Webinar Recap: 9 Ways to Optimize the Resident Payment Experience

Tessa Newell

Tessa Newell

If your staff is tired of fielding payment-related calls from the residents of your city, town, or village — whether to make payments over the phone, ask a payment-related question, or file a complaint — your resident payment experience may be lacking some important elements.

To hear this from biller payers themselves, InvoiceCloud surveyed over 1,200 residents like yours on their payment preferences, allowing us to analyze trends and behaviors around making payments today. For the full rundown of those results, get your free copy of the 2021 State of Online Payments, right here.

InvoiceCloud’s own Sara Faied teamed up with the team at Governing for a live webinar, to dive into the results of this report and explore how local government teams can enhance the resident payment experience.

If you missed the webinar, don’t worry! You can watch the on-demand presentation right here or keep reading for a few important points from the webinar.

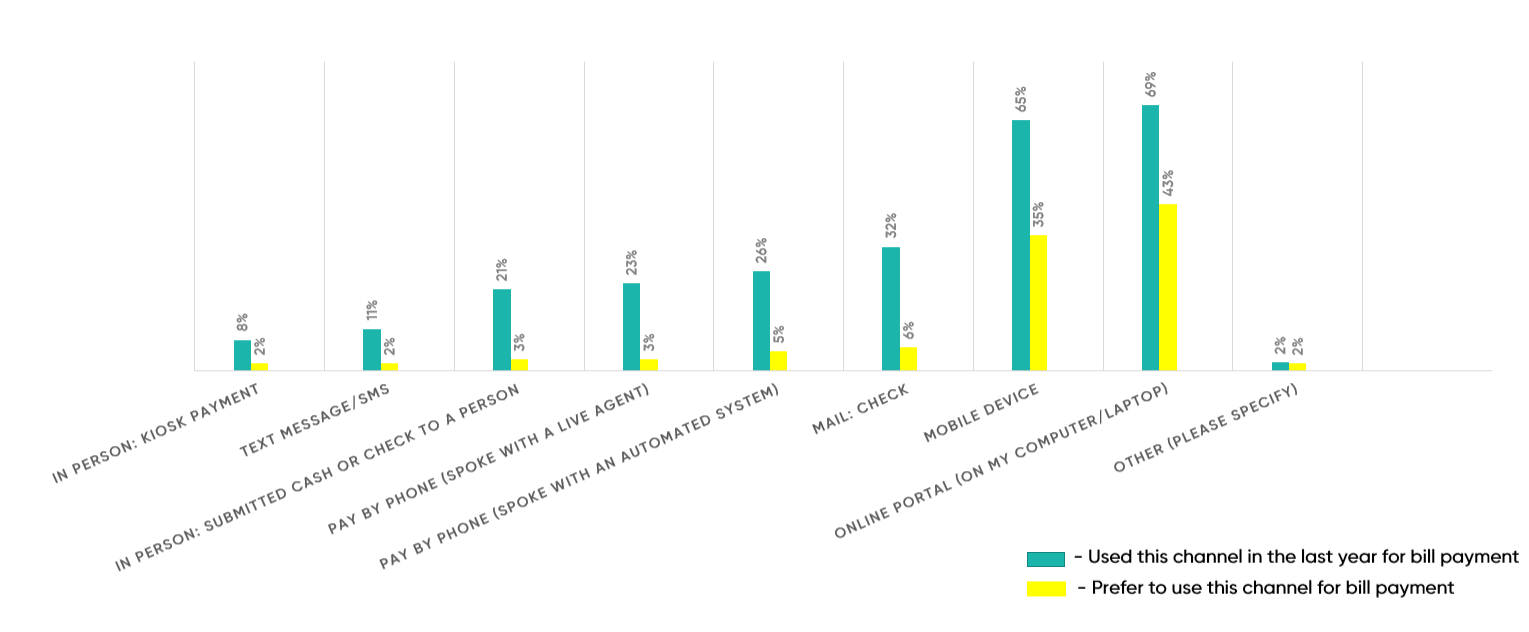

1. There’s a disconnect between channel preference and usage

For starters, we wanted to understand which payment channels are in demand among bill payers — and which are actually being utilized, preferences aside. As you can see in the graph below, there was an interesting disconnect among payers.

Mobile and online channels are far and away the most popular payment routes — it makes sense, then, that they would be the two channels with the most real-life usage. What’s more confounding is the left half of the graph.

When we look at the payment option “Mail: check,” we see this is the third most used payment channel for respondents in the last year. However, right next to it, we see that only 6% of those same respondents actually want to pay bills via mail.

This data backs up my strong opinion that people aren’t opposed to online channels, they’re simply unwilling or unable to follow through with hard-to-use digital payments. If residents are frustrated or if there’s friction along the payment route, they are going to go back to what they know — and in this case, they’re going back to a manual payment method that takes up employee time, slows revenue collection, and costs more to process in the long run.

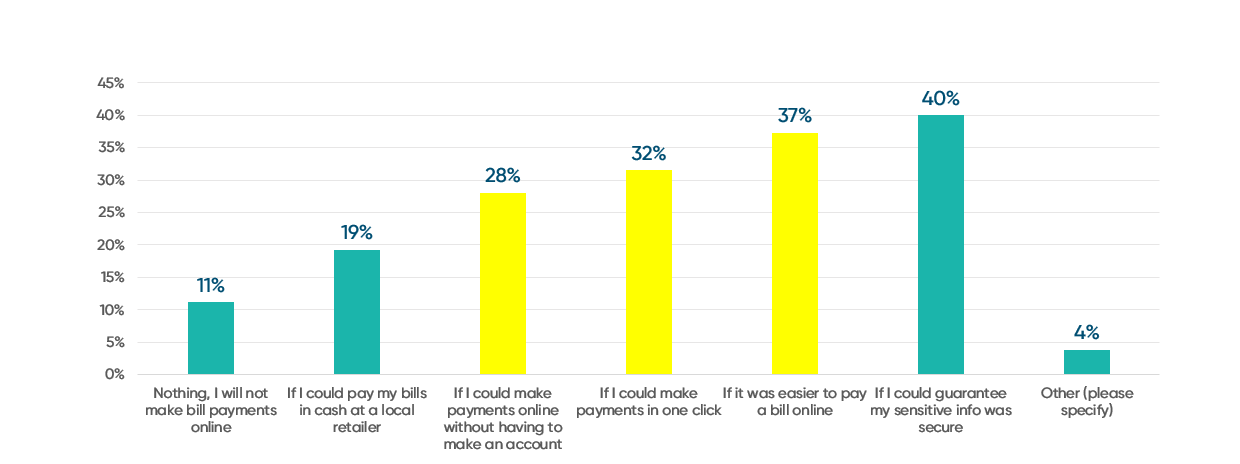

2. Consumers want more convenient payment experiences

This point is aptly reinforced by another interesting takeaway from the data, where this time, we spoke directly to the folks who historically prefer to pay their bills on non-digital channels (via mail, in-person, over the phone to your service reps, etc).

Here’s what non-digital bill payers had to say when we asked, “Which of the following options (as many or as few as you’d like), would compel you to pay bills through an online or mobile channel?”

Overall, 89% of non-digital payers would be willing to try digital payment routes for some specific features or assurances. The focus on the guarantee of data security makes perfect sense; cyberattacks have become a fast-growing threat for municipalities. And while it’s certainly critical to leverage a payments solution that holds the highest level of PCI compliance possible (for both your peace of mind and your residents’), our attention was drawn to the three popular options highlighted in yellow.

All three options — the ability to make digital payments without an account, the ability to make payments in one click, and a generally improved ease of use — come back to the same answer: bill payers, including your residents, are willing to adopt self-service payments, as long as they’re convenient and easy to use.

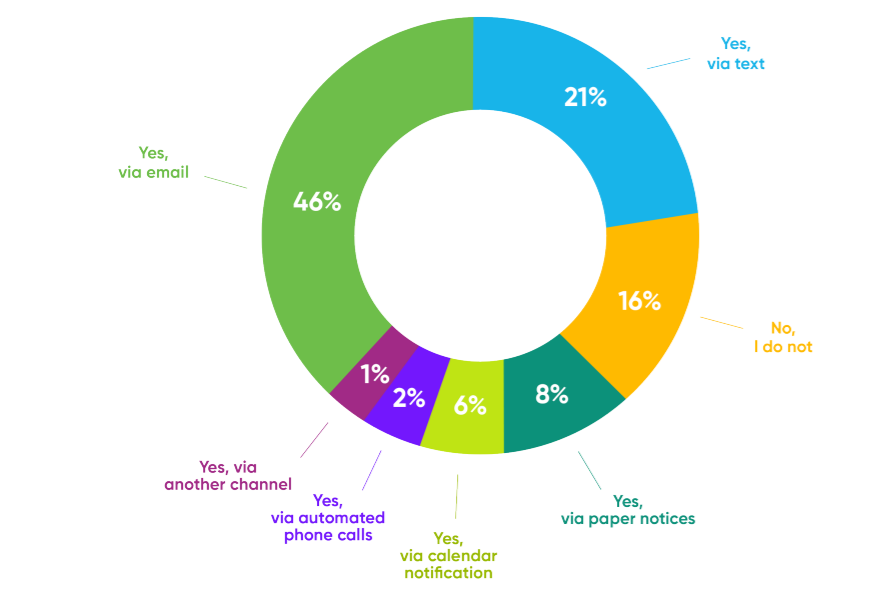

3. Payment reminders prevent late and delinquent collections

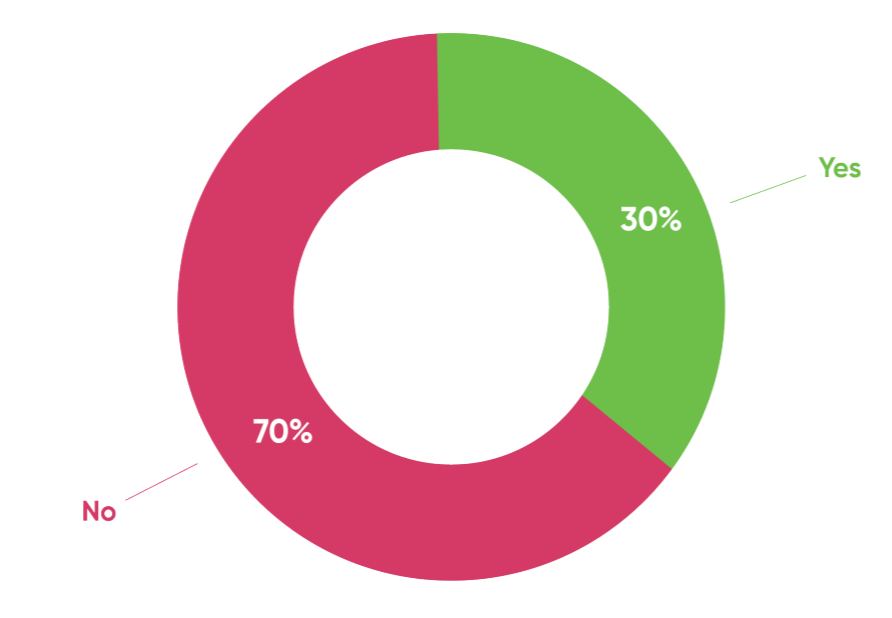

If you’ve ever wished you could understand what’s preventing your habitually late or delinquent residents from making payments on-time (or at all), the survey data may have some answers for you. When we asked over 1,200 bill payers, “Do you receive payment reminders or notifications?” across a variety of channels, we got an overwhelmingly positive response.

That’s right — 84% of these respondents have signed up to receive payment reminders via their communication channel of choice. When we next asked those same respondents if they had submitted a late or delinquent payment in the last 12 months, the majority of them claim their payments had been timely all year.

This is a striking correlation, one that truly shines a light on the importance of strategic communications. If your organization’s goal in 2022 is to reduce the volume of late premiums you receive or to chase down fewer delinquent payers, implementing a robust payment notification system is an impactful way to make this happen for your team. One word of advice: make sure you offer these reminders to insureds across a wide variety of channels, to guarantee that more policyholders enroll in and receive these important reminders.

More ways to improve the resident payment experience

If you want more insights on how you can leverage this consumer data to meet policyholder expectations, watch the on-demand webinar recording below! You can always save the recording on your browser to share with colleagues or revisit anytime.