People often think about accessible design in terms of what these measures help prevent: mainly, lawsuits and regulatory risk. But if we stop our line of thinking there, we could miss the real opportunity.

Accessibility isn’t just about checking a box for compliance. It’s about designing accessible digital payment services that make life easier for everyone in our communities — and when we take this approach, both customers and organizations benefit greatly.

Why Accessibility Isn’t a Niche Issue

Accessibility affects more people than you think. Research* shows that more than 1 in 3 Americans has an accessibility need — whether it’s a visual, mobility, cognitive, or language-related barrier — that affects how they engage with digital experiences. When online payment systems aren’t designed with that in mind, adoption suffers, call volume spikes, and trust erodes.

Think about it: if your payment site requires precise clicks, small-font navigation, or assumes everyone speaks English and uses a laptop, you’ve unintentionally shut out a massive segment of your population.

Accessibility isn’t a fringe issue. It’s a mainstream business problem, and solving it is good for customers, compliance, and operational results.

Inclusion Improves the Experience for Everyone

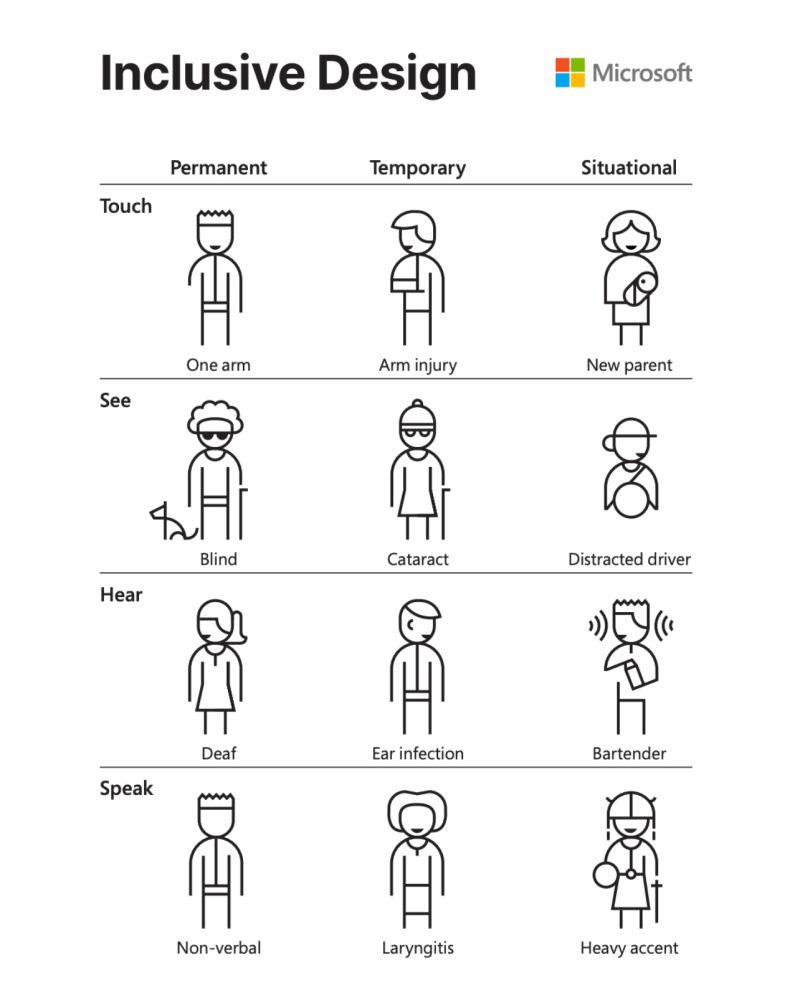

A great example of the ripple effect of accessible UX comes from Microsoft’s inclusive design work. The graphic below illustrates how designing for permanent disabilities often improves the experience for people with temporary or situational ones, too.

Say you build an online utility bill payment experience that’s easy to use with one hand. That certainly helps someone with a motor disability, but also a new parent holding a baby or a commuter using their phone on the go.

Designing for low vision? That benefits someone using your site in bright sunlight.

Offering multilingual support? That’s essential for folks who don’t fluently speak English, but it’s also helpful for people reading on small screens or navigating unfamiliar terminology.

When we design for the edges, we make the center stronger.

How InvoiceCloud Designs for Compliance and Confidence

At InvoiceCloud, we put deep, intentional focus on accessibility in the design of our digital payment platform — not because we were forced to, but because it aligns with how we think about trust and adoption.

We’ve worked with Level Access, a leader in digital accessibility, to identify and remediate barriers in our user experience. That includes everything from improving color contrast and tab order, to simplifying payment flows and error messages. We publish third-party verified VPATs (Voluntary Product Accessibility Templates) to help our customers see exactly where we stand.

Here are a few of the enhancements that help our bill payment platform work for more users, regardless of ability or channel:

- Multilingual payment options

- Zoom-optimized layouts

- Error handling that doesn’t force users to restart

- Accessible, automated payment reminders via IVR (Interactive Voice Response), SMS, and email

Each of these helps more users self-serve with confidence, which can offer impactful benefits for service providers.

The Operational Payoff of Accessible Design

Beyond ensuring that no one is left behind, providing accessible payment interfaces offers a clear upside for service providers. When more people can use your online payment services without issue, you’re more likely to increase self-service.

That means:

- Fewer calls to customer service

- Faster payments

- Lower paper and postage costs

- Happier customers and a more positive brand reputation

It also means less risk. With updated ADA Title II rules taking effect in April, state and local governments must ensure their digital properties — including local government billing and payment platforms — meet WCAG 2.1 Level AA standards. These requirements are enforceable and specific, especially if your population served is 50,000 or more.

Research: How to Provide Digital Payments for Everyone

The only way to make digital bill payment accessible to everyone is to understand the unique challenges and nuances of American bill payers. That’s why InvoiceCloud conducts annual research for our report, The State of Online Payments.

Get your free copy of the report to learn what’s preventing customers like yours from using your digital bill payment options and how you can remove those barriers to self-service.

* Source: Survey was conducted via Dynata and polled 1,000 general U.S.-based consumers over 18 years of age in January 2026. Respondents were segmented and analyzed across age groups, gender, marital status, having children and household income.