3 Insurance Best Practices in the Wake of COVID-19

Angela Abbott

Angela Abbott

As COVID-19 continues to ebb and flow, insurance organizations have had to continuously pivot in response to the health crisis. From making collections to interacting with policyholders and more, insurance best practices will likely never be the same as a result of the pandemic. Primarily, the health crisis has encouraged (and in many cases, forced) insureds to opt for contactless, digital ways to pay premiums and communicate with their insurance provider. Research shows that policyholder preferences have been trending this way for some time, however.

According to InvoiceCloud’s 2021 State of Online Payments research report, 63% of bill payers surveyed were already using digital channels to pay bills prior to COVID. If anything, the need for digital, contactless options has only been accelerated by the current health crisis.

So, how can insurers balance policyholder expectations, health concerns, and maintain the steady revenue collection any organization needs to continue operating smoothly? Based on the successes of over 2,700 InvoiceCloud billers, we’re outlining 3 new best practices insurance organizations must adhere to in order to pull off today’s juggling act and, what’s more, keep policyholder retention steady through the end of COVID-19.

Best Practice #1: Make the transition to digital payments easy for historically non-digital policyholders

For some insureds, 2020 marked their first-time paying bills online rather than in person, over the phone, or by mail. To accommodate the influx of newly digital payers, it’s imperative that insurance organizations do everything in their power to make the transition to online payment methods seamless.

Here are a few ways your organization can improve this transition for those who are newer to digital payments:

- Make sure to mirror the details of your paper bill in your organization’s online payment portal, so policyholders know exactly what is due. This online bill should also have consistent branding, so policyholders can confidently identify that they’re paying in the right place.

- Consider including notes in bill inserts, to inform non-digital policyholders about your organization’s online payment options. You can also utilize “envelope teasers” to provide online payment information on the outside of your billing envelopes, to increase the likelihood that policyholders will note these payment channels.

- Don’t forget to provide relevant and timely bill payment reminders so these insureds don’t worry about missing a payment. And, crucially, make sure you’re delivering those reminders through channels that your customer base is comfortable using.

Best Practice #2: Prioritize communication with policyholders who are struggling to make payments

Keeping your collections consistent and employees safe are critical, but it’s also important to remember that your customers may be struggling, too. Insurance organizations offer peace of mind that many policyholders and their families are depending on, even if there are outstanding payments your customers are unable to address at the moment.

In all cases, insurers must lead with empathy. One way to approach this is with personalized communications through your online payment solution. This allows insurers the ability to stay in touch with policyholders in a decidedly more human way.

An Outbound Campaign functionality, for example, allows billers to send out personalized campaigns around much more than payment reminders. Through Outbound Campaigns, insurers can leverage existing information about policyholders (their geographical location, preferred communication channels, details on their policies, etc.) to provide targeted reminders and messages on updated COVID-19 hours, community resources, and more.

Finally, when talking directly to a policyholder, always end the conversation with a target date. This can be a potential payment date or a date on which you can check back in to talk about payment. During these important conversations, make sure you share with customers all the ways they can pay through your online payments system (online, on their mobile device, via text, IVR) and the methods they can pay with (cash, ACH, credit cards, mobile wallets, payment installments)

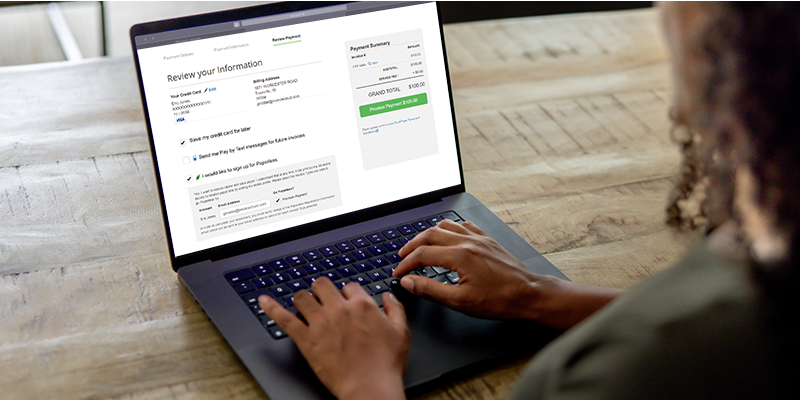

Best Practice #3: Make experiences frictionless wherever possible

Unless your digital payment options are quick and easy to use, policyholders may be resistant to adopt online payment channels, especially those who have historically relied on in-person payments. That’s why it’s critical for billing organizations to take stock of their digital payment experiences and take every step to make them as frictionless as possible.

Frictionless payment experiences mean your organization has minimized the barriers involved in receiving bills and paying premiums. This can involve:

- Removing login screens

- Offering mobile payments

- Leveraging one-click payments

- Saving account information for the future

- Helping policyholders enroll in automatic payments

- Offering digital wallet options

Reducing payment friction is likely to reduce call volumes, save operational costs, boost your customer satisfaction scores, and keep policyholders regularly using contactless payment options. This last part is critical; driving more policyholders to contactless payment options is ultimately in the best interest of the insured, but removing friction works in your employees’ favor, too.

Automating the claims process is a great example of this. By digitizing outbound payments to claimants, carriers can eliminate the need for employees to physically go to your office, simply to print out claim checks. This reduction of friction keeps employees safe, expedites the claims payment process, and is guaranteed to impress your policyholders.

Get the full scope of the new insurance best practices

No insurer can afford to follow outdated best practices, especially when it comes to something as mission-critical as collecting revenue. Since the landscape of insurance billing is completely different than it was just a few years ago, we’ve compiled additional best practices in our free ebook, The New Insurance Billing Best Practices: How COVID-19 continues to change billing and collecting premiums.

Get your copy below for more tips on how your insurance organization can meet policyholders where they are while maintaining consistent collections and customer satisfaction.