For most elected officials, at least on the local level, constituent communications often present a challenge. While communications around collections are critical, many officials don’t want their relationship with residents to begin and end with collecting property taxes. Fortunately, there are plenty of opportunities to take your municipalities’ communication strategy to the next level.

Here are a few tips any collection professional should consider for a more effective constituent communication strategy.

3 Ways to Improve Constituent Communications

1. Expand your communication channels

Determining the best channels through which to contact your residents might seem simple, but there is no “one-size-fits-all” when it comes to communication channel preference. This answer often varies from person to person or may depend on what the message entails; for example, a resident may like to receive emergency weather notifications in a text but prefers to receive payment reminders via email.

The best bet for any organization is to leverage as many popular channels as possible and allow residents to utilize the ones that work for them.

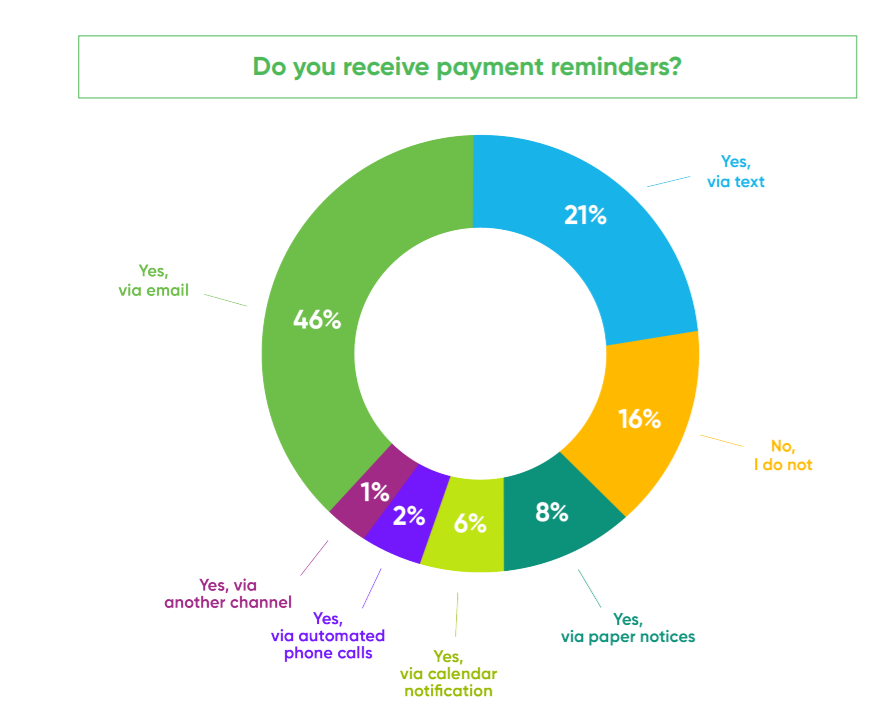

Not sure where to get started? Here’s the breakdown of preferred channels for payment reminders, according to a recent InvoiceCloud survey of over 1,200 bill payers nationwide.

2. Send personalized, targeted messages

For communications to really land with constituents, personalization is key – that’s why implementing an online payment system with an Outbound Campaign functionality is so critical for local governments. Outbound Campaigns are messages that your organization can send to customers, notifying them of events that go beyond bill reminders and late payment notices. These campaigns allow billers to keep payers informed of things like delinquency, tax sales, or emergency communications.

InvoiceCloud’s Outbound Campaigns functionality, for example, allows these messages to be sent by email, text, phone call, or all in combination. With Outbound Campaigns your organization can leverage existing information about your customers (their geographical location, preferred communication channels, the services they receive, etc.) to provide targeted reminders and messages.

3. Opt for systems that allow for full audit trails

No strategy is complete without room to audit and analyze trends, challenges, and successes that have come from your efforts!

Make sure that the communication system that your organization uses – whether that’s your online billing and payment solution or a separate tool – allows for a full audit trail of your constituent communications. This is the best way to evaluate which channels are producing the most delivery success, if the messages or electronic bills were opened, which links within messages are clicked, the percentage of kickbacks on certain channels, and so on.

Bonus: Tips for digitally communicating what’s due

Whether or not electronic billing (e-billing) is available for collecting property taxes varies state by state and even county by county. However, with the price of paper on the rise, there has been a wave of e-billing legislation across the country to allow states to collect property taxes electronically. From happier customers to fewer payment-related calls, it’s not hard to see why e-billing for property taxes is a gamechanger.

So, is your organization ready for the e-billing boom? Here are a few tips to ramp up your e-billing efforts.

1. Choose a solution that gives your local government a head start

For states where e-billing legislation is in progress or at least on the radar, InvoiceCloud can help accumulate enrollments before your state even allows e-billing, giving you a head start on enrollments. This ensures you have residents receiving electronic bills from the get-go, which can be extremely impactful for states that have multiple billings per year.

Once legislation is passed, we’ll work with your organization to transition over to e-billing by implementing an Electronic Bill Presentment and Payment (EBPP) solution configured to meet the needs of your town or city. Our simple-to-use interface engages customers throughout the payment process to deliver high adoption rates and satisfied residents.

2. Communicate channel options to residents to improve adoption

To see the full benefits of all digital communications, including paperless billing, you’ll first need to communicate that this type of payment is available to residents. You can do this the old-fashioned way, think: hanging up flyers in government buildings, town halls, etc. Another effective form of notifying residents is through a variety of platforms including mail, email, text, voicemail, and more. Consider QR codes that lead to more information about e-Billing and place them in multiple places like the back of envelopes for paper bills or even on flyers and posters.

3. Make it easy to enroll in e-communication and e-billing options

Implementing a paperless billing solution and offering e-communications is only half the battle. Once your organization has launched e-billing, it’s crucial to make a concentrated effort to drive residents to sign up for paperless billing. Utilizing buttons or links with clear language like “Enroll in Paperless Billing Here” is a great place to start but, ideally, you should be leveraging all customer touchpoints—throughout the payment process and beyond.

Here are just a few of the major touchpoints where you’ll want to push your paperless enrollment options:

- Receiving the bill: Send residents their bill electronically and offer an easy way for them to make a payment directly from the bill.

- Making a payment: Make it clear that residents will be able to easily and quickly make payments anywhere, any time, and on the channel of their choice.

- Payment reminders: Display actionable reminders via omnichannel experiences for upcoming bills.

- One-time payment or guest checkout: When residents are making a one-time online payment, offer them the option to enroll in paperless billing on an ongoing basis.

- Payment confirmation: When sending residents a confirmation of their most recent payment, offer options to enroll in e-Billing as well.

By offering e-billing across multiple touchpoints will enable your town or city to encourage residents to enroll in paperless billing.

Get the Property Tax Toolkit

Not sure where to get started? Check out InvoiceCloud’s Property Tax Toolkit, a suite of resources to help collectors, treasurers, and beyond. This toolkit will help you enhance customer communications, prepare for the e-billing boom, and improve the tax payment experience for all.