The goals of billing and payment teams vary from organization to organization. Some might prioritize reducing payment delinquencies, while others may aim to improve or maintain customer satisfaction scores. Regardless of the specific goal, making meaningful progress in these critical areas requires a deep understanding of American bill payment habits.

To help billers ensure their key touchpoints are optimized for future growth, InvoiceCloud commissioned Regina Corso Consulting to conduct a survey of 2,042 Americans who make payments online. The 2025 State of Online Payments report uses this data to explore the latest trends in online and mobile bill payments.

Let’s look at some of the key takeaways from this year’s report.

1. Mobile Preferences Lead the Pack

Almost two-thirds of Americans surveyed used mobile devices for bill payments in the past year. Mobile also remains the most preferred payment channel for billpayers, growing from 26% in 2023 to 29% in 2024.

Mobile wallets have overtaken Automated Clearing House (ACH) transactions in popularity for the first time in this survey’s history. Usage of wallets like PayPal, Venmo, and Apple Pay continues to grow year-over-year (only 3% of respondents said they used mobile wallets to pay bills in 2022, compared to 10% in this year’s report). This shift highlights the growing reliance on smartphones for managing financial transactions across several demographics.

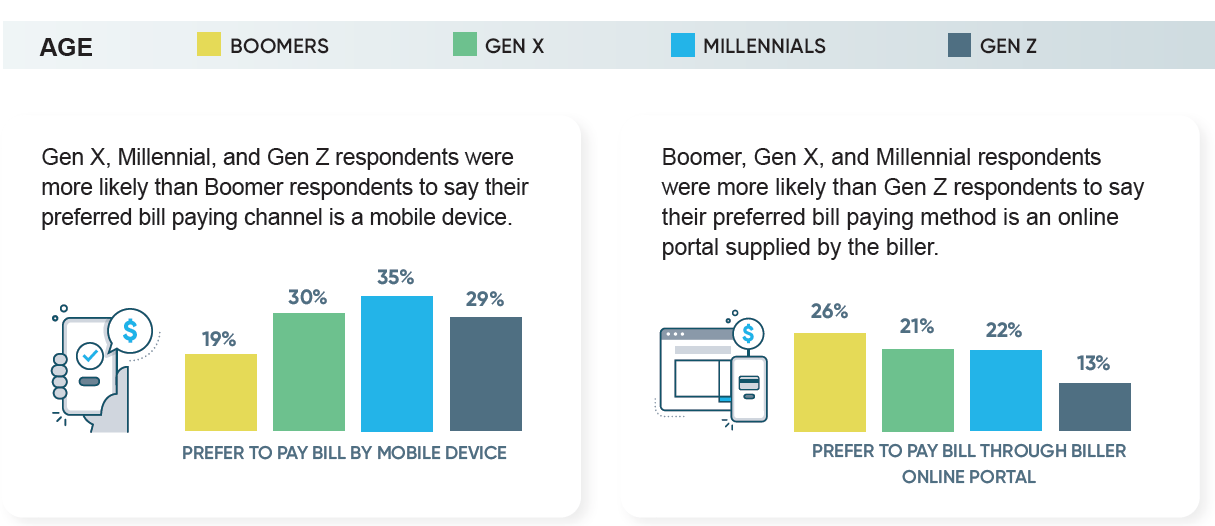

While millennials were most inclined to pay bills using a mobile device, you can see the preference is intergenerational. Even Gen Z, who are less likely to opt for mobile devices, prefer a pay by text option more than other generations.

Respondents from lower income households also prefer mobile devices for bill payment. This coincides with data from the National Telecommunications and Information Administration, which shows lower-income households are more likely to either have no in-home internet connection or be mobile-only, limiting the digital channels they can use for payments.

With mobile devices leading the way for digital payment channels, billers must prioritize mobile optimization — including responsive design for diverse screen sizes and the inclusion of mobile wallets — to meet all payers’ preferences.

2. Challenges in Online Bill Payments

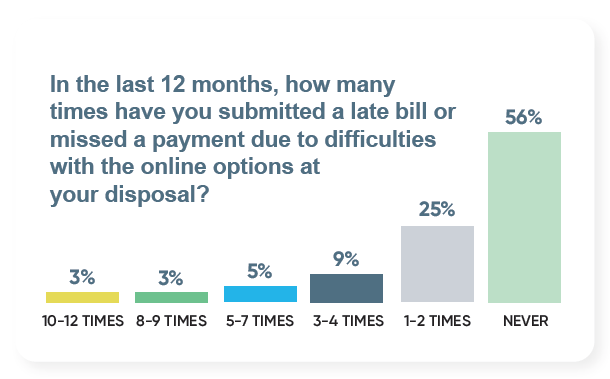

Despite the rise in digital payments, 72% of Americans encounter issues when making online bill payments. Over a fifth of Americans shared that not remembering usernames and/or passwords is the main challenge they experience, while 17% report a lack of payment reminders is the problem.

These issues have significant consequences, with nearly half (44%) of these respondents indicating user experience challenges have caused late or delinquent payments.

Addressing these common challenges is critical for ensuring customers’ access your services. Implementing user-friendly features such as password recovery, guest checkout, and automated payment reminders can help mitigate these issues and encourage timely payments.

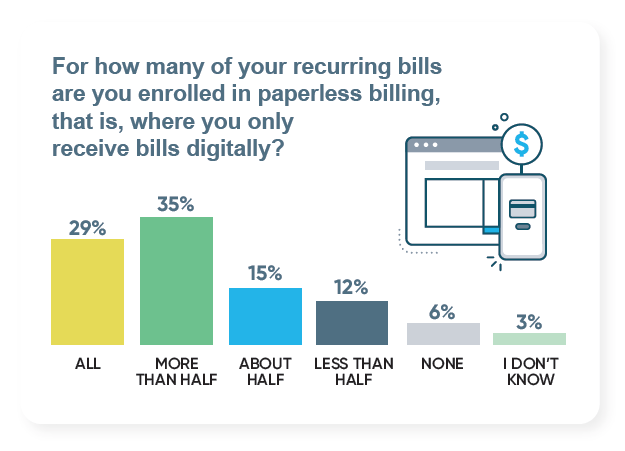

3. Growth Potential for Paperless Billing Enrollment

The survey also highlights barriers to increasing paperless billing enrollment. One in five Americans who are not enrolled in paperless billing for all payments cite the lack of an enrollment option as the primary reason.

While a third of respondents who are unenrolled simply prefer to receive paper bills, uncertainty about the enrollment process and lack of initiative have prevented many others from making the switch to paperless.

These unenrolled payers represent a substantial opportunity for increasing paperless billing adoption. Respondents from younger demographics even expressed a preference for being automatically enrolled in paperless options by their billers, indicating that with incentives and education, more consumers could be encouraged to make the switch.

More American Bill Payment Habits in the State of Online Payments Report

Curious to learn more about bill payment habits in America? The annual State of Online Payments report provides valuable insights from customers just like yours.

Get your free copy of the report to see the latest trends and determine how your organization can best meet the needs of today’s billpayer.