Fintech Trend to Watch: Cryptocurrency for Bill Payments

Tessa Newell

Tessa Newell

When you think of cryptocurrency (or “crypto”), you might picture a futuristic type of currency that belongs in the financial landscape of tomorrow – but believe it or not, the crypto future we’ve heard about is already here.

Despite being at the forefront of today’s financial technology (fintech) trends, crypto is more popular and more accessible to a wider audience than ever before. Something so cutting edge feels like it would be far off, at least for your typical bill payments however, there are billing organizations offering crypto as a payment option today.

For example, the cities of Chandler, AZ and Portsmouth, NH now allow customers to sell cryptocurrency for fiat money (government-backed funds, like the U.S. dollar) that can then be used to pay outstanding debts and bills. Portsmouth Mayor Deaglan McEachern said he sees this as a great opportunity to raise funds, thrill more residents, and increase trust in digital formats.

Fintech trends move fast, even for regular consumer payments – it wasn’t too long ago that we were swiping our cards at the store rather than tapping or inserting a chip – leaving no reason to think that crypto’s usage will slow down anytime soon.

What is Cryptocurrency?

Cryptocurrency is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank. It’s important to underline that crypto isn’t a payment method; most bill pay products that integrate crypto today allow customers a simple way to sell crypto and use the fiat proceeds to pay their bills.

You might think of crypto as a kind of foreign currency, at least when used for bill payments. Customers can purchase crypto with a service like PayPal, but need a way to convert it into dollars, the currency used for paying bills.

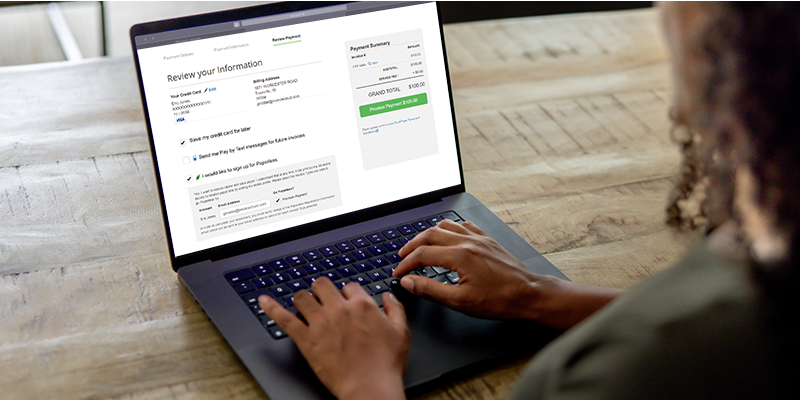

InvoiceCloud and Crypto: How it works for bill payment

InvoiceCloud’s partnership with PayPal enables your customers to pay their bills online with PayPal, Venmo, and pay later options like Pay in 41 and PayPal Credit2.

Beginning in early 2021 , PayPal introduced Checkout with Crypto. This new way to checkout gives your customers more choices when paying their bills. At checkout, if a customer has a sufficient balance of cryptocurrency to cover their bill amount, they will be able to select a crypto option which will automatically display as a payment method in PayPal Checkout. The cryptocurrencies available for buying and selling on PayPal are Bitcoin, Ethereum, Bitcoin Cash and Litecoin. When a customer sells cryptocurrency, you will be paid in fiat currency from the crypto sale or a backup funding source and it will have no impact to your deposit and reconciliation process.

InvoiceCloud: Your guide to cutting-edge tech

Navigating the new frontier of technological innovation will always be easiest with a guide – and that’s where InvoiceCloud comes in. Considering that our digital billing and payment solutions are at the forefront of fintech innovation, the InvoiceCloud team is specially equipped to act as your navigator across the cutting edge of technology.

InvoiceCloud’s dedicated services teams – from product specialists to client services and customer success – are always available to answer questions or offer quick solutions. Our customer marketing team can even help your organization market offerings like crypto to your customer base!

Plus, our SaaS technology makes offering the latest and greatest features literally effortless; the InvoiceCloud platform is cloud-native, which means that any new functionality (like offering crypto payment via a digital wallet) is automatically available to everyone who uses our platform. That means your organization can offer future-looking payment options to those who want them, without any lift from your team.

Want to learn more about how our partnership with PayPal can benefit your organization? Request more information today or schedule a call with someone on the InvoiceCloud team.

1 About Pay in 4: Loans to California residents are made or arranged pursuant to a California Finance Lenders Law License. PayPal, Inc. is a Georgia Installment Lender Licensee, NMLS #910457.

2 PayPal Credit is subject to consumer credit approval.