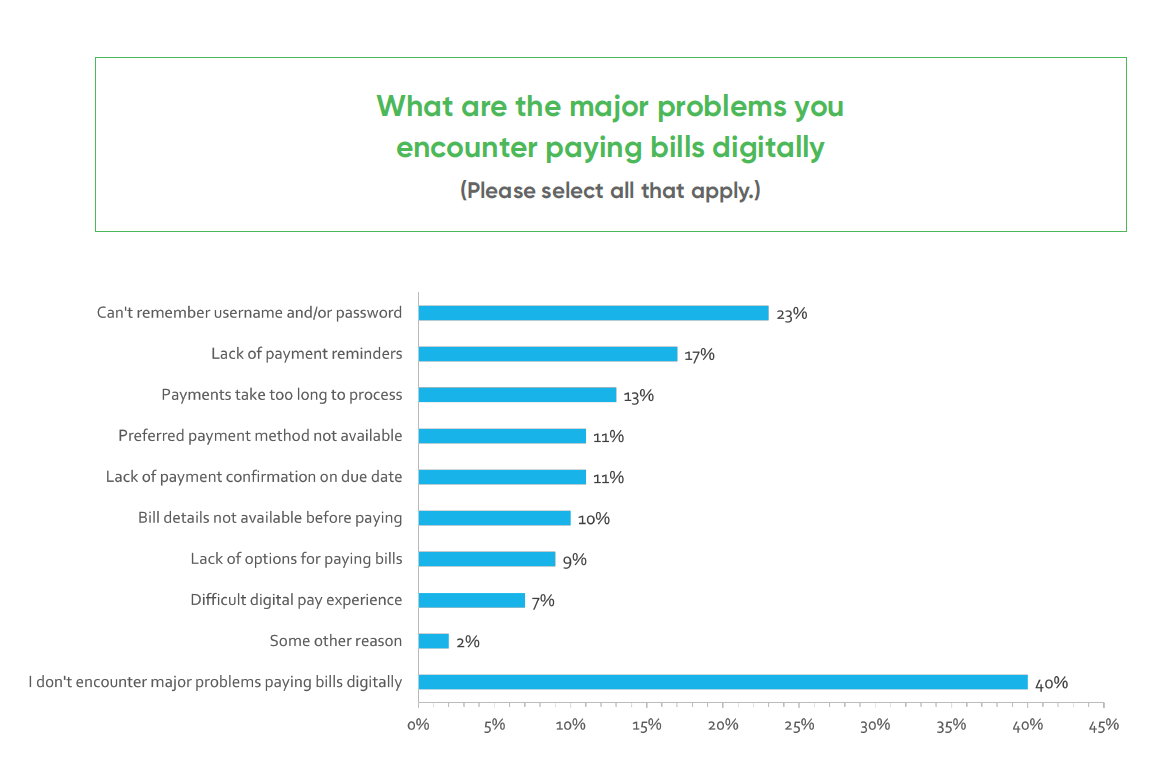

In the realm of digital transactions, challenges often surface, stemming from a variety of sources ranging from user errors to glitches within the payment systems themselves. The State of Online Payments report sheds light on the prevalence of these hurdles, revealing that a staggering 60% of respondents regularly grapple with issues concerning their monthly digital payments. The data also reveals the respondent’s ideal way to resolve payment issues.

Among the myriad obstacles cited, frequent occurrences include the forgetfulness of usernames and/or passwords, the absence of timely payment reminders, and frustrating delays in the processing of payments. These findings underscore the pressing need for streamlined, user-friendly solutions to mitigate these challenges and enhance the overall efficiency of online payment experiences.

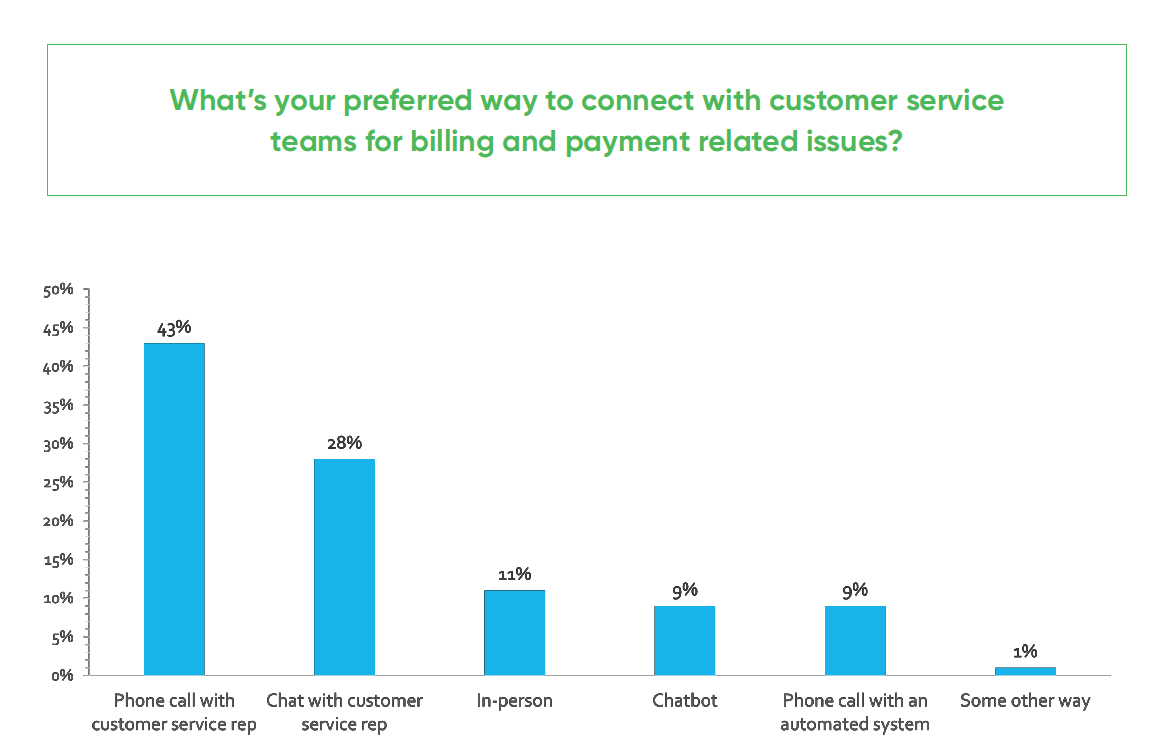

In our quest to better understand how customers navigate these inevitable obstacles, we sought insights into their preferred avenues for resolving billing and payment-related problems. Through our survey, respondents were posed with the question: “What’s your preferred way to connect with customer service teams for billing and payment-related issues?” The results unveiled clear trends, with the top responses indicating a preference for direct communication channels.

How Do Customer Prefer to Resolve Payment Issues?

Specifically, survey respondents favored contacting the biller’s office via phone call, engaging in live chat interactions with customer service representatives, or opting to address the matter in-person at the biller’s physical location. These preferences shed light on the significance of accessible and efficient customer service solutions to address the daily concerns of digital payment users.

Customers facing these problems want them fixed quickly, so they can finish their payment and move on with their day. Naturally, they seek assistance from customer support teams to address their concerns, but this can exacerbate call volumes and even lead to heightened lobby traffic for billing organizations. This surge in inquiries is not only time-consuming, but can divert staff’s attention away from critical projects and potentially lead to employee burnout.

In order to avoid this, we’re highlighting several strategies billing organizations can implement to streamline issue resolution.

1. Leveraging Technology for Self-Service Options

The most impactful way to drive results for billers is to increase the volume of customers that are willing to self-serve, which they can do by enrolling in services like automatic payments (AutoPay), paperless billing, and even by signing up for payment reminders. Increased self-service means fewer customer service calls, reduced walk-in and lobby traffic, decreased staff workloads, fewer account shutoffs or cancellations — in short, increased self-service enrollment means fewer headaches for you and your team.

Offering an enhanced interactive voice response solution (IVR) is a simple way to provide that convenient, contactless customer experience your payers expect while also diverting customer service calls, improving operational efficiencies, and increasing your revenue flow. IVRs are ideal for providing 24/7 access to bill payment over the phone.

Online portals for digital payments are another great form of self-service. Allowing customers to pay when and how they want and on the device of their choice can not only decrease call volumes but can significantly increase customer satisfaction. Also, offering omni-channel options is crucial. Providing more options can lead to higher adoption rates — however, regardless of how many options you offer, the user experience should remain the same across all channels. Customers should have the same effortless experience making via phone that they have on the web, too.

Chatbots in EBPP, when used properly and in line with the law, can also help people pay their bills faster and with less hassle. Many common billing problems have simple solutions that chatbots, powered by AI, can explain easily. With the right keywords, chatbots can understand a biller’s problem, even if the biller isn’t sure themselves. In these cases, AI-powered chatbots can solve mundane problems quickly, saving time and resources so staff can focus on higher-value work.

Overall, these technologies can address common customer queries in a way that saves time for customer service teams and simplifies the process enough to eliminate typical issues, such as difficulty finding where to pay.

2. Implementing Effective Communication Strategies

Merely establishing communication channels with customers is insufficient. Understanding their preferences and payment history is crucial. Clear and accurate billing statements are essential to prevent issues and confusion.

Payment notifications play a pivotal role, identified as the second most significant problem by our survey respondents. Intelligent communications capitalize on existing customer information to deliver targeted reminders and notifications. For example, sending a payment reminder to someone who has already settled their bill is redundant. Likewise, a single email about an upcoming bill might not suffice to counter the “I forgot” excuse for late payments, especially if it’s lacking a link to payment, the amount due, or other details.

Employing various communication channels, such as email and SMS, based on customer preferences, is essential. Proactive communication, including FAQs and user guides, is also vital to preempt common inquiries.

3. Training and Empowering Customer Service Staff

Finally, investing in the training and empowerment of customer service staff yields multifaceted benefits. Well-trained teams not only possess the skills to efficiently address customer inquiries but also play a pivotal role in minimizing call volume through their adept problem-solving abilities. Moreover, empowering employees by granting them the autonomy to make decisions fosters a sense of ownership and accountability, directly influencing customer satisfaction levels.

When frontline staff feel empowered to resolve issues promptly and effectively, customers are more likely to receive satisfactory resolutions on the first contact, leading to a significant reduction in unnecessary calls and ultimately enhancing overall service quality.

Ready to learn more? For more insights into customer payment habits and billing preferences, download the most recent State of Online Payments report here.