3 Benefits of Automatically Matching Electronic Payments to Open Invoices

Steve Schult

Steve Schult

Of all the valuable resources billing organizations are looking to conserve these days, time is the most finite. Whether a business is short-staffed or simply trapped in a manual process loop – stuffing envelopes with bills and notices, mailing them out, receiving paper checks which then must be manually processed, and so on – finding the time to focus on high-priority projects or initiatives can feel impossible.

Leveraging smart-match intelligence to automatically match electronic payments to open invoices is an impactful way to reduce manual workloads, operational costs, errors, and, ultimately, give billing and payment collection teams the invaluable gift of time.

Let’s dive into how this technology can revolutionize the way billing offices run.

Why Choose an Automated Matching Solution?

Consider the amount of time you or your team spend manually matching check payments and reconciling them to invoices every collection cycle, or even on a daily basis. Invoice-matching technology exists to help billing organizations avoid this major hassle.

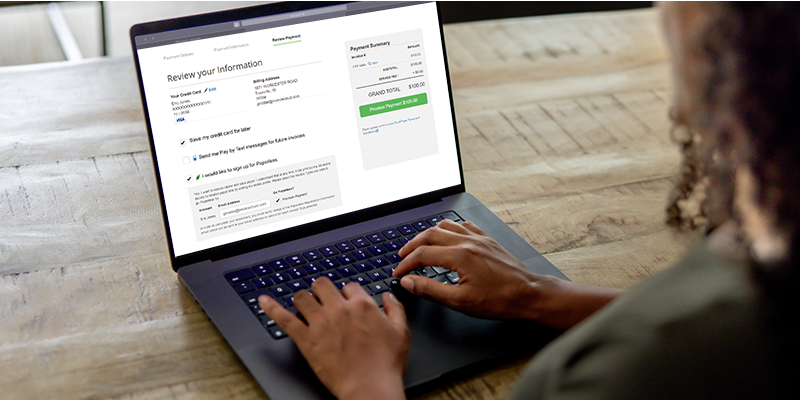

The proprietary smart-match intelligence in lnvoiceCloud’s Online Bank Direct (OBD) solution, for example, automatically matches payments to invoices, enabling billers to spend less time manually matching. If there are payments that don’t match, billers can navigate a simple interface to choose from a list of suggestions or search for a specific invoice, and then manually match them with one click. Online Bank Direct then uses machine learning to “remember” the match so that it automatically matches in the future.

Within the InvoiceCloud customer base, we’ve witnessed countless billers improve processes with this matching functionality. Here are just a few of the major benefits solutions like Online Bank Direct can offer.

1. Save time for high-priority tasks

The main benefit of OBD for billers is the major time savings for staff, specifically by reducing the number of bank-issued paper checks that need to be manually processed. In the past 3 years alone, InvoiceCloud’s Online Bank Direct has been used to process millions of payments and has saved our billers over 200,000 hours that would have been spent manually processing paper checks. Assuming a 40-hour work week, that’s 100 years’ worth of work saved in the past three years.1

In addition, the easy-to-use design of the OBD interface makes manually matching payments to invoices easy. Payments that have been manually matched will be remembered and automatically matched going forward, saving billers future hours of work.

Organizations can dedicate the time saved to better serve their customer base (likely resulting in a healthy boost in customer satisfaction!) and refocus on high-priority initiatives that have been “on the back burner” due to lack of bandwidth.

2. Compensate for today’s workforce gap

In recent years, a few key factors have influenced a significant workforce shortage that’s being felt across all industries, including The Great Resignation: a trend in which nearly 57 million Americans quit their jobs in search of more fulfilling work and a better work-life balance.

Whether retirement has left openings in your team or you’re struggling to backfill roles due to the talent shortage, leveraging automated match solutions is a great way to compensate for any workforce gap and empower your existing team to get more done with less. Not to mention the improvement this kind of technology can have on an office – more manageable workloads can significantly reduce stress on the job, making for a more pleasant environment and a more attractive workplace for new hires.

3. Improve critical operational efficiencies

Automated matching technology is a great solution for streamlining inefficient processes, simplifying, reconciliation, and reducing errors in manual work.

Here’s a common scenario: a customer pays right at their bill due date. Despite having paid their bill, manual check processing can take days to register this, often resulting in late fees or essential services being interrupted for the customer. Not only can this negative experience impact satisfaction, but the biller’s staff is then responsible for fielding frustrated calls from the customer, all because of a manual process that is completely out of their control.

With Online Bank Direct, payments are reported to your business in two days and deposited within 72 hours, a significantly faster process than banks issuing paper checks. Most InvoiceCloud billers see auto-match rates over 90%, with many seeing rates over 95%, making reconciliation a breeze and reducing the likelihood of errors and mismatched invoices.

InvoiceCloud’s Enhanced Online Bank Direct Solution

The proprietary smart-match intelligence that powers lnvoiceCloud’s Online Bank Direct (OBD) solution enables your team to spend less time on manual processes by automatically matching payments to open invoices. We’ve already seen incredible results within the InvoiceCloud customer base, and the nature of our true SaaS solution means we’re continuously making enhancements, including Online Bank Direct.

Here are a few of the latest enhancements billers can now expect from InvoiceCloud’s OBD solution:

- Only receive matched payments; you will not see funds that may never match, or don’t belong to you

- Single, consolidated deposit for all OBD payments (instead of two) which simplifies reconciliation

- Ability to deposit funds to separate accounts based on invoice type

To learn more about how Online Bank Direct can streamline your processes and transform your organization, schedule some time to speak with our team here.

1 Based on data collected by InvoiceCloud from 1/1/20 through 1/1/23. Between 1/1/20 and 1/1/23, Invoice Cloud processed $1,190,320,493.21 in OBD volume from 7,855,995 OBD payments. Average time to manually match a payment to the correct invoice is ~90 seconds (most of which we Auto Match). 7,855,995 payments x 90 seconds = 707039550 sec total = 11783992.5 mins = 196399.875 hours since 1/1/2020. 196399.875 hours / 2000 working hours per year (full time job) = 98.19994 years