Payment Processing 101

Published 4/6/23

Discover the payment path from batch close to deposit in your account. Whether a customer pays by credit/debit card or EFT/ACH, these payments go through the same basic flow. However, the touch points are different for each payment method.

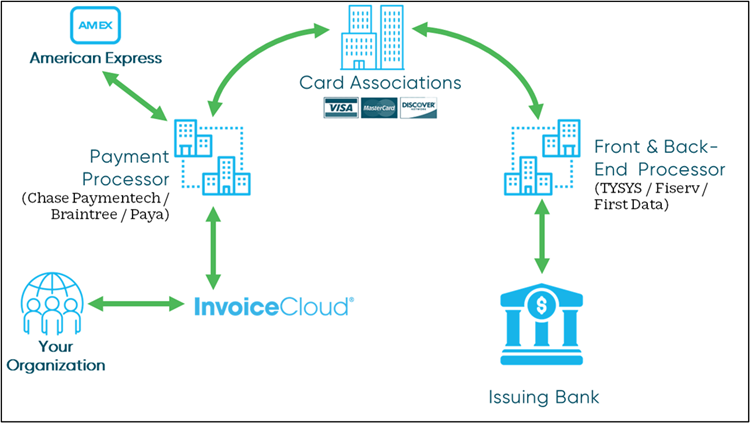

Credit Card Processing

As your customers make payments throughout the day, they are stored in an open batch. At the indicated batch close time, payments are sent to the payment processor. The primary payment processors are Chase Paymentech, Paya (Sage), and Braintree.

Once payments are received by the payment processor, American Express payments are separated from the rest and get sent directly to American Express, as they process their own payments. The remaining Visa, MasterCard, and Discover credit card payments are then funneled to their corresponding card associations. This path is determined by the first 4 digits of the credit card account number.

The card associations then send the payments to the issuing bank, where your customer opened their credit/debit card account. If you are using a front or back-end processor such as First Data (FISERV) or TSYS, these payments pass through the back-end processor between the card association and the issuing bank.

Once payments are approved by the issuing bank, the process flows back through the same path, until the funds are deposited in your bank account in approximately 1 to 2 days.

Here’s a graphical representation of the credit/debit card payment processing flow:

EFT/ACH Processing

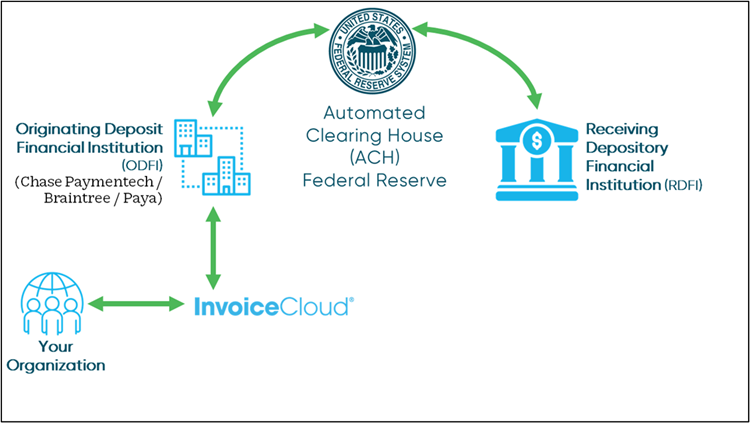

The EFT/ACH processing cycle functions largely the same way as credit cards, but the payment processing touchpoints are different. Let’s take a look.

Once your batch closes at the designated time, the payments are sent through your payment processor – Chase Paymentech, Paya (Sage), or Braintree. These processors are designated as the ODFI or Originating Deposit Financial Institution.

From the ODFI, the EFT/ACH batch is sent to the ACH (Automated Clearing House) which can either be the Federal Reserve or a clearing house. During this step, the payments are sorted and directed to the RDFI or Receiving Depository Financial Institution, where the customer’s bank account is held.

The RDFI approves or declines the payment request, and then the information and funds flow back through the same process in reverse until the funds are deposited into your bank account in approximately 1 to 3 days.

Here’s a graphical representation of the EFT/ACH payment processing flow:

Have other questions? Explore Support Central to get the answers to your questions anytime you need them! You can access Support Central via the Biller Portal.