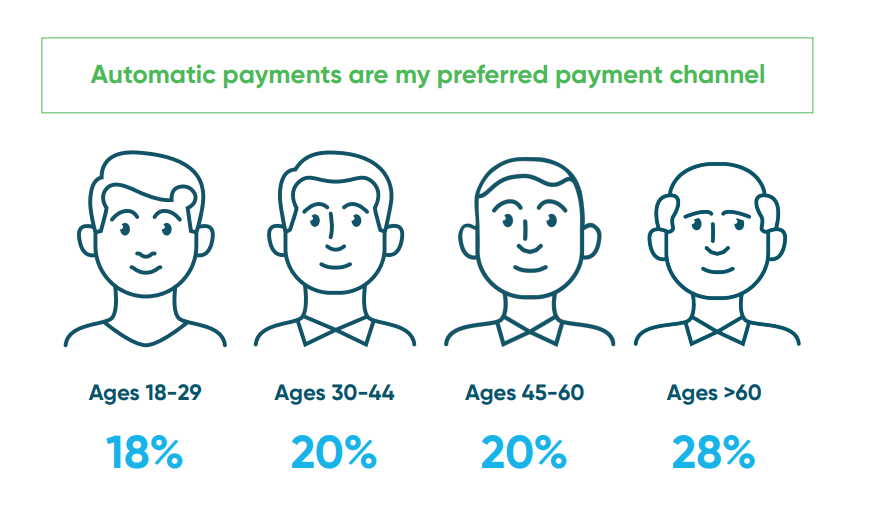

Another burgeoning trend uncovered in the report is the rise of automatic payment (AutoPay) enrollment, which has climbed by 5% since last year. Considering that the “set it and forget it” nature of this payment channel offers maximum peace of mind and minimal friction for the bill payer, it makes sense that this convenient option would be gaining popularity among today’s customers.

Despite the upward momentum of this payment option, there is still plenty of opportunity for adoption. The data shows that 88% of respondents are enrolled in AutoPay for at least some of their bills, but only 45% have signed up for AutoPay for more than half or all their bills.

Interestingly, the preference for AutoPay over other payment channels was more common among older respondents.

With AutoPay enrollment on the rise and favored by our traditionally less digital demographic, it’s important to make AutoPay exposure a priority for your organization. Here are a few ways to make finding and enrolling in self-service options like AutoPay frictionless:

- Include QR codes that route customers to AutoPay enrollment on paper bills or on flyers in your office.

- Send out communications explaining where and how to sign up for AutoPay, with a link to enroll embedded in these messages.

- Highlight where to enroll in AutoPay everywhere possible on your website: your homepage, on invoices, on checkout screens, etc.

☐ Focus on making customer service representatives more available

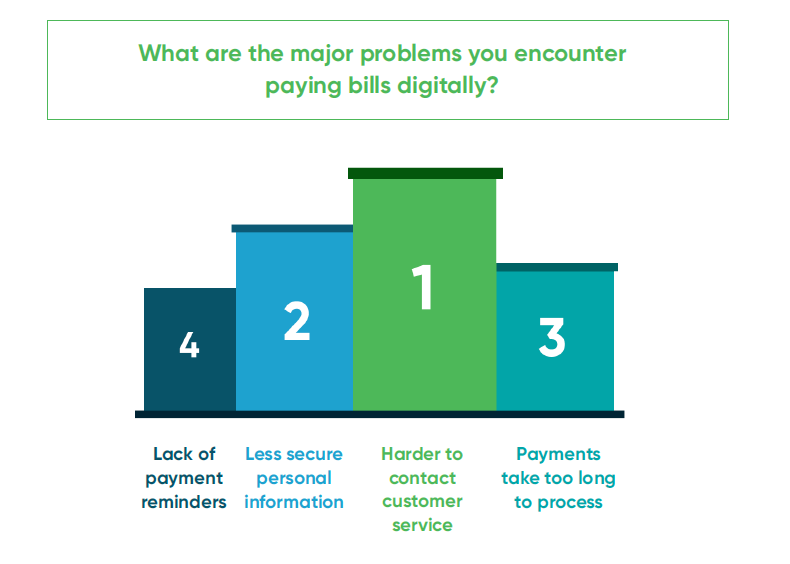

We also wanted to take stock of the common issues facing respondents when it comes to paying bills digitally, and the #1 issue overall (and among three of the four age groups surveyed) was the inability to “contact customer service.”

There are a few ways this leading challenge might be interpreted.

It could be that, try as they might, folks trying to call their billing organization cannot get through to customer service. One way to make CSRs more accessible is by actively reducing billing and payment-related calls — InvoiceCloud data has found that, on average, 10-20 hours of a billing and payment team’s week is spent fielding calls related to bill payment. If your organization can prioritize removing friction from the bill payment experience by making self-service options easy to find and use, calls starting with “I’m trying to pay my bill” and free up customer service for other customer concerns.

Or customers may be having a hard time completing their digital payment. To avoid abandonment, it’s best to have a way for CSRs to interject and assist customers without interrupting self-service behaviors. For example, InvoiceCloud’s AgentConnect API allows agents to securely and remotely log in as a bill payer and perform actions on their behalf, thereby simplifying the payment process and keeping customer service lines open.

The State of Online Payments for the New Year

There are more insights to help your team get aligned with customer preferences for the New Year and beyond!

Want to know what the most popular mobile wallet is? Or the other major digital payment challenges your customers are struggling with? Get the whole checklist and all the new customer data by getting your free copy of our annual report, The State of Online Payments.